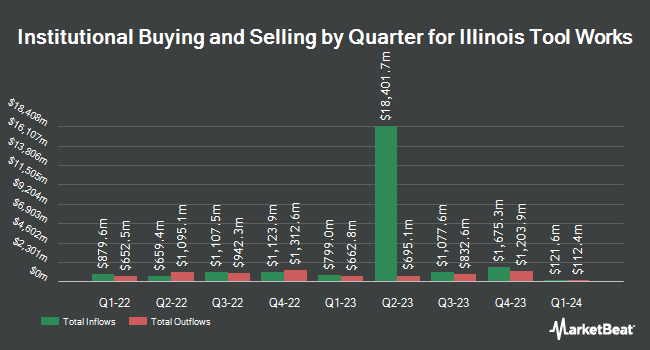

Edgestream Partners L.P. decreased its holdings in Illinois Tool Works Inc. (NYSE:ITW - Free Report) by 58.5% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 16,860 shares of the industrial products company's stock after selling 23,802 shares during the quarter. Edgestream Partners L.P.'s holdings in Illinois Tool Works were worth $4,418,000 as of its most recent filing with the SEC.

Other large investors also recently modified their holdings of the company. Kolinsky Wealth Management LLC acquired a new position in Illinois Tool Works during the 3rd quarter valued at about $207,000. Captrust Financial Advisors boosted its holdings in shares of Illinois Tool Works by 9.9% in the third quarter. Captrust Financial Advisors now owns 39,704 shares of the industrial products company's stock valued at $10,405,000 after acquiring an additional 3,581 shares in the last quarter. CWS Financial Advisors LLC increased its stake in shares of Illinois Tool Works by 12.5% during the third quarter. CWS Financial Advisors LLC now owns 1,633 shares of the industrial products company's stock valued at $428,000 after acquiring an additional 181 shares during the period. Public Sector Pension Investment Board raised its holdings in Illinois Tool Works by 17.5% during the third quarter. Public Sector Pension Investment Board now owns 8,043 shares of the industrial products company's stock worth $2,108,000 after purchasing an additional 1,200 shares in the last quarter. Finally, Financial Counselors Inc. boosted its stake in Illinois Tool Works by 3.7% during the third quarter. Financial Counselors Inc. now owns 13,631 shares of the industrial products company's stock valued at $3,572,000 after buying an additional 487 shares in the last quarter. 79.77% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several analysts recently commented on the stock. StockNews.com raised shares of Illinois Tool Works from a "hold" rating to a "buy" rating in a research note on Thursday, October 31st. Barclays increased their price objective on Illinois Tool Works from $215.00 to $230.00 and gave the company an "underweight" rating in a research report on Friday, November 1st. Evercore ISI cut Illinois Tool Works from an "in-line" rating to an "underperform" rating and lifted their target price for the stock from $246.00 to $255.00 in a report on Wednesday, November 13th. Wells Fargo & Company upped their target price on Illinois Tool Works from $236.00 to $250.00 and gave the company an "underweight" rating in a report on Monday, October 7th. Finally, Truist Financial lifted their price target on Illinois Tool Works from $281.00 to $312.00 and gave the stock a "buy" rating in a research note on Wednesday, October 9th. Four investment analysts have rated the stock with a sell rating, four have assigned a hold rating, three have issued a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Illinois Tool Works currently has a consensus rating of "Hold" and a consensus price target of $257.30.

Read Our Latest Stock Analysis on ITW

Illinois Tool Works Stock Up 0.5 %

Shares of NYSE ITW traded up $1.48 during mid-day trading on Friday, reaching $277.52. The company had a trading volume of 570,770 shares, compared to its average volume of 836,109. The stock has a fifty day moving average of $264.35 and a two-hundred day moving average of $250.78. Illinois Tool Works Inc. has a 12-month low of $232.77 and a 12-month high of $279.13. The company has a market capitalization of $81.95 billion, a price-to-earnings ratio of 24.01, a PEG ratio of 4.30 and a beta of 1.10. The company has a debt-to-equity ratio of 1.94, a quick ratio of 0.97 and a current ratio of 1.36.

Illinois Tool Works (NYSE:ITW - Get Free Report) last released its earnings results on Wednesday, October 30th. The industrial products company reported $2.65 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.53 by $0.12. Illinois Tool Works had a net margin of 21.66% and a return on equity of 97.06%. The company had revenue of $3.97 billion during the quarter, compared to the consensus estimate of $4.02 billion. During the same quarter in the prior year, the firm earned $2.55 EPS. The company's revenue was down 1.6% compared to the same quarter last year. As a group, equities research analysts expect that Illinois Tool Works Inc. will post 10.13 EPS for the current year.

Illinois Tool Works Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, January 10th. Shareholders of record on Tuesday, December 31st will be given a $1.50 dividend. This represents a $6.00 annualized dividend and a yield of 2.16%. The ex-dividend date of this dividend is Tuesday, December 31st. Illinois Tool Works's payout ratio is currently 51.90%.

Illinois Tool Works Company Profile

(

Free Report)

Illinois Tool Works Inc manufactures and sells industrial products and equipment in the United States and internationally. It operates through seven segments: Automotive OEM; Food Equipment; Test & Measurement and Electronics; Welding; Polymers & Fluids; Construction Products; and Specialty Products.

Further Reading

Before you consider Illinois Tool Works, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illinois Tool Works wasn't on the list.

While Illinois Tool Works currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.