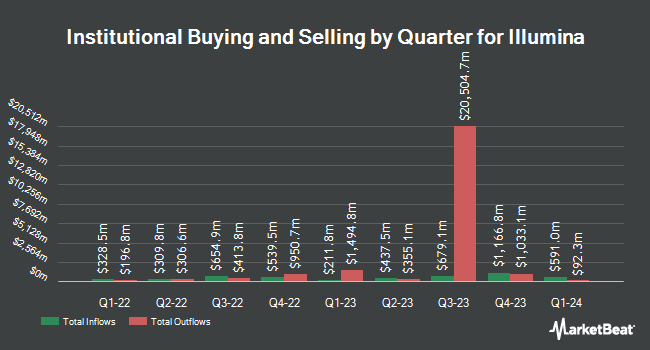

Baillie Gifford & Co. cut its stake in shares of Illumina, Inc. (NASDAQ:ILMN - Free Report) by 35.4% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 3,622,813 shares of the life sciences company's stock after selling 1,982,362 shares during the period. Baillie Gifford & Co. owned about 2.27% of Illumina worth $472,451,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the stock. Versant Capital Management Inc raised its stake in Illumina by 292.9% during the 2nd quarter. Versant Capital Management Inc now owns 330 shares of the life sciences company's stock valued at $34,000 after purchasing an additional 246 shares during the last quarter. Industrial Alliance Investment Management Inc. acquired a new position in Illumina during the 2nd quarter valued at $34,000. Massmutual Trust Co. FSB ADV raised its stake in Illumina by 65.1% during the 3rd quarter. Massmutual Trust Co. FSB ADV now owns 426 shares of the life sciences company's stock valued at $56,000 after purchasing an additional 168 shares during the last quarter. Itau Unibanco Holding S.A. acquired a new position in Illumina during the 2nd quarter valued at $61,000. Finally, Mizuho Securities Co. Ltd. acquired a new position in Illumina during the 2nd quarter valued at $63,000. 89.42% of the stock is owned by hedge funds and other institutional investors.

Illumina Stock Down 1.5 %

Illumina stock traded down $2.31 during mid-day trading on Tuesday, hitting $149.19. The company had a trading volume of 795,648 shares, compared to its average volume of 2,000,929. The company has a current ratio of 2.43, a quick ratio of 0.86 and a debt-to-equity ratio of 0.94. The stock's 50 day moving average price is $138.50 and its two-hundred day moving average price is $123.77. Illumina, Inc. has a 12 month low of $92.26 and a 12 month high of $156.66. The company has a market capitalization of $23.66 billion, a PE ratio of -15.21 and a beta of 1.13.

Illumina (NASDAQ:ILMN - Get Free Report) last posted its earnings results on Monday, November 4th. The life sciences company reported $1.14 earnings per share for the quarter, beating analysts' consensus estimates of $0.88 by $0.26. Illumina had a positive return on equity of 7.29% and a negative net margin of 36.10%. The company had revenue of $1.08 billion for the quarter, compared to the consensus estimate of $1.08 billion. During the same quarter in the prior year, the company earned $0.33 earnings per share. Illumina's revenue was down 3.5% on a year-over-year basis. As a group, sell-side analysts anticipate that Illumina, Inc. will post 4.11 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently issued reports on ILMN shares. Morgan Stanley restated an "equal weight" rating and issued a $156.00 price objective on shares of Illumina in a research note on Tuesday. Stephens increased their price objective on shares of Illumina from $170.00 to $184.00 and gave the company an "overweight" rating in a research note on Tuesday. Barclays increased their price objective on shares of Illumina from $135.00 to $145.00 and gave the company an "equal weight" rating in a research note on Tuesday, November 5th. StockNews.com initiated coverage on shares of Illumina in a research note on Thursday, August 29th. They issued a "buy" rating for the company. Finally, Canaccord Genuity Group upped their target price on shares of Illumina from $130.00 to $145.00 and gave the stock a "hold" rating in a report on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, eight have issued a hold rating, fourteen have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $164.00.

View Our Latest Stock Analysis on Illumina

Illumina Profile

(

Free Report)

Illumina, Inc offers sequencing- and array-based solutions for genetic and genomic analysis in the United States, Singapore, the United Kingdom, and internationally. It operates through Core Illumina and GRAIL segments. The company offers sequencing and array-based instruments and consumables, which include reagents, flow cells, and library preparation; whole-genome sequencing kits, which sequence entire genomes of various size and complexity; and targeted resequencing kits, which sequence exomes, specific genes, and RNA or other genomic regions of interest.

Further Reading

Before you consider Illumina, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Illumina wasn't on the list.

While Illumina currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.