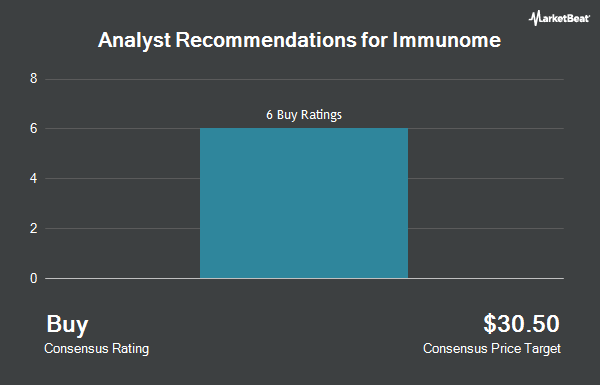

Shares of Immunome, Inc. (NASDAQ:IMNM - Get Free Report) have earned a consensus recommendation of "Buy" from the seven analysts that are currently covering the company, Marketbeat Ratings reports. Seven research analysts have rated the stock with a buy recommendation. The average 1-year target price among analysts that have issued a report on the stock in the last year is $28.83.

Several brokerages have recently issued reports on IMNM. Piper Sandler decreased their price target on Immunome from $23.00 to $21.00 and set an "overweight" rating on the stock in a research note on Thursday, November 14th. Wedbush reaffirmed an "outperform" rating and issued a $33.00 price objective on shares of Immunome in a research note on Friday, October 25th. Finally, Stephens initiated coverage on Immunome in a research note on Friday, November 8th. They set an "overweight" rating and a $30.00 target price for the company.

View Our Latest Research Report on Immunome

Immunome Price Performance

NASDAQ:IMNM traded up $0.38 during mid-day trading on Tuesday, reaching $11.53. The stock had a trading volume of 1,014,805 shares, compared to its average volume of 780,808. Immunome has a 12 month low of $6.93 and a 12 month high of $30.96. The stock has a market capitalization of $719.70 million, a PE ratio of -1.42 and a beta of 1.82. The stock has a 50-day simple moving average of $12.49 and a two-hundred day simple moving average of $13.55.

Insiders Place Their Bets

In other Immunome news, CEO Clay B. Siegall purchased 66,057 shares of the firm's stock in a transaction on Thursday, November 21st. The stock was purchased at an average cost of $9.54 per share, for a total transaction of $630,183.78. Following the transaction, the chief executive officer now owns 485,693 shares in the company, valued at $4,633,511.22. The trade was a 15.74 % increase in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, CTO Philip Tsai purchased 21,000 shares of the company's stock in a transaction dated Thursday, November 21st. The shares were acquired at an average cost of $9.43 per share, with a total value of $198,030.00. Following the purchase, the chief technology officer now directly owns 21,000 shares of the company's stock, valued at approximately $198,030. The trade was a ∞ increase in their position. The disclosure for this purchase can be found here. Insiders bought a total of 102,862 shares of company stock valued at $978,045 in the last 90 days. Corporate insiders own 8.60% of the company's stock.

Institutional Trading of Immunome

A number of institutional investors and hedge funds have recently bought and sold shares of the stock. Quest Partners LLC bought a new stake in shares of Immunome in the 2nd quarter valued at about $81,000. Zurcher Kantonalbank Zurich Cantonalbank bought a new stake in Immunome in the second quarter valued at approximately $97,000. Arizona State Retirement System increased its position in Immunome by 9.2% during the 2nd quarter. Arizona State Retirement System now owns 10,862 shares of the company's stock valued at $131,000 after purchasing an additional 918 shares during the period. Intech Investment Management LLC bought a new position in Immunome during the 3rd quarter worth approximately $219,000. Finally, AQR Capital Management LLC lifted its position in shares of Immunome by 34.6% in the 2nd quarter. AQR Capital Management LLC now owns 16,064 shares of the company's stock worth $194,000 after purchasing an additional 4,129 shares during the period. 44.58% of the stock is currently owned by institutional investors and hedge funds.

Immunome Company Profile

(

Get Free ReportImmunome, Inc, a biotechnology company, develops targeted cancer therapies. The company's clinical asset comprises AL102, an investigational gamma secretase inhibitor currently in evaluation in a Phase 3 trial for the treatment of desmoid tumors; and preclinical assets consist of IM-1021, a receptor tyrosine kinase-like orphan receptor 1 and antibody-drug conjugates, as well as IM-3050, a fibroblast activation protein targeted radioligand therapy; and IM-4320, an anti-IL-38 immunotherapy candidate.

Further Reading

Before you consider Immunome, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunome wasn't on the list.

While Immunome currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.