Immunovant (NASDAQ:IMVT - Get Free Report)'s stock had its "buy" rating reiterated by equities researchers at HC Wainwright in a research note issued to investors on Friday,Benzinga reports. They currently have a $51.00 target price on the stock. HC Wainwright's target price suggests a potential upside of 66.39% from the company's previous close.

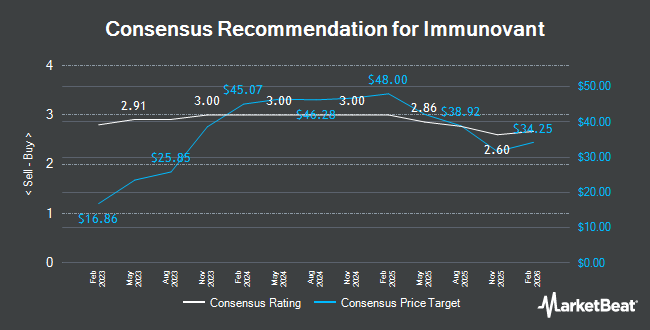

Other research analysts also recently issued research reports about the stock. Cantor Fitzgerald restated an "overweight" rating on shares of Immunovant in a report on Monday, September 9th. JPMorgan Chase & Co. cut their price target on shares of Immunovant from $51.00 to $46.00 and set an "overweight" rating on the stock in a report on Thursday, August 8th. Oppenheimer raised their price target on shares of Immunovant from $47.00 to $53.00 and gave the company an "outperform" rating in a report on Wednesday, October 9th. Raymond James restated an "outperform" rating and set a $36.00 price target on shares of Immunovant in a report on Thursday, October 10th. Finally, UBS Group cut their price target on shares of Immunovant from $42.00 to $41.00 and set a "buy" rating on the stock in a report on Tuesday, August 13th. Eleven equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, Immunovant currently has a consensus rating of "Buy" and a consensus target price of $48.10.

Get Our Latest Stock Report on Immunovant

Immunovant Stock Up 2.4 %

Shares of NASDAQ:IMVT traded up $0.72 during trading on Friday, reaching $30.65. 683,138 shares of the company traded hands, compared to its average volume of 1,079,466. The firm has a fifty day simple moving average of $29.77 and a 200 day simple moving average of $28.96. The firm has a market cap of $4.49 billion, a P/E ratio of -15.88 and a beta of 0.66. Immunovant has a 1-year low of $24.67 and a 1-year high of $45.58.

Immunovant (NASDAQ:IMVT - Get Free Report) last issued its earnings results on Thursday, November 7th. The company reported ($0.74) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.59) by ($0.15). During the same quarter in the prior year, the business earned ($0.45) EPS. As a group, research analysts anticipate that Immunovant will post -2.41 EPS for the current year.

Insider Buying and Selling

In related news, CEO Peter Salzmann sold 9,095 shares of Immunovant stock in a transaction on Wednesday, October 16th. The shares were sold at an average price of $28.79, for a total value of $261,845.05. Following the transaction, the chief executive officer now owns 994,789 shares in the company, valued at $28,639,975.31. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Immunovant news, CEO Peter Salzmann sold 9,095 shares of the firm's stock in a transaction on Wednesday, October 16th. The shares were sold at an average price of $28.79, for a total value of $261,845.05. Following the sale, the chief executive officer now directly owns 994,789 shares in the company, valued at $28,639,975.31. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, insider William L. Macias sold 3,188 shares of the firm's stock in a transaction on Wednesday, October 16th. The stock was sold at an average price of $28.79, for a total transaction of $91,782.52. Following the completion of the sale, the insider now owns 365,144 shares in the company, valued at $10,512,495.76. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 32,277 shares of company stock worth $941,919 in the last quarter. 5.90% of the stock is currently owned by company insiders.

Institutional Trading of Immunovant

Hedge funds and other institutional investors have recently bought and sold shares of the stock. KBC Group NV grew its position in Immunovant by 46.2% in the 3rd quarter. KBC Group NV now owns 1,936 shares of the company's stock worth $55,000 after purchasing an additional 612 shares during the last quarter. Quest Partners LLC boosted its position in shares of Immunovant by 216.7% during the 2nd quarter. Quest Partners LLC now owns 2,610 shares of the company's stock valued at $69,000 after acquiring an additional 1,786 shares in the last quarter. Assetmark Inc. boosted its position in shares of Immunovant by 73.8% during the 3rd quarter. Assetmark Inc. now owns 2,891 shares of the company's stock valued at $82,000 after acquiring an additional 1,228 shares in the last quarter. EntryPoint Capital LLC boosted its position in shares of Immunovant by 288.8% during the 1st quarter. EntryPoint Capital LLC now owns 2,912 shares of the company's stock valued at $94,000 after acquiring an additional 2,163 shares in the last quarter. Finally, Headlands Technologies LLC acquired a new stake in shares of Immunovant during the 2nd quarter valued at about $77,000. 47.08% of the stock is currently owned by institutional investors and hedge funds.

Immunovant Company Profile

(

Get Free Report)

Immunovant, Inc, a clinical-stage biopharmaceutical company, develops monoclonal antibodies for the treatment of autoimmune diseases. It develops batoclimab, a novel fully human monoclonal antibody that target the neonatal fragment crystallizable receptor for the treatment of myasthenia gravis, thyroid eye disease, chronic inflammatory demyelinating polyneuropathy, and Graves diseases, as well as warm autoimmune hemolytic anemia.

Featured Stories

Before you consider Immunovant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunovant wasn't on the list.

While Immunovant currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.