Impact Capital Partners LLC purchased a new position in shares of Netflix, Inc. (NASDAQ:NFLX - Free Report) in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 2,672 shares of the Internet television network's stock, valued at approximately $2,382,000. Netflix makes up 0.8% of Impact Capital Partners LLC's holdings, making the stock its 29th largest holding.

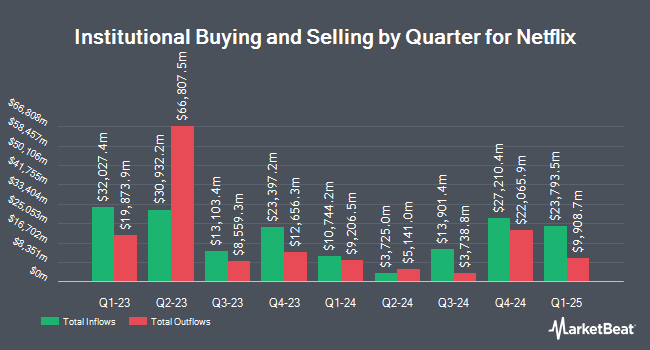

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in NFLX. RPg Family Wealth Advisory LLC acquired a new stake in Netflix during the third quarter worth about $25,000. Pathway Financial Advisers LLC grew its position in shares of Netflix by 82.4% during the fourth quarter. Pathway Financial Advisers LLC now owns 31 shares of the Internet television network's stock worth $27,000 after buying an additional 14 shares in the last quarter. Newton One Investments LLC bought a new stake in shares of Netflix in the 4th quarter worth about $34,000. MidAtlantic Capital Management Inc. acquired a new stake in Netflix during the third quarter valued at approximately $37,000. Finally, Pineridge Advisors LLC boosted its holdings in Netflix by 4,000.0% in the fourth quarter. Pineridge Advisors LLC now owns 41 shares of the Internet television network's stock worth $37,000 after purchasing an additional 40 shares during the period. 80.93% of the stock is currently owned by hedge funds and other institutional investors.

Netflix Price Performance

Shares of NFLX opened at $919.68 on Thursday. Netflix, Inc. has a fifty-two week low of $542.01 and a fifty-two week high of $1,064.50. The stock has a market capitalization of $393.40 billion, a PE ratio of 46.38, a PEG ratio of 2.12 and a beta of 1.38. The company has a debt-to-equity ratio of 0.56, a quick ratio of 1.22 and a current ratio of 1.22. The company has a 50 day moving average price of $950.23 and a 200-day moving average price of $845.78.

Netflix (NASDAQ:NFLX - Get Free Report) last posted its quarterly earnings results on Tuesday, January 21st. The Internet television network reported $4.27 earnings per share for the quarter, beating the consensus estimate of $4.20 by $0.07. Netflix had a return on equity of 38.32% and a net margin of 22.34%. The business had revenue of $10.25 billion for the quarter, compared to the consensus estimate of $10.14 billion. During the same quarter in the previous year, the business earned $2.11 EPS. The company's quarterly revenue was up 16.0% compared to the same quarter last year. Equities analysts predict that Netflix, Inc. will post 24.58 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on the company. Oppenheimer boosted their price objective on Netflix from $1,040.00 to $1,150.00 and gave the stock an "outperform" rating in a research report on Wednesday, January 22nd. Rosenblatt Securities raised Netflix from a "neutral" rating to a "buy" rating and boosted their target price for the stock from $680.00 to $1,494.00 in a research report on Wednesday, January 22nd. UBS Group reiterated a "buy" rating on shares of Netflix in a research report on Monday. Argus upped their price objective on shares of Netflix from $840.00 to $1,040.00 and gave the company a "buy" rating in a research note on Monday, January 6th. Finally, Macquarie boosted their price target on Netflix from $965.00 to $1,150.00 and gave the stock an "outperform" rating in a research report on Wednesday, January 22nd. Ten analysts have rated the stock with a hold rating, twenty-five have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $1,014.26.

View Our Latest Analysis on NFLX

Insider Buying and Selling

In related news, Chairman Reed Hastings sold 35,868 shares of Netflix stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $888.08, for a total value of $31,853,653.44. Following the completion of the sale, the chairman now owns 114 shares in the company, valued at approximately $101,241.12. This trade represents a 99.68 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Ann Mather sold 2,682 shares of the stock in a transaction dated Monday, February 3rd. The stock was sold at an average price of $973.00, for a total transaction of $2,609,586.00. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 288,103 shares of company stock worth $279,142,041. 1.76% of the stock is owned by corporate insiders.

Netflix Company Profile

(

Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Recommended Stories

Want to see what other hedge funds are holding NFLX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Netflix, Inc. (NASDAQ:NFLX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.