Impax Asset Management Group plc bought a new stake in shares of Iridium Communications Inc. (NASDAQ:IRDM - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 22,902 shares of the technology company's stock, valued at approximately $697,000.

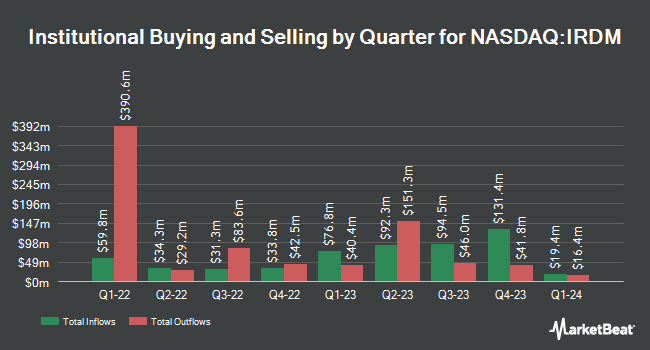

Several other large investors have also added to or reduced their stakes in the business. Allspring Global Investments Holdings LLC raised its holdings in shares of Iridium Communications by 7,684.6% during the second quarter. Allspring Global Investments Holdings LLC now owns 1,012 shares of the technology company's stock valued at $27,000 after purchasing an additional 999 shares during the period. Acadian Asset Management LLC bought a new position in Iridium Communications in the first quarter worth approximately $29,000. Mather Group LLC. acquired a new stake in Iridium Communications in the second quarter valued at approximately $32,000. Blue Trust Inc. increased its holdings in shares of Iridium Communications by 109.7% during the second quarter. Blue Trust Inc. now owns 1,491 shares of the technology company's stock valued at $39,000 after acquiring an additional 780 shares in the last quarter. Finally, International Assets Investment Management LLC acquired a new position in shares of Iridium Communications during the second quarter worth approximately $45,000. Institutional investors and hedge funds own 84.36% of the company's stock.

Wall Street Analyst Weigh In

IRDM has been the subject of a number of analyst reports. BWS Financial reiterated a "neutral" rating and set a $30.00 price target on shares of Iridium Communications in a research note on Monday, October 21st. Barclays upped their target price on shares of Iridium Communications from $44.00 to $45.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 24th. Two analysts have rated the stock with a hold rating, one has issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $41.00.

Check Out Our Latest Stock Report on IRDM

Insider Buying and Selling at Iridium Communications

In other Iridium Communications news, insider Suzanne E. Mcbride sold 4,420 shares of the stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $29.48, for a total transaction of $130,301.60. Following the completion of the transaction, the insider now owns 182,797 shares in the company, valued at $5,388,855.56. This trade represents a 2.36 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Robert H. Niehaus sold 38,355 shares of Iridium Communications stock in a transaction dated Wednesday, October 23rd. The stock was sold at an average price of $29.39, for a total transaction of $1,127,253.45. Following the completion of the transaction, the director now owns 254,824 shares of the company's stock, valued at $7,489,277.36. The trade was a 13.08 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 2.00% of the company's stock.

Iridium Communications Stock Performance

Shares of IRDM stock traded down $1.34 during trading on Friday, hitting $28.31. The company's stock had a trading volume of 1,018,582 shares, compared to its average volume of 1,138,468. The company has a current ratio of 2.62, a quick ratio of 2.01 and a debt-to-equity ratio of 2.68. The company has a market cap of $3.22 billion, a PE ratio of 30.12 and a beta of 0.65. The business has a fifty day moving average of $29.41 and a 200-day moving average of $28.30. Iridium Communications Inc. has a 52 week low of $24.14 and a 52 week high of $41.66.

Iridium Communications (NASDAQ:IRDM - Get Free Report) last announced its quarterly earnings data on Thursday, October 17th. The technology company reported $0.21 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.20 by $0.01. The firm had revenue of $212.77 million during the quarter, compared to the consensus estimate of $205.68 million. Iridium Communications had a return on equity of 14.34% and a net margin of 14.09%. As a group, research analysts anticipate that Iridium Communications Inc. will post 0.8 earnings per share for the current year.

Iridium Communications Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Shareholders of record on Friday, September 13th were given a $0.14 dividend. This represents a $0.56 annualized dividend and a yield of 1.98%. The ex-dividend date was Friday, September 13th. Iridium Communications's dividend payout ratio is 59.57%.

Iridium Communications declared that its board has approved a share buyback program on Thursday, September 19th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the technology company to repurchase up to 14.2% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's board of directors believes its shares are undervalued.

About Iridium Communications

(

Free Report)

Iridium Communications Inc provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide. The company offers postpaid mobile voice and data satellite communications; prepaid mobile voice satellite communications; push-to-talk; broadband data; and Internet of Things (IoT) services.

Recommended Stories

Before you consider Iridium Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iridium Communications wasn't on the list.

While Iridium Communications currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.