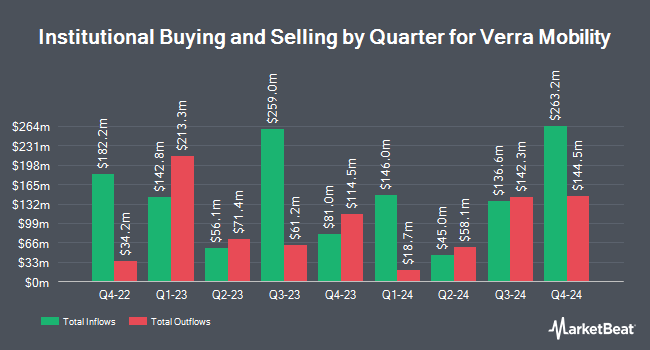

Impax Asset Management Group plc cut its stake in Verra Mobility Co. (NASDAQ:VRRM - Free Report) by 39.8% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 173,661 shares of the company's stock after selling 115,000 shares during the period. Impax Asset Management Group plc owned 0.10% of Verra Mobility worth $4,830,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors also recently modified their holdings of the company. Allspring Global Investments Holdings LLC bought a new position in shares of Verra Mobility in the first quarter worth about $26,000. Quest Partners LLC raised its stake in shares of Verra Mobility by 1,732.7% in the second quarter. Quest Partners LLC now owns 1,008 shares of the company's stock worth $27,000 after acquiring an additional 953 shares during the last quarter. Signaturefd LLC raised its stake in shares of Verra Mobility by 112.4% during the third quarter. Signaturefd LLC now owns 1,060 shares of the company's stock worth $29,000 after buying an additional 561 shares during the last quarter. Picton Mahoney Asset Management bought a new stake in shares of Verra Mobility during the first quarter worth approximately $74,000. Finally, Montag A & Associates Inc. raised its stake in shares of Verra Mobility by 17.1% during the first quarter. Montag A & Associates Inc. now owns 3,045 shares of the company's stock worth $76,000 after buying an additional 445 shares during the last quarter.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on VRRM. Morgan Stanley dropped their price target on shares of Verra Mobility from $26.00 to $25.00 and set an "equal weight" rating for the company in a research note on Wednesday, October 30th. Robert W. Baird dropped their price target on shares of Verra Mobility from $29.00 to $28.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. Finally, Deutsche Bank Aktiengesellschaft dropped their price target on shares of Verra Mobility from $31.00 to $29.00 and set a "buy" rating for the company in a research note on Friday, November 1st.

Get Our Latest Stock Report on Verra Mobility

Verra Mobility Trading Up 3.6 %

NASDAQ VRRM traded up $0.83 during trading on Wednesday, reaching $23.95. 1,986,029 shares of the stock traded hands, compared to its average volume of 1,075,652. The firm has a market cap of $3.94 billion, a price-to-earnings ratio of 38.53, a price-to-earnings-growth ratio of 1.51 and a beta of 1.27. The stock's 50-day moving average price is $26.84 and its 200 day moving average price is $27.14. The company has a quick ratio of 2.52, a current ratio of 2.61 and a debt-to-equity ratio of 2.13. Verra Mobility Co. has a fifty-two week low of $18.76 and a fifty-two week high of $31.03.

Verra Mobility (NASDAQ:VRRM - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The company reported $0.32 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.32. The firm had revenue of $225.55 million during the quarter, compared to analysts' expectations of $226.65 million. Verra Mobility had a net margin of 11.64% and a return on equity of 38.97%. The business's revenue for the quarter was up 7.4% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.27 earnings per share. Analysts predict that Verra Mobility Co. will post 1.07 EPS for the current year.

Verra Mobility Company Profile

(

Free Report)

Verra Mobility Corporation provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe. It operates through three segments: Commercial Services, Government Solutions, and Parking Solutions. The Commercial Services segment provides automated toll and violations management, and title and registration services to rental car companies, fleet management companies, and other large fleet owners.

Further Reading

Before you consider Verra Mobility, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Verra Mobility wasn't on the list.

While Verra Mobility currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.