Impax Asset Management Group plc grew its holdings in Sprout Social, Inc. (NASDAQ:SPT - Free Report) by 46.6% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 188,724 shares of the company's stock after purchasing an additional 60,000 shares during the period. Impax Asset Management Group plc owned approximately 0.33% of Sprout Social worth $5,486,000 as of its most recent filing with the Securities & Exchange Commission.

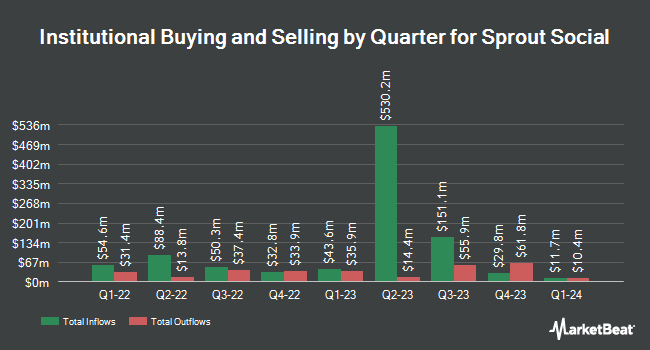

A number of other hedge funds have also modified their holdings of SPT. Dorsey Asset Management LLC purchased a new stake in Sprout Social in the second quarter valued at approximately $61,583,000. Jericho Capital Asset Management L.P. acquired a new position in Sprout Social during the 1st quarter worth about $22,332,000. Allspring Global Investments Holdings LLC boosted its holdings in Sprout Social by 98.7% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 664,970 shares of the company's stock valued at $23,726,000 after acquiring an additional 330,309 shares during the period. Millennium Management LLC grew its position in Sprout Social by 9,779.5% in the 2nd quarter. Millennium Management LLC now owns 331,260 shares of the company's stock valued at $11,819,000 after acquiring an additional 327,907 shares in the last quarter. Finally, Principal Financial Group Inc. grew its position in Sprout Social by 20.0% in the 3rd quarter. Principal Financial Group Inc. now owns 1,199,451 shares of the company's stock valued at $34,868,000 after acquiring an additional 200,190 shares in the last quarter.

Insider Activity

In other news, insider Justyn Russell Howard sold 20,000 shares of the business's stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $28.23, for a total value of $564,600.00. Following the transaction, the insider now owns 7,417 shares of the company's stock, valued at approximately $209,381.91. The trade was a 72.95 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director Aaron Edward Frederick Rankin sold 1,181 shares of the business's stock in a transaction on Wednesday, September 4th. The shares were sold at an average price of $29.23, for a total transaction of $34,520.63. Following the completion of the transaction, the director now directly owns 42,122 shares in the company, valued at $1,231,226.06. This represents a 2.73 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 62,882 shares of company stock valued at $1,801,351. 10.97% of the stock is currently owned by company insiders.

Analyst Ratings Changes

Several research analysts have recently commented on SPT shares. KeyCorp lowered shares of Sprout Social from a "sector weight" rating to an "underweight" rating and set a $28.00 price objective for the company. in a research note on Thursday, August 22nd. Barclays dropped their price target on shares of Sprout Social from $48.00 to $38.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. Piper Sandler cut their price objective on Sprout Social from $40.00 to $29.00 and set a "neutral" rating on the stock in a research report on Monday, November 11th. Robert W. Baird lifted their target price on Sprout Social from $38.00 to $40.00 and gave the company a "neutral" rating in a report on Friday, August 2nd. Finally, Cantor Fitzgerald reissued an "overweight" rating and set a $46.00 target price on shares of Sprout Social in a research note on Friday, August 2nd. One equities research analyst has rated the stock with a sell rating, six have assigned a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat.com, Sprout Social presently has a consensus rating of "Hold" and an average target price of $47.08.

Read Our Latest Stock Report on SPT

Sprout Social Stock Down 0.4 %

Shares of NASDAQ:SPT traded down $0.12 during trading on Friday, hitting $28.64. 528,064 shares of the company were exchanged, compared to its average volume of 749,067. The firm's 50 day moving average price is $28.10 and its 200-day moving average price is $31.72. Sprout Social, Inc. has a 12-month low of $25.05 and a 12-month high of $68.41. The company has a debt-to-equity ratio of 0.19, a current ratio of 0.96 and a quick ratio of 0.98. The stock has a market capitalization of $1.63 billion, a P/E ratio of -23.87 and a beta of 0.99.

Sprout Social (NASDAQ:SPT - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The company reported ($0.28) earnings per share for the quarter, missing analysts' consensus estimates of ($0.22) by ($0.06). Sprout Social had a negative net margin of 17.24% and a negative return on equity of 40.94%. The company had revenue of $102.64 million during the quarter, compared to analysts' expectations of $102.04 million. On average, research analysts predict that Sprout Social, Inc. will post -0.9 earnings per share for the current fiscal year.

Sprout Social Company Profile

(

Free Report)

Sprout Social, Inc designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company provides cloud software for social messaging, data and workflows in a unified system of record, intelligence, and action.

Further Reading

Before you consider Sprout Social, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sprout Social wasn't on the list.

While Sprout Social currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.