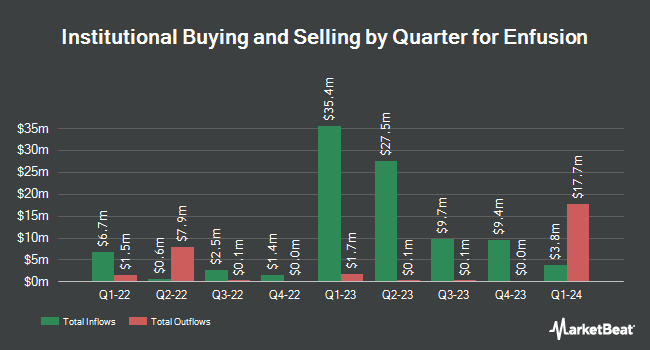

Impax Asset Management Group plc increased its holdings in shares of Enfusion, Inc. (NYSE:ENFN - Free Report) by 25.4% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 676,948 shares of the company's stock after purchasing an additional 136,948 shares during the period. Impax Asset Management Group plc owned approximately 0.53% of Enfusion worth $6,424,000 at the end of the most recent reporting period.

Several other large investors have also made changes to their positions in the business. Harbor Capital Advisors Inc. lifted its position in shares of Enfusion by 12.4% during the 3rd quarter. Harbor Capital Advisors Inc. now owns 11,887 shares of the company's stock worth $113,000 after purchasing an additional 1,315 shares during the last quarter. 272 Capital LP raised its holdings in Enfusion by 1.5% in the 2nd quarter. 272 Capital LP now owns 139,180 shares of the company's stock valued at $1,186,000 after acquiring an additional 2,000 shares in the last quarter. California State Teachers Retirement System raised its holdings in Enfusion by 11.0% in the 1st quarter. California State Teachers Retirement System now owns 36,002 shares of the company's stock valued at $333,000 after acquiring an additional 3,556 shares in the last quarter. The Manufacturers Life Insurance Company raised its holdings in Enfusion by 27.7% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 19,562 shares of the company's stock valued at $167,000 after acquiring an additional 4,239 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC acquired a new position in Enfusion in the 1st quarter valued at approximately $44,000. Institutional investors and hedge funds own 81.05% of the company's stock.

Enfusion Stock Up 4.2 %

Enfusion stock traded up $0.38 during trading hours on Wednesday, hitting $9.33. The stock had a trading volume of 897,138 shares, compared to its average volume of 371,983. The company has a 50-day moving average of $8.77 and a two-hundred day moving average of $8.84. The company has a market cap of $1.20 billion, a PE ratio of 223.81, a price-to-earnings-growth ratio of 2.51 and a beta of 0.93. Enfusion, Inc. has a fifty-two week low of $7.52 and a fifty-two week high of $10.45.

Enfusion (NYSE:ENFN - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The company reported $0.02 EPS for the quarter, missing the consensus estimate of $0.03 by ($0.01). Enfusion had a net margin of 1.98% and a return on equity of 6.17%. The firm had revenue of $49.46 million during the quarter, compared to analyst estimates of $50.27 million. As a group, analysts forecast that Enfusion, Inc. will post 0.07 EPS for the current fiscal year.

About Enfusion

(

Free Report)

Enfusion, Inc provides software-as-a-service solutions for investment management industry in the United States, Europe, the Middle East, Africa, and the Asia Pacific. The company provides Portfolio Management System, which generates a real-time investment book of record that consists of valuation and risk tools, which allows users to analyze aggregated or decomposed portfolio data for chief investment officers (CIOs) and portfolio managers; and Order and Execution Management System that enables portfolio managers, traders, compliance teams, and analysts to electronically communicate trade orders for a variety of asset classes, manage trade orders, and systemically enforce trading regulations and internal guidelines.

See Also

Before you consider Enfusion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enfusion wasn't on the list.

While Enfusion currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.