Impax Asset Management Group plc lifted its holdings in Enfusion, Inc. (NYSE:ENFN - Free Report) by 25.4% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 676,948 shares of the company's stock after acquiring an additional 136,948 shares during the period. Impax Asset Management Group plc owned approximately 0.53% of Enfusion worth $6,424,000 as of its most recent filing with the SEC.

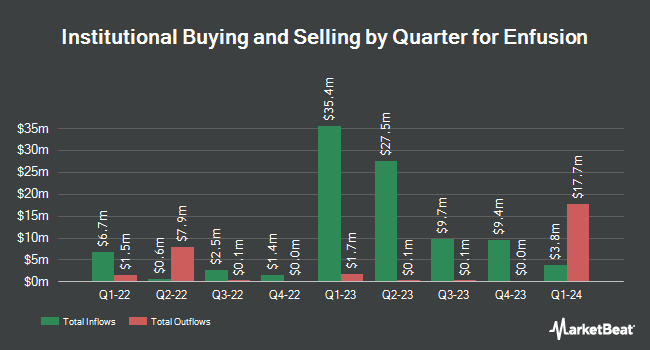

Other hedge funds and other institutional investors have also bought and sold shares of the company. Allspring Global Investments Holdings LLC bought a new stake in shares of Enfusion during the 1st quarter valued at $44,000. RiverPark Advisors LLC bought a new stake in Enfusion during the second quarter worth about $68,000. Arizona State Retirement System acquired a new stake in Enfusion during the second quarter worth about $86,000. Price T Rowe Associates Inc. MD bought a new position in Enfusion in the 1st quarter valued at about $102,000. Finally, Quadrature Capital Ltd acquired a new position in shares of Enfusion in the 1st quarter valued at approximately $109,000. Institutional investors and hedge funds own 81.05% of the company's stock.

Enfusion Stock Performance

Shares of Enfusion stock traded down $0.09 on Friday, reaching $9.79. 668,885 shares of the stock were exchanged, compared to its average volume of 381,949. The firm has a market cap of $1.26 billion, a PE ratio of 244.75, a P/E/G ratio of 3.62 and a beta of 0.93. The firm's 50 day moving average is $9.00 and its 200-day moving average is $8.86. Enfusion, Inc. has a one year low of $7.52 and a one year high of $10.45.

Enfusion Company Profile

(

Free Report)

Enfusion, Inc provides software-as-a-service solutions for investment management industry in the United States, Europe, the Middle East, Africa, and the Asia Pacific. The company provides Portfolio Management System, which generates a real-time investment book of record that consists of valuation and risk tools, which allows users to analyze aggregated or decomposed portfolio data for chief investment officers (CIOs) and portfolio managers; and Order and Execution Management System that enables portfolio managers, traders, compliance teams, and analysts to electronically communicate trade orders for a variety of asset classes, manage trade orders, and systemically enforce trading regulations and internal guidelines.

Further Reading

Before you consider Enfusion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enfusion wasn't on the list.

While Enfusion currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.