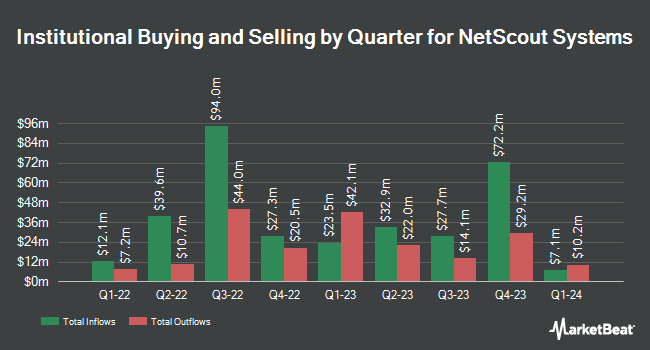

Impax Asset Management Group plc increased its position in NetScout Systems, Inc. (NASDAQ:NTCT - Free Report) by 32.0% in the third quarter, according to its most recent 13F filing with the SEC. The firm owned 495,000 shares of the technology company's stock after purchasing an additional 120,000 shares during the period. Impax Asset Management Group plc owned about 0.69% of NetScout Systems worth $10,766,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Meeder Asset Management Inc. purchased a new stake in NetScout Systems in the 2nd quarter worth approximately $38,000. Innealta Capital LLC bought a new position in shares of NetScout Systems during the 2nd quarter valued at $60,000. Gladius Capital Management LP bought a new position in shares of NetScout Systems during the 2nd quarter valued at $69,000. Quest Partners LLC bought a new position in shares of NetScout Systems during the 2nd quarter valued at $73,000. Finally, CWM LLC raised its holdings in shares of NetScout Systems by 250.8% during the 3rd quarter. CWM LLC now owns 6,409 shares of the technology company's stock valued at $139,000 after purchasing an additional 4,582 shares in the last quarter. Institutional investors and hedge funds own 91.64% of the company's stock.

Analyst Ratings Changes

Several research analysts recently commented on NTCT shares. Royal Bank of Canada reiterated a "sector perform" rating and issued a $22.00 target price on shares of NetScout Systems in a report on Friday, July 26th. StockNews.com downgraded shares of NetScout Systems from a "strong-buy" rating to a "buy" rating in a report on Wednesday, July 24th.

Read Our Latest Research Report on NetScout Systems

Insiders Place Their Bets

In other news, COO Michael Szabados sold 6,500 shares of NetScout Systems stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $18.81, for a total transaction of $122,265.00. Following the sale, the chief operating officer now directly owns 43,434 shares in the company, valued at approximately $816,993.54. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. In other NetScout Systems news, EVP John Downing sold 4,247 shares of the business's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $20.00, for a total value of $84,940.00. Following the transaction, the executive vice president now directly owns 131,590 shares in the company, valued at $2,631,800. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, COO Michael Szabados sold 6,500 shares of the business's stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $18.81, for a total transaction of $122,265.00. Following the completion of the transaction, the chief operating officer now owns 43,434 shares in the company, valued at approximately $816,993.54. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 36,452 shares of company stock worth $736,991 in the last ninety days. Insiders own 3.71% of the company's stock.

NetScout Systems Stock Performance

NASDAQ NTCT traded up $1.65 during midday trading on Wednesday, hitting $22.67. The company had a trading volume of 523,577 shares, compared to its average volume of 642,644. The company has a quick ratio of 1.63, a current ratio of 1.68 and a debt-to-equity ratio of 0.05. The stock has a market cap of $1.62 billion, a price-to-earnings ratio of -2.50 and a beta of 0.58. The firm has a fifty day simple moving average of $20.82 and a two-hundred day simple moving average of $19.93. NetScout Systems, Inc. has a fifty-two week low of $17.10 and a fifty-two week high of $24.42.

NetScout Systems Company Profile

(

Free Report)

NetScout Systems, Inc provides service assurance and cybersecurity solutions for protect digital business services against disruptions in the United States, Europe, Asia, and internationally. The company offers nGeniusONE management software that enables customers to predict, preempt, and resolve network and service delivery problems, as well as facilitate the optimization and capacity planning of their network infrastructures; and specialized platforms and analytic modules that enable its customers to analyze and troubleshoot traffic in radio access and Wi-Fi networks.

Further Reading

Before you consider NetScout Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetScout Systems wasn't on the list.

While NetScout Systems currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.