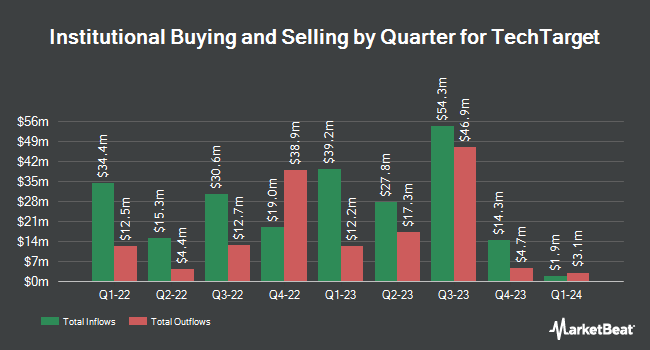

Impax Asset Management Group plc grew its stake in shares of TechTarget, Inc. (NASDAQ:TTGT - Free Report) by 24.9% in the third quarter, according to its most recent filing with the SEC. The fund owned 351,387 shares of the information services provider's stock after acquiring an additional 70,000 shares during the period. Impax Asset Management Group plc owned about 1.20% of TechTarget worth $8,591,000 at the end of the most recent reporting period.

Other large investors have also modified their holdings of the company. BOKF NA purchased a new stake in shares of TechTarget during the second quarter valued at $239,000. SG Americas Securities LLC purchased a new position in TechTarget during the 3rd quarter worth approximately $307,000. The Manufacturers Life Insurance Company raised its stake in TechTarget by 4.5% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 9,993 shares of the information services provider's stock valued at $311,000 after purchasing an additional 430 shares during the period. Riverwater Partners LLC purchased a new stake in shares of TechTarget in the second quarter valued at $350,000. Finally, Inspire Investing LLC boosted its position in shares of TechTarget by 4.3% in the second quarter. Inspire Investing LLC now owns 11,379 shares of the information services provider's stock worth $355,000 after buying an additional 469 shares during the period. 93.52% of the stock is owned by institutional investors.

Analyst Ratings Changes

TTGT has been the topic of several recent analyst reports. Craig Hallum raised TechTarget from a "hold" rating to a "buy" rating and upped their price target for the company from $34.00 to $36.00 in a research report on Tuesday, October 15th. Raymond James decreased their price target on shares of TechTarget from $39.00 to $34.00 and set an "outperform" rating for the company in a report on Monday, August 12th. Needham & Company LLC dropped their price objective on shares of TechTarget from $50.00 to $40.00 and set a "buy" rating on the stock in a research note on Monday, September 16th. Finally, KeyCorp cut their target price on shares of TechTarget from $40.00 to $38.00 and set an "overweight" rating for the company in a research report on Monday, August 12th. One research analyst has rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, TechTarget currently has a consensus rating of "Moderate Buy" and a consensus price target of $37.67.

Read Our Latest Analysis on TechTarget

TechTarget Stock Up 5.2 %

TTGT stock traded up $1.49 during trading hours on Wednesday, hitting $29.99. The company's stock had a trading volume of 198,889 shares, compared to its average volume of 128,491. The stock has a 50 day moving average price of $25.98 and a two-hundred day moving average price of $28.49. TechTarget, Inc. has a 12 month low of $22.82 and a 12 month high of $41.93. The company has a market capitalization of $876.91 million, a PE ratio of -95.00, a price-to-earnings-growth ratio of 31.81 and a beta of 1.03. The company has a quick ratio of 9.35, a current ratio of 9.35 and a debt-to-equity ratio of 1.74.

TechTarget (NASDAQ:TTGT - Get Free Report) last posted its earnings results on Thursday, August 8th. The information services provider reported $0.42 EPS for the quarter, topping the consensus estimate of $0.41 by $0.01. TechTarget had a negative net margin of 3.84% and a positive return on equity of 5.92%. The firm had revenue of $58.91 million for the quarter, compared to the consensus estimate of $58.08 million. During the same period in the prior year, the business posted $0.17 earnings per share. The business's quarterly revenue was up .8% on a year-over-year basis. On average, equities research analysts expect that TechTarget, Inc. will post 0.5 earnings per share for the current year.

TechTarget Profile

(

Free Report)

TechTarget, Inc, together with its subsidiaries, provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally. The company's service enables technology vendors to identify, reach, and influence corporate information technology (IT) decision-makers actively researching specific IT purchases; and customized marketing programs that integrate demand generation, brand advertising techniques, and content curation and creation.

Further Reading

Before you consider TechTarget, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechTarget wasn't on the list.

While TechTarget currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.