Imperial Oil (TSE:IMO - Get Free Report) NYSEMKT: IMO was upgraded by analysts at Wolfe Research from a "hold" rating to a "strong-buy" rating in a research note issued to investors on Monday,Zacks.com reports.

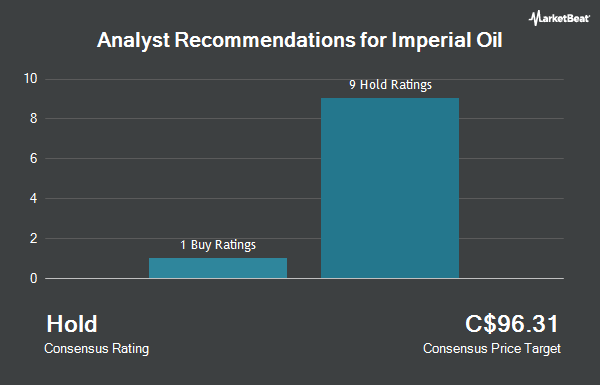

Other analysts have also issued research reports about the company. Desjardins decreased their price objective on Imperial Oil from C$91.00 to C$85.00 and set a "hold" rating on the stock in a report on Tuesday, April 15th. TD Securities lowered their price target on shares of Imperial Oil from C$94.00 to C$92.00 and set a "hold" rating on the stock in a report on Monday. National Bankshares raised their price objective on shares of Imperial Oil from C$109.00 to C$110.00 and gave the stock a "sector perform" rating in a report on Thursday, January 30th. Raymond James raised shares of Imperial Oil from a "market perform" rating to an "outperform" rating and lowered their target price for the company from C$108.00 to C$104.00 in a research note on Wednesday, April 9th. Finally, Scotiabank raised shares of Imperial Oil to a "hold" rating in a research report on Wednesday, March 19th. One analyst has rated the stock with a sell rating, six have assigned a hold rating, one has given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of C$103.33.

Read Our Latest Research Report on IMO

Imperial Oil Stock Performance

IMO stock traded up C$1.42 during trading on Monday, reaching C$94.67. 797,720 shares of the stock were exchanged, compared to its average volume of 900,302. Imperial Oil has a twelve month low of C$82.98 and a twelve month high of C$108.89. The company has a current ratio of 1.44, a quick ratio of 0.98 and a debt-to-equity ratio of 18.04. The company has a market capitalization of C$49.42 billion, a P/E ratio of 10.17, a price-to-earnings-growth ratio of 0.21 and a beta of 1.78. The stock has a 50 day simple moving average of C$95.90 and a 200-day simple moving average of C$98.43.

About Imperial Oil

(

Get Free Report)

Imperial Oil is one of Canada's largest integrated oil companies, focusing on upstream operations, petroleum refining operations, and the marketing of petroleum products. Production averaged 398 thousand barrels of oil equivalent per day in 2020. The company estimates that it holds 5.2 billion boe of proved and probable crude oil and natural gas reserves.

Further Reading

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.