Jacobs Levy Equity Management Inc. decreased its holdings in Incyte Co. (NASDAQ:INCY - Free Report) by 40.3% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 92,782 shares of the biopharmaceutical company's stock after selling 62,713 shares during the period. Jacobs Levy Equity Management Inc.'s holdings in Incyte were worth $6,133,000 as of its most recent SEC filing.

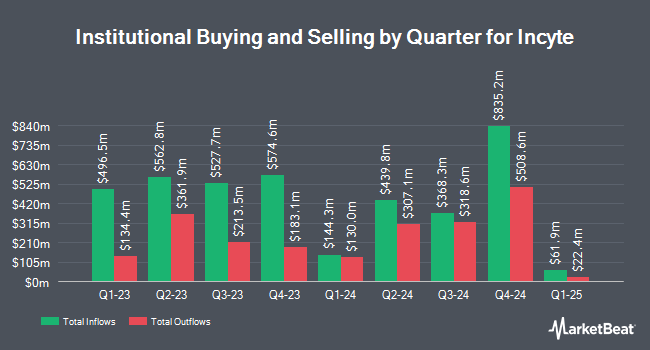

A number of other institutional investors also recently made changes to their positions in INCY. MFA Wealth Advisors LLC bought a new stake in Incyte during the 2nd quarter valued at $26,000. Brooklyn Investment Group bought a new position in Incyte in the 3rd quarter worth $30,000. Innealta Capital LLC bought a new position in Incyte in the 2nd quarter worth $32,000. Point72 Asia Singapore Pte. Ltd. bought a new position in Incyte in the 3rd quarter worth $33,000. Finally, Itau Unibanco Holding S.A. purchased a new stake in shares of Incyte in the 2nd quarter worth about $36,000. Hedge funds and other institutional investors own 96.97% of the company's stock.

Incyte Price Performance

Shares of INCY stock traded up $1.00 on Friday, reaching $75.92. The company's stock had a trading volume of 1,321,695 shares, compared to its average volume of 2,349,618. The stock's fifty day simple moving average is $71.53 and its 200-day simple moving average is $65.57. Incyte Co. has a 1 year low of $50.35 and a 1 year high of $83.95. The company has a current ratio of 1.87, a quick ratio of 1.82 and a debt-to-equity ratio of 0.01. The company has a market capitalization of $14.63 billion, a price-to-earnings ratio of 542.32, a price-to-earnings-growth ratio of 8.30 and a beta of 0.69.

Incyte (NASDAQ:INCY - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The biopharmaceutical company reported $1.07 EPS for the quarter, missing the consensus estimate of $1.19 by ($0.12). Incyte had a negative return on equity of 0.63% and a net margin of 0.80%. The firm had revenue of $1.14 billion for the quarter, compared to analysts' expectations of $1.08 billion. During the same period in the previous year, the firm earned $0.91 earnings per share. The firm's quarterly revenue was up 23.8% compared to the same quarter last year. Analysts forecast that Incyte Co. will post 0.4 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. StockNews.com raised shares of Incyte from a "buy" rating to a "strong-buy" rating in a research report on Thursday, November 28th. Cantor Fitzgerald reissued a "neutral" rating on shares of Incyte in a research report on Tuesday, November 19th. Truist Financial reissued a "hold" rating and set a $74.00 price objective (down from $83.00) on shares of Incyte in a research report on Wednesday, September 18th. Wells Fargo & Company increased their price objective on shares of Incyte from $62.00 to $68.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 30th. Finally, Morgan Stanley increased their price objective on shares of Incyte from $64.00 to $69.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 30th. One analyst has rated the stock with a sell rating, eleven have assigned a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $77.16.

Get Our Latest Report on INCY

Insider Activity at Incyte

In other news, EVP Jonathan Elliott Dickinson sold 8,450 shares of the company's stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $62.36, for a total transaction of $526,942.00. Following the completion of the transaction, the executive vice president now directly owns 36,390 shares of the company's stock, valued at $2,269,280.40. This represents a 18.84 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, insider Thomas Tray sold 572 shares of the company's stock in a transaction on Thursday, September 12th. The shares were sold at an average price of $62.94, for a total value of $36,001.68. Following the completion of the sale, the insider now owns 24,825 shares of the company's stock, valued at approximately $1,562,485.50. The trade was a 2.25 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 18,745 shares of company stock worth $1,311,687 over the last three months. 17.60% of the stock is owned by corporate insiders.

About Incyte

(

Free Report)

Incyte Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for hematology/oncology, and inflammation and autoimmunity areas in the United States and internationally. The company offers JAKAFI (ruxolitinib) for treatment of intermediate or high-risk myelofibrosis, polycythemia vera, and steroid-refractory acute graft-versus-host disease; MONJUVI (tafasitamab-cxix)/MINJUVI (tafasitamab) for relapsed or refractory diffuse large B-cell lymphoma; PEMAZYRE (pemigatinib), a fibroblast growth factor receptor kinase inhibitor that act as oncogenic drivers in liquid and solid tumor types; ICLUSIG (ponatinib) to treat chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia; and ZYNYZ (retifanlimab-dlwr) to treat adults with metastatic or recurrent locally advanced Merkel cell carcinoma, as well as OPZELURA cream for treatment of atopic dermatitis.

Further Reading

Before you consider Incyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Incyte wasn't on the list.

While Incyte currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.