Incyte (NASDAQ:INCY - Get Free Report)'s stock had its "neutral" rating restated by equities researchers at Cantor Fitzgerald in a research report issued to clients and investors on Tuesday,Benzinga reports.

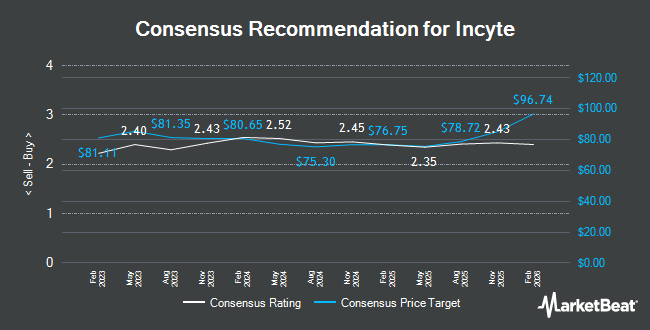

Other research analysts have also recently issued reports about the stock. JPMorgan Chase & Co. boosted their target price on shares of Incyte from $65.00 to $71.00 and gave the stock a "neutral" rating in a research report on Wednesday, October 30th. Wolfe Research started coverage on shares of Incyte in a research report on Tuesday, October 1st. They set an "outperform" rating and a $84.00 target price on the stock. Citigroup boosted their target price on shares of Incyte from $92.00 to $97.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. Truist Financial restated a "hold" rating and issued a $74.00 price target (down previously from $83.00) on shares of Incyte in a research note on Wednesday, September 18th. Finally, Deutsche Bank Aktiengesellschaft lifted their price target on shares of Incyte from $55.00 to $60.00 and gave the stock a "hold" rating in a research note on Thursday, August 1st. One investment analyst has rated the stock with a sell rating, eleven have given a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, Incyte presently has an average rating of "Hold" and an average price target of $77.16.

Read Our Latest Stock Report on Incyte

Incyte Trading Down 8.3 %

NASDAQ INCY traded down $6.41 during mid-day trading on Tuesday, hitting $70.56. The company's stock had a trading volume of 10,778,206 shares, compared to its average volume of 2,377,895. Incyte has a 52-week low of $50.35 and a 52-week high of $83.95. The stock's fifty day simple moving average is $69.28 and its two-hundred day simple moving average is $64.07. The company has a debt-to-equity ratio of 0.01, a current ratio of 1.87 and a quick ratio of 1.82. The firm has a market capitalization of $13.59 billion, a P/E ratio of 477.75, a price-to-earnings-growth ratio of 8.75 and a beta of 0.71.

Incyte (NASDAQ:INCY - Get Free Report) last posted its earnings results on Tuesday, October 29th. The biopharmaceutical company reported $1.07 EPS for the quarter, missing analysts' consensus estimates of $1.19 by ($0.12). Incyte had a negative return on equity of 0.63% and a net margin of 0.80%. The firm had revenue of $1.14 billion for the quarter, compared to analyst estimates of $1.08 billion. During the same period in the previous year, the firm posted $0.91 earnings per share. The company's revenue for the quarter was up 23.8% on a year-over-year basis. Research analysts expect that Incyte will post 0.4 EPS for the current year.

Insider Buying and Selling at Incyte

In other news, EVP Barry P. Flannelly sold 3,680 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $79.68, for a total transaction of $293,222.40. Following the completion of the transaction, the executive vice president now owns 58,042 shares in the company, valued at approximately $4,624,786.56. This represents a 5.96 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Jonathan Elliott Dickinson sold 8,450 shares of the company's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $62.36, for a total transaction of $526,942.00. Following the transaction, the executive vice president now owns 36,390 shares of the company's stock, valued at $2,269,280.40. This represents a 18.84 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 12,702 shares of company stock worth $856,166 over the last 90 days. Insiders own 17.60% of the company's stock.

Hedge Funds Weigh In On Incyte

Institutional investors have recently modified their holdings of the company. MFA Wealth Advisors LLC bought a new position in shares of Incyte during the second quarter worth about $26,000. Brooklyn Investment Group acquired a new stake in Incyte in the third quarter worth about $30,000. Innealta Capital LLC acquired a new stake in Incyte in the second quarter worth about $32,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in Incyte in the third quarter worth about $33,000. Finally, Itau Unibanco Holding S.A. acquired a new stake in Incyte in the second quarter worth about $36,000. Institutional investors own 96.97% of the company's stock.

Incyte Company Profile

(

Get Free Report)

Incyte Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of therapeutics for hematology/oncology, and inflammation and autoimmunity areas in the United States and internationally. The company offers JAKAFI (ruxolitinib) for treatment of intermediate or high-risk myelofibrosis, polycythemia vera, and steroid-refractory acute graft-versus-host disease; MONJUVI (tafasitamab-cxix)/MINJUVI (tafasitamab) for relapsed or refractory diffuse large B-cell lymphoma; PEMAZYRE (pemigatinib), a fibroblast growth factor receptor kinase inhibitor that act as oncogenic drivers in liquid and solid tumor types; ICLUSIG (ponatinib) to treat chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia; and ZYNYZ (retifanlimab-dlwr) to treat adults with metastatic or recurrent locally advanced Merkel cell carcinoma, as well as OPZELURA cream for treatment of atopic dermatitis.

Featured Stories

Before you consider Incyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Incyte wasn't on the list.

While Incyte currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.