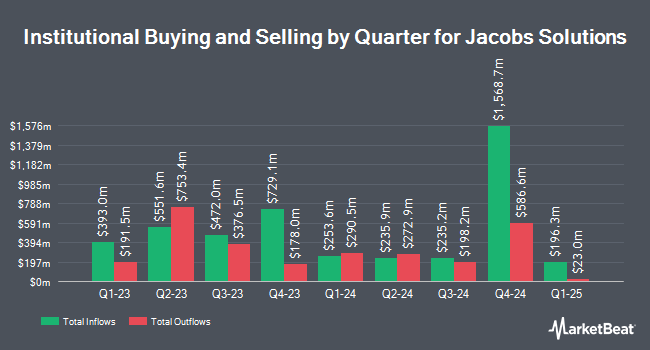

Independent Advisor Alliance boosted its holdings in shares of Jacobs Solutions Inc. (NYSE:J - Free Report) by 314.3% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm owned 8,780 shares of the company's stock after buying an additional 6,661 shares during the period. Independent Advisor Alliance's holdings in Jacobs Solutions were worth $1,149,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the business. EdgeRock Capital LLC purchased a new stake in shares of Jacobs Solutions during the 2nd quarter valued at $26,000. Bruce G. Allen Investments LLC raised its position in Jacobs Solutions by 427.5% during the second quarter. Bruce G. Allen Investments LLC now owns 211 shares of the company's stock valued at $29,000 after purchasing an additional 171 shares in the last quarter. First Horizon Advisors Inc. lifted its stake in Jacobs Solutions by 44.3% during the third quarter. First Horizon Advisors Inc. now owns 241 shares of the company's stock worth $32,000 after purchasing an additional 74 shares during the last quarter. LRI Investments LLC purchased a new position in shares of Jacobs Solutions in the 1st quarter worth about $48,000. Finally, Capital Performance Advisors LLP bought a new position in shares of Jacobs Solutions during the 3rd quarter valued at about $42,000. 85.65% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of analysts recently weighed in on J shares. Truist Financial dropped their target price on Jacobs Solutions from $158.00 to $139.00 and set a "hold" rating for the company in a research report on Wednesday, October 9th. StockNews.com started coverage on shares of Jacobs Solutions in a report on Tuesday. They issued a "buy" rating for the company. UBS Group increased their target price on shares of Jacobs Solutions from $161.00 to $165.00 and gave the company a "buy" rating in a report on Wednesday, August 14th. Robert W. Baird boosted their price target on shares of Jacobs Solutions from $147.00 to $149.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 20th. Finally, Benchmark cut Jacobs Solutions from a "buy" rating to a "hold" rating in a research note on Wednesday, November 20th. Five analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $156.50.

Read Our Latest Stock Report on J

Jacobs Solutions Trading Up 0.3 %

Shares of Jacobs Solutions stock traded up $0.43 during trading on Wednesday, reaching $141.12. 711,674 shares of the stock were exchanged, compared to its average volume of 809,241. The company has a quick ratio of 1.14, a current ratio of 1.20 and a debt-to-equity ratio of 0.30. The firm has a market cap of $17.53 billion, a price-to-earnings ratio of 22.26, a price-to-earnings-growth ratio of 2.10 and a beta of 0.71. Jacobs Solutions Inc. has a 1 year low of $101.64 and a 1 year high of $150.54. The stock's fifty day moving average is $141.92 and its 200 day moving average is $142.32.

Jacobs Solutions (NYSE:J - Get Free Report) last released its quarterly earnings data on Tuesday, November 19th. The company reported $1.37 earnings per share for the quarter, missing the consensus estimate of $2.08 by ($0.71). Jacobs Solutions had a return on equity of 14.82% and a net margin of 5.16%. The business had revenue of $2.96 billion during the quarter, compared to analysts' expectations of $4.50 billion. During the same quarter last year, the business posted $1.90 EPS. The company's quarterly revenue was up 4.4% compared to the same quarter last year. As a group, equities research analysts expect that Jacobs Solutions Inc. will post 6.06 earnings per share for the current fiscal year.

Jacobs Solutions Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 22nd. Shareholders of record on Friday, October 25th were given a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a yield of 0.82%. The ex-dividend date was Friday, October 25th. Jacobs Solutions's payout ratio is currently 18.33%.

Insiders Place Their Bets

In related news, Director Christopher M.T. Thompson sold 1,898 shares of the company's stock in a transaction on Thursday, August 29th. The stock was sold at an average price of $150.85, for a total value of $286,313.30. Following the sale, the director now directly owns 42,069 shares of the company's stock, valued at $6,346,108.65. This represents a 4.32 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Shelette M. Gustafson sold 4,167 shares of the firm's stock in a transaction on Thursday, August 29th. The shares were sold at an average price of $150.14, for a total value of $625,633.38. Following the transaction, the executive vice president now directly owns 24,564 shares of the company's stock, valued at $3,688,038.96. This represents a 14.50 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 1.00% of the company's stock.

Jacobs Solutions Company Profile

(

Free Report)

Jacobs Solutions Inc provides consulting, technical, engineering, scientific, and project delivery services for the government and private sectors in the United States, Europe, Canada, India, Asia, Australia, New Zealand, the Middle East, and Africa. It operates through Critical Mission Solutions, People & Places Solutions, Divergent Solutions, and PA Consulting segments.

Featured Stories

Before you consider Jacobs Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jacobs Solutions wasn't on the list.

While Jacobs Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.