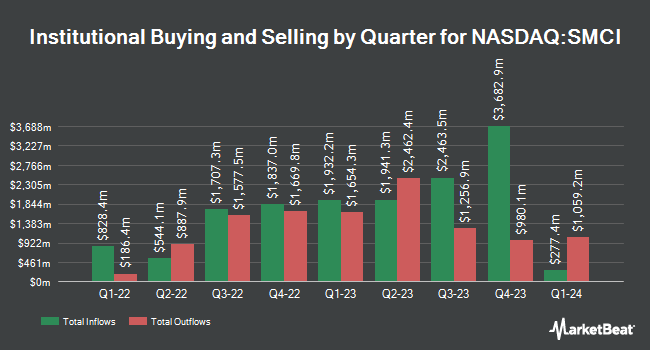

Independent Advisor Alliance raised its stake in shares of Super Micro Computer, Inc. (NASDAQ:SMCI - Free Report) by 1,043.6% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 191,738 shares of the company's stock after acquiring an additional 174,972 shares during the period. Independent Advisor Alliance's holdings in Super Micro Computer were worth $5,844,000 as of its most recent SEC filing.

Other hedge funds and other institutional investors have also bought and sold shares of the company. Archer Investment Corp lifted its stake in Super Micro Computer by 364.2% during the 3rd quarter. Archer Investment Corp now owns 571 shares of the company's stock valued at $238,000 after acquiring an additional 448 shares during the period. Bell Bank bought a new position in shares of Super Micro Computer in the 3rd quarter worth approximately $259,000. Meridian Wealth Management LLC bought a new position in shares of Super Micro Computer in the 3rd quarter worth approximately $270,000. Mizuho Markets Cayman LP bought a new position in shares of Super Micro Computer in the 3rd quarter worth approximately $300,000. Finally, ICICI Prudential Asset Management Co Ltd bought a new position in shares of Super Micro Computer in the 3rd quarter worth approximately $318,000. Institutional investors own 84.06% of the company's stock.

Super Micro Computer Trading Up 10.7 %

Shares of SMCI opened at $40.84 on Wednesday. The company has a debt-to-equity ratio of 0.32, a current ratio of 3.77 and a quick ratio of 1.93. Super Micro Computer, Inc. has a 1 year low of $17.25 and a 1 year high of $119.80. The company has a 50 day simple moving average of $37.41 and a two-hundred day simple moving average of $38.32. The firm has a market cap of $24.24 billion, a P/E ratio of 20.50 and a beta of 1.21.

Analysts Set New Price Targets

Several brokerages have recently weighed in on SMCI. Northland Securities set a $70.00 price objective on shares of Super Micro Computer in a research note on Thursday, March 6th. JPMorgan Chase & Co. increased their price objective on shares of Super Micro Computer from $23.00 to $35.00 and gave the stock an "underweight" rating in a research note on Wednesday, February 12th. Wedbush reiterated a "hold" rating on shares of Super Micro Computer in a research note on Tuesday, February 18th. Rosenblatt Securities began coverage on shares of Super Micro Computer in a research note on Monday. They issued a "buy" rating and a $60.00 price objective on the stock. Finally, Cfra upgraded shares of Super Micro Computer from a "hold" rating to a "buy" rating and set a $48.00 price objective on the stock in a research note on Tuesday, February 11th. Three equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $52.57.

View Our Latest Stock Report on Super Micro Computer

Insider Buying and Selling at Super Micro Computer

In other Super Micro Computer news, Director Robert L. Blair sold 19,460 shares of the stock in a transaction that occurred on Friday, February 28th. The shares were sold at an average price of $42.58, for a total transaction of $828,606.80. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, SVP George Kao sold 71,720 shares of the stock in a transaction that occurred on Wednesday, February 26th. The shares were sold at an average price of $50.48, for a total value of $3,620,425.60. Following the transaction, the senior vice president now owns 19,449 shares of the company's stock, valued at $981,785.52. This represents a 78.67 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 137,473 shares of company stock valued at $6,771,552 in the last three months. 17.60% of the stock is currently owned by corporate insiders.

Super Micro Computer Company Profile

(

Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.