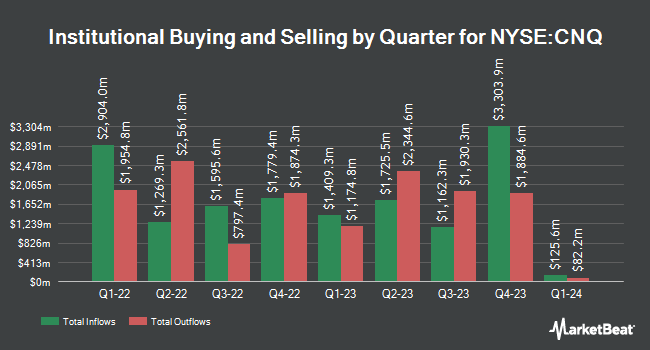

Independent Advisor Alliance acquired a new stake in shares of Canadian Natural Resources Limited (NYSE:CNQ - Free Report) TSE: CNQ during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 8,306 shares of the oil and gas producer's stock, valued at approximately $256,000.

Other institutional investors and hedge funds have also modified their holdings of the company. Duncker Streett & Co. Inc. purchased a new position in shares of Canadian Natural Resources during the fourth quarter valued at approximately $25,000. Continuum Advisory LLC lifted its stake in shares of Canadian Natural Resources by 144.1% during the third quarter. Continuum Advisory LLC now owns 830 shares of the oil and gas producer's stock valued at $28,000 after buying an additional 490 shares during the period. R Squared Ltd purchased a new position in shares of Canadian Natural Resources during the fourth quarter valued at approximately $32,000. Newbridge Financial Services Group Inc. purchased a new position in shares of Canadian Natural Resources during the fourth quarter valued at approximately $35,000. Finally, Wilmington Savings Fund Society FSB purchased a new position in shares of Canadian Natural Resources during the third quarter valued at approximately $37,000. Hedge funds and other institutional investors own 74.03% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently issued reports on the stock. Tudor Pickering downgraded shares of Canadian Natural Resources from a "strong-buy" rating to a "hold" rating in a research note on Monday, February 10th. Royal Bank of Canada upped their price objective on shares of Canadian Natural Resources from $62.00 to $63.00 and gave the company an "outperform" rating in a research note on Friday, March 7th. Evercore ISI raised shares of Canadian Natural Resources from an "in-line" rating to an "outperform" rating in a research note on Friday, March 7th. Scotiabank raised shares of Canadian Natural Resources from a "sector perform" rating to a "sector outperform" rating in a research note on Wednesday. Finally, Raymond James reaffirmed a "market perform" rating on shares of Canadian Natural Resources in a research note on Friday, March 7th. Four equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, Canadian Natural Resources currently has an average rating of "Hold" and an average price target of $63.00.

Check Out Our Latest Analysis on Canadian Natural Resources

Canadian Natural Resources Trading Down 1.6 %

NYSE:CNQ traded down $0.49 during trading hours on Friday, reaching $30.33. 10,510,661 shares of the company were exchanged, compared to its average volume of 5,131,722. The company has a debt-to-equity ratio of 0.21, a current ratio of 0.84 and a quick ratio of 0.53. The firm has a market cap of $63.70 billion, a price-to-earnings ratio of 11.78 and a beta of 1.48. Canadian Natural Resources Limited has a 52-week low of $25.62 and a 52-week high of $41.29. The stock has a 50 day simple moving average of $30.02 and a 200 day simple moving average of $32.22.

Canadian Natural Resources Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, April 4th. Stockholders of record on Friday, March 21st will be given a $0.4117 dividend. The ex-dividend date of this dividend is Friday, March 21st. This represents a $1.65 annualized dividend and a dividend yield of 5.43%. This is a positive change from Canadian Natural Resources's previous quarterly dividend of $0.39. Canadian Natural Resources's dividend payout ratio is presently 77.88%.

Canadian Natural Resources Profile

(

Free Report)

Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Further Reading

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.