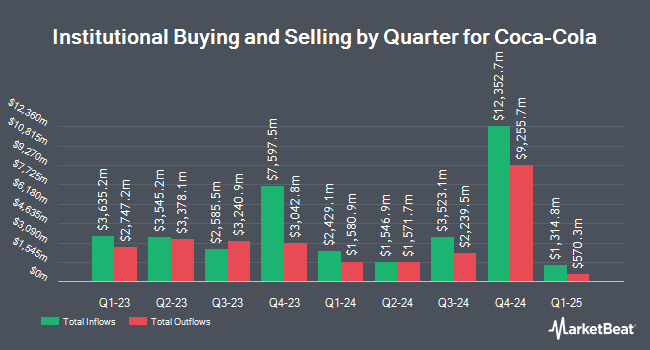

Independent Advisor Alliance decreased its position in shares of The Coca-Cola Company (NYSE:KO - Free Report) by 21.3% in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 420,672 shares of the company's stock after selling 113,953 shares during the period. Independent Advisor Alliance's holdings in Coca-Cola were worth $26,191,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors also recently bought and sold shares of the company. Fort Sheridan Advisors LLC grew its holdings in shares of Coca-Cola by 3.3% during the fourth quarter. Fort Sheridan Advisors LLC now owns 4,993 shares of the company's stock worth $311,000 after purchasing an additional 161 shares during the last quarter. Wells Trecaso Financial Group LLC lifted its holdings in shares of Coca-Cola by 4.8% in the 4th quarter. Wells Trecaso Financial Group LLC now owns 3,616 shares of the company's stock valued at $225,000 after purchasing an additional 164 shares during the last quarter. Atlas Brown Inc. boosted its position in shares of Coca-Cola by 0.8% in the 4th quarter. Atlas Brown Inc. now owns 21,024 shares of the company's stock valued at $1,309,000 after purchasing an additional 166 shares during the period. Town & Country Bank & Trust CO dba First Bankers Trust CO boosted its position in shares of Coca-Cola by 0.4% in the 4th quarter. Town & Country Bank & Trust CO dba First Bankers Trust CO now owns 39,198 shares of the company's stock valued at $2,440,000 after purchasing an additional 169 shares during the period. Finally, Great Diamond Partners LLC grew its stake in Coca-Cola by 1.7% during the 4th quarter. Great Diamond Partners LLC now owns 10,314 shares of the company's stock worth $642,000 after buying an additional 169 shares during the last quarter. 70.26% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on KO shares. Wells Fargo & Company increased their price objective on Coca-Cola from $70.00 to $75.00 and gave the company an "overweight" rating in a report on Wednesday, February 12th. TD Cowen upgraded shares of Coca-Cola from a "hold" rating to a "buy" rating and set a $75.00 price target for the company in a research note on Wednesday, January 8th. UBS Group lifted their price objective on shares of Coca-Cola from $72.00 to $78.00 and gave the company a "buy" rating in a research note on Wednesday, February 12th. Jefferies Financial Group upgraded shares of Coca-Cola from a "hold" rating to a "buy" rating and increased their target price for the stock from $69.00 to $75.00 in a research note on Thursday, January 30th. Finally, Barclays boosted their price target on Coca-Cola from $66.00 to $73.00 and gave the company an "overweight" rating in a research report on Thursday, February 13th. Two equities research analysts have rated the stock with a hold rating, seventeen have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Coca-Cola presently has an average rating of "Moderate Buy" and a consensus target price of $74.24.

View Our Latest Research Report on Coca-Cola

Coca-Cola Price Performance

Coca-Cola stock traded down $0.78 during midday trading on Wednesday, reaching $70.27. The company's stock had a trading volume of 7,534,336 shares, compared to its average volume of 14,002,418. The firm has a market capitalization of $302.21 billion, a PE ratio of 28.43, a P/E/G ratio of 3.79 and a beta of 0.57. The Coca-Cola Company has a fifty-two week low of $57.93 and a fifty-two week high of $73.53. The stock's 50 day simple moving average is $65.72 and its 200 day simple moving average is $66.58. The company has a debt-to-equity ratio of 1.61, a quick ratio of 0.84 and a current ratio of 1.03.

Coca-Cola (NYSE:KO - Get Free Report) last announced its quarterly earnings data on Tuesday, February 11th. The company reported $0.55 EPS for the quarter, beating the consensus estimate of $0.51 by $0.04. Coca-Cola had a net margin of 22.59% and a return on equity of 45.37%. On average, equities research analysts forecast that The Coca-Cola Company will post 2.96 earnings per share for the current year.

Coca-Cola Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Stockholders of record on Friday, March 14th will be paid a dividend of $0.51 per share. This is a positive change from Coca-Cola's previous quarterly dividend of $0.49. The ex-dividend date of this dividend is Friday, March 14th. This represents a $2.04 annualized dividend and a dividend yield of 2.90%. Coca-Cola's payout ratio is 82.59%.

Insider Buying and Selling

In other Coca-Cola news, CEO James Quincey sold 145,435 shares of the company's stock in a transaction dated Tuesday, February 25th. The shares were sold at an average price of $71.01, for a total value of $10,327,339.35. Following the sale, the chief executive officer now owns 342,546 shares of the company's stock, valued at $24,324,191.46. This represents a 29.80 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Nikolaos Koumettis sold 54,708 shares of the firm's stock in a transaction that occurred on Wednesday, February 26th. The stock was sold at an average price of $70.96, for a total transaction of $3,882,079.68. Following the transaction, the insider now directly owns 246,909 shares of the company's stock, valued at approximately $17,520,662.64. This trade represents a 18.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 288,146 shares of company stock worth $20,456,524 in the last quarter. Company insiders own 0.97% of the company's stock.

Coca-Cola Profile

(

Free Report)

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks, sparkling flavors; water, sports, coffee, and tea; juice, value-added dairy, and plant-based beverages; and other beverages. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores.

Further Reading

Before you consider Coca-Cola, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola wasn't on the list.

While Coca-Cola currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report