Independent Advisor Alliance lessened its holdings in shares of Comcast Co. (NASDAQ:CMCSA - Free Report) by 30.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 69,429 shares of the cable giant's stock after selling 30,661 shares during the quarter. Independent Advisor Alliance's holdings in Comcast were worth $2,900,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

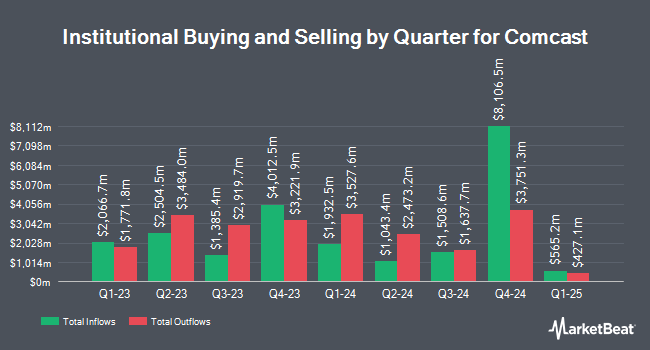

A number of other large investors also recently modified their holdings of the company. Fairscale Capital LLC bought a new position in Comcast in the 2nd quarter worth about $26,000. Strategic Financial Concepts LLC purchased a new position in shares of Comcast during the second quarter worth $27,000. IAG Wealth Partners LLC raised its holdings in shares of Comcast by 204.7% during the second quarter. IAG Wealth Partners LLC now owns 777 shares of the cable giant's stock worth $30,000 after purchasing an additional 522 shares during the last quarter. McClarren Financial Advisors Inc. grew its position in Comcast by 365.4% during the third quarter. McClarren Financial Advisors Inc. now owns 726 shares of the cable giant's stock valued at $30,000 after buying an additional 570 shares during the period. Finally, Archer Investment Corp grew its position in Comcast by 177.1% during the second quarter. Archer Investment Corp now owns 812 shares of the cable giant's stock valued at $32,000 after buying an additional 519 shares during the period. Hedge funds and other institutional investors own 84.32% of the company's stock.

Comcast Price Performance

Shares of CMCSA traded down $0.56 during trading hours on Tuesday, reaching $42.64. The company had a trading volume of 18,338,154 shares, compared to its average volume of 19,621,549. The firm has a 50 day simple moving average of $42.13 and a 200-day simple moving average of $40.11. The company has a current ratio of 0.72, a quick ratio of 0.72 and a debt-to-equity ratio of 1.14. The company has a market capitalization of $163.16 billion, a price-to-earnings ratio of 11.46, a PEG ratio of 1.64 and a beta of 1.00. Comcast Co. has a 12-month low of $36.43 and a 12-month high of $47.11.

Comcast (NASDAQ:CMCSA - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The cable giant reported $1.12 EPS for the quarter, beating analysts' consensus estimates of $1.06 by $0.06. The firm had revenue of $32.07 billion for the quarter, compared to analysts' expectations of $31.78 billion. Comcast had a net margin of 11.92% and a return on equity of 19.81%. The firm's revenue was up 6.5% on a year-over-year basis. During the same period in the prior year, the company earned $1.08 EPS. Research analysts expect that Comcast Co. will post 4.26 earnings per share for the current year.

Comcast Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 29th. Shareholders of record on Wednesday, January 8th will be paid a dividend of $0.31 per share. The ex-dividend date of this dividend is Wednesday, January 8th. This represents a $1.24 annualized dividend and a dividend yield of 2.91%. Comcast's dividend payout ratio is currently 33.33%.

Analyst Upgrades and Downgrades

A number of research firms recently weighed in on CMCSA. Pivotal Research boosted their price target on shares of Comcast from $47.00 to $54.00 and gave the stock a "buy" rating in a research report on Friday, November 1st. Wells Fargo & Company lifted their target price on shares of Comcast from $43.00 to $46.00 and gave the stock an "equal weight" rating in a research note on Friday, November 1st. Rosenblatt Securities reaffirmed a "neutral" rating and set a $45.00 target price on shares of Comcast in a research note on Wednesday, November 6th. StockNews.com downgraded shares of Comcast from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, September 24th. Finally, Evercore ISI raised shares of Comcast to a "strong-buy" rating in a research note on Thursday, November 21st. One research analyst has rated the stock with a sell rating, six have assigned a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $47.19.

Check Out Our Latest Analysis on CMCSA

About Comcast

(

Free Report)

Comcast Corporation operates as a media and technology company worldwide. It operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments. The Residential Connectivity & Platforms segment provides residential broadband and wireless connectivity services, residential and business video services, sky-branded entertainment television networks, and advertising.

See Also

Before you consider Comcast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comcast wasn't on the list.

While Comcast currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.