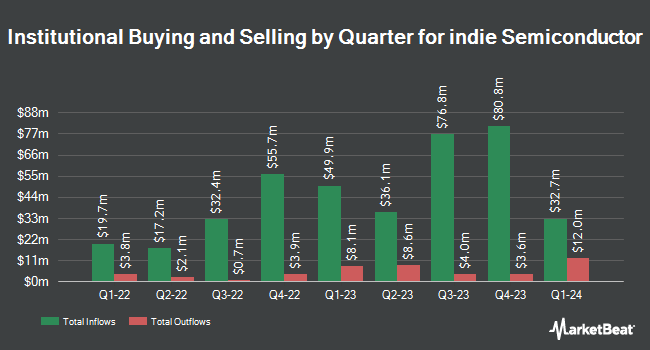

Emerald Advisers LLC lifted its holdings in indie Semiconductor, Inc. (NASDAQ:INDI - Free Report) by 139.5% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 272,929 shares of the company's stock after purchasing an additional 158,957 shares during the quarter. Emerald Advisers LLC owned 0.14% of indie Semiconductor worth $1,105,000 as of its most recent SEC filing.

Other hedge funds have also added to or reduced their stakes in the company. Virtu Financial LLC acquired a new stake in shares of indie Semiconductor in the third quarter valued at approximately $58,000. Daiwa Securities Group Inc. boosted its position in indie Semiconductor by 74.6% during the fourth quarter. Daiwa Securities Group Inc. now owns 14,897 shares of the company's stock worth $60,000 after purchasing an additional 6,363 shares during the period. Cibc World Markets Corp bought a new position in indie Semiconductor during the fourth quarter worth $62,000. FNY Investment Advisers LLC acquired a new position in shares of indie Semiconductor in the fourth quarter valued at $74,000. Finally, Legato Capital Management LLC raised its position in shares of indie Semiconductor by 47.9% in the fourth quarter. Legato Capital Management LLC now owns 20,285 shares of the company's stock valued at $82,000 after purchasing an additional 6,570 shares during the period. Institutional investors own 67.73% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently commented on INDI shares. KeyCorp decreased their price target on shares of indie Semiconductor from $8.00 to $7.00 and set an "overweight" rating on the stock in a research note on Friday, February 21st. UBS Group started coverage on indie Semiconductor in a research report on Friday, January 24th. They issued a "neutral" rating and a $4.50 target price on the stock. Finally, Benchmark dropped their price target on indie Semiconductor from $9.00 to $8.00 and set a "buy" rating for the company in a report on Friday, February 21st. One investment analyst has rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $7.50.

Get Our Latest Stock Analysis on INDI

Insider Activity at indie Semiconductor

In other indie Semiconductor news, COO Michael Wittmann sold 10,875 shares of the firm's stock in a transaction dated Monday, March 10th. The shares were sold at an average price of $2.81, for a total value of $30,558.75. Following the transaction, the chief operating officer now directly owns 77,887 shares of the company's stock, valued at $218,862.47. This trade represents a 12.25 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Donald Mcclymont sold 50,000 shares of the company's stock in a transaction that occurred on Thursday, February 27th. The stock was sold at an average price of $3.12, for a total transaction of $156,000.00. Following the sale, the chief executive officer now directly owns 65,932 shares of the company's stock, valued at approximately $205,707.84. This trade represents a 43.13 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 151,414 shares of company stock valued at $456,699 over the last quarter. 8.20% of the stock is owned by corporate insiders.

indie Semiconductor Stock Performance

Shares of INDI traded down $0.15 during mid-day trading on Friday, hitting $2.11. 5,302,929 shares of the company's stock were exchanged, compared to its average volume of 3,689,157. The company has a quick ratio of 1.87, a current ratio of 2.39 and a debt-to-equity ratio of 0.32. indie Semiconductor, Inc. has a 52 week low of $2.03 and a 52 week high of $7.82. The stock's 50-day simple moving average is $3.35 and its 200-day simple moving average is $3.83. The firm has a market cap of $426.04 million, a price-to-earnings ratio of -2.78 and a beta of 1.54.

indie Semiconductor (NASDAQ:INDI - Get Free Report) last announced its quarterly earnings data on Thursday, February 20th. The company reported ($0.15) earnings per share for the quarter, missing the consensus estimate of ($0.07) by ($0.08). The company had revenue of $58.01 million during the quarter, compared to analyst estimates of $58.20 million. indie Semiconductor had a negative net margin of 61.59% and a negative return on equity of 28.08%. On average, equities research analysts expect that indie Semiconductor, Inc. will post -0.54 EPS for the current year.

indie Semiconductor Profile

(

Free Report)

indie Semiconductor, Inc provides automotive semiconductors and software solutions for advanced driver assistance systems, autonomous vehicle, in-cabin, connected car, and electrification applications in the United States, South America, rest of North America, Greater China, South Korea, rest of the Asia Pacific, and Europe.

Read More

Before you consider indie Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and indie Semiconductor wasn't on the list.

While indie Semiconductor currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.