indie Semiconductor (NASDAQ:INDI - Get Free Report) had its price target reduced by Benchmark from $12.00 to $9.00 in a research report issued on Tuesday, Benzinga reports. The brokerage currently has a "buy" rating on the stock. Benchmark's target price suggests a potential upside of 170.27% from the company's previous close.

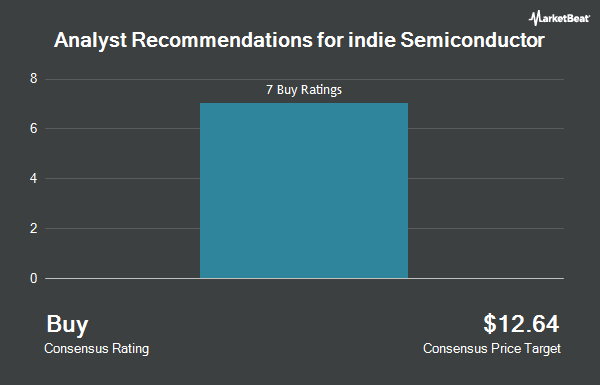

A number of other brokerages have also recently issued reports on INDI. Roth Mkm dropped their price objective on shares of indie Semiconductor from $10.00 to $7.00 and set a "buy" rating on the stock in a research note on Friday, August 9th. Deutsche Bank Aktiengesellschaft reduced their price objective on indie Semiconductor from $9.00 to $7.00 and set a "buy" rating for the company in a research report on Friday, August 9th. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company currently has an average rating of "Buy" and an average price target of $10.07.

View Our Latest Stock Report on INDI

indie Semiconductor Trading Down 1.2 %

Shares of NASDAQ INDI traded down $0.04 during midday trading on Tuesday, hitting $3.33. 3,431,821 shares of the company traded hands, compared to its average volume of 2,691,637. indie Semiconductor has a 12-month low of $3.16 and a 12-month high of $8.69. The firm has a market cap of $657.41 million, a P/E ratio of -6.49 and a beta of 1.22. The stock has a 50-day moving average price of $3.71 and a 200 day moving average price of $5.18. The company has a debt-to-equity ratio of 0.31, a quick ratio of 2.20 and a current ratio of 2.66.

indie Semiconductor (NASDAQ:INDI - Get Free Report) last announced its earnings results on Thursday, August 8th. The company reported ($0.09) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.09). The firm had revenue of $52.40 million during the quarter, compared to analyst estimates of $53.61 million. indie Semiconductor had a negative return on equity of 22.48% and a negative net margin of 34.65%. The business's revenue was up .6% compared to the same quarter last year. During the same quarter in the prior year, the company earned ($0.11) EPS. As a group, analysts expect that indie Semiconductor will post -0.7 earnings per share for the current year.

Insider Activity at indie Semiconductor

In other indie Semiconductor news, CFO Thomas Schiller sold 75,000 shares of the company's stock in a transaction dated Tuesday, September 3rd. The shares were sold at an average price of $3.83, for a total transaction of $287,250.00. Following the transaction, the chief financial officer now owns 977,192 shares in the company, valued at approximately $3,742,645.36. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 8.20% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of the company. Principal Financial Group Inc. increased its position in shares of indie Semiconductor by 15.3% during the 1st quarter. Principal Financial Group Inc. now owns 20,162 shares of the company's stock valued at $143,000 after purchasing an additional 2,674 shares during the last quarter. Commonwealth Equity Services LLC raised its position in indie Semiconductor by 63.1% in the first quarter. Commonwealth Equity Services LLC now owns 80,638 shares of the company's stock worth $571,000 after acquiring an additional 31,200 shares during the period. Mirae Asset Global Investments Co. Ltd. boosted its stake in shares of indie Semiconductor by 26.1% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,300,540 shares of the company's stock worth $9,208,000 after acquiring an additional 268,776 shares during the last quarter. Zevenbergen Capital Investments LLC bought a new stake in shares of indie Semiconductor during the 1st quarter valued at $524,000. Finally, Swiss National Bank increased its stake in shares of indie Semiconductor by 5.4% in the 1st quarter. Swiss National Bank now owns 270,800 shares of the company's stock worth $1,917,000 after purchasing an additional 13,800 shares in the last quarter. Institutional investors own 67.73% of the company's stock.

indie Semiconductor Company Profile

(

Get Free Report)

indie Semiconductor, Inc provides automotive semiconductors and software solutions for advanced driver assistance systems, autonomous vehicle, in-cabin, connected car, and electrification applications in the United States, South America, rest of North America, Greater China, South Korea, rest of the Asia Pacific, and Europe.

See Also

Before you consider indie Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and indie Semiconductor wasn't on the list.

While indie Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.