Vestcor Inc reduced its stake in shares of Infosys Limited (NYSE:INFY - Free Report) by 7.9% during the fourth quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 314,754 shares of the technology company's stock after selling 27,098 shares during the quarter. Vestcor Inc's holdings in Infosys were worth $6,899,000 at the end of the most recent reporting period.

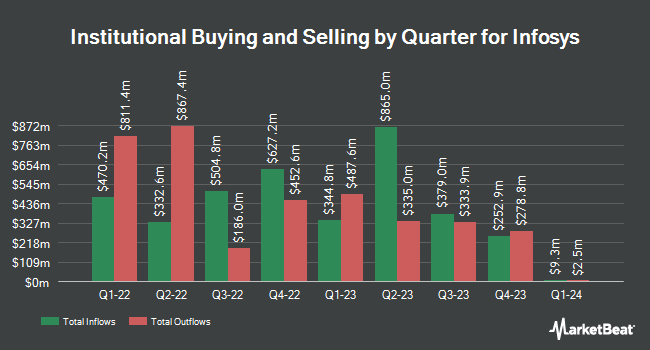

Other hedge funds and other institutional investors have also modified their holdings of the company. Sierra Ocean LLC bought a new stake in Infosys in the fourth quarter worth about $29,000. Mizuho Securities Co. Ltd. bought a new stake in Infosys in the third quarter worth about $33,000. Brooklyn Investment Group bought a new stake in Infosys in the fourth quarter worth about $52,000. Wilmington Savings Fund Society FSB bought a new stake in Infosys in the third quarter worth about $57,000. Finally, Farther Finance Advisors LLC raised its position in Infosys by 69.7% in the fourth quarter. Farther Finance Advisors LLC now owns 3,115 shares of the technology company's stock worth $68,000 after acquiring an additional 1,279 shares in the last quarter. 16.20% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

INFY has been the topic of several research reports. HSBC upgraded shares of Infosys from a "hold" rating to a "buy" rating in a research report on Monday, December 9th. StockNews.com cut Infosys from a "buy" rating to a "hold" rating in a research note on Monday. Hsbc Global Res raised Infosys from a "hold" rating to a "strong-buy" rating in a research note on Monday, December 9th. Guggenheim reissued a "neutral" rating on shares of Infosys in a research note on Friday, January 17th. Finally, CLSA raised Infosys from a "hold" rating to an "outperform" rating in a research note on Friday, March 7th. Two research analysts have rated the stock with a sell rating, four have assigned a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $20.22.

Check Out Our Latest Report on Infosys

Infosys Price Performance

NYSE:INFY opened at $18.51 on Thursday. Infosys Limited has a fifty-two week low of $16.04 and a fifty-two week high of $23.63. The stock's 50-day moving average is $21.42 and its two-hundred day moving average is $22.13. The stock has a market cap of $76.65 billion, a PE ratio of 23.42, a price-to-earnings-growth ratio of 3.50 and a beta of 1.01.

Infosys (NYSE:INFY - Get Free Report) last released its earnings results on Thursday, January 16th. The technology company reported $0.19 earnings per share for the quarter, meeting the consensus estimate of $0.19. Infosys had a return on equity of 31.60% and a net margin of 17.28%. During the same quarter in the previous year, the firm posted $0.18 EPS. On average, equities research analysts anticipate that Infosys Limited will post 0.74 earnings per share for the current year.

Infosys Company Profile

(

Free Report)

Infosys Ltd. is a digital services and consulting company, which engages in the provision of end-to-end business solutions. It operates through the following segments: Financial Services, Retail, Communication, Energy, Utilities, Resources, and Services, Manufacturing, Hi-Tech, Life Sciences, and All Other.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Infosys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Infosys wasn't on the list.

While Infosys currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.