ING Groep NV bought a new position in Fifth Third Bancorp (NASDAQ:FITB - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor bought 30,306 shares of the financial services provider's stock, valued at approximately $1,281,000.

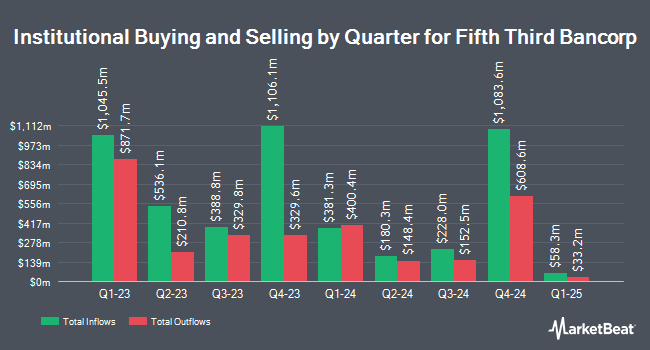

A number of other institutional investors and hedge funds have also bought and sold shares of the business. Hussman Strategic Advisors Inc. purchased a new stake in shares of Fifth Third Bancorp in the 4th quarter valued at $2,220,000. Concurrent Investment Advisors LLC boosted its position in Fifth Third Bancorp by 33.4% during the fourth quarter. Concurrent Investment Advisors LLC now owns 6,697 shares of the financial services provider's stock valued at $283,000 after buying an additional 1,677 shares during the period. Global Retirement Partners LLC boosted its position in Fifth Third Bancorp by 20.6% during the fourth quarter. Global Retirement Partners LLC now owns 11,249 shares of the financial services provider's stock valued at $476,000 after buying an additional 1,924 shares during the period. Convergence Investment Partners LLC grew its stake in shares of Fifth Third Bancorp by 18.5% during the fourth quarter. Convergence Investment Partners LLC now owns 79,302 shares of the financial services provider's stock valued at $3,353,000 after buying an additional 12,356 shares during the last quarter. Finally, Kentucky Retirement Systems Insurance Trust Fund increased its holdings in shares of Fifth Third Bancorp by 56.0% in the fourth quarter. Kentucky Retirement Systems Insurance Trust Fund now owns 31,264 shares of the financial services provider's stock worth $1,322,000 after buying an additional 11,226 shares during the period. 83.79% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, EVP Kevin P. Lavender sold 21,700 shares of the company's stock in a transaction that occurred on Thursday, February 20th. The stock was sold at an average price of $43.55, for a total value of $945,035.00. Following the sale, the executive vice president now owns 130,856 shares in the company, valued at $5,698,778.80. This represents a 14.22 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, COO James C. Leonard sold 17,200 shares of the firm's stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $44.26, for a total value of $761,272.00. Following the transaction, the chief operating officer now directly owns 244,487 shares of the company's stock, valued at approximately $10,820,994.62. This trade represents a 6.57 % decrease in their position. The disclosure for this sale can be found here. 0.50% of the stock is owned by company insiders.

Fifth Third Bancorp Price Performance

Shares of FITB stock opened at $42.88 on Monday. The business's fifty day moving average is $43.50 and its 200 day moving average is $43.67. The company has a quick ratio of 0.80, a current ratio of 0.80 and a debt-to-equity ratio of 0.82. The stock has a market cap of $28.75 billion, a price-to-earnings ratio of 13.66, a PEG ratio of 1.42 and a beta of 1.23. Fifth Third Bancorp has a twelve month low of $33.03 and a twelve month high of $49.07.

Fifth Third Bancorp Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st were given a $0.37 dividend. This represents a $1.48 dividend on an annualized basis and a dividend yield of 3.45%. The ex-dividend date was Tuesday, December 31st. Fifth Third Bancorp's dividend payout ratio is presently 47.13%.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on FITB. StockNews.com lowered Fifth Third Bancorp from a "hold" rating to a "sell" rating in a research report on Wednesday, November 6th. Wells Fargo & Company increased their price objective on Fifth Third Bancorp from $52.00 to $54.00 and gave the company an "overweight" rating in a research note on Friday, November 15th. Piper Sandler reaffirmed an "overweight" rating and issued a $53.00 target price (down from $54.00) on shares of Fifth Third Bancorp in a research note on Wednesday, January 22nd. DA Davidson increased their price target on shares of Fifth Third Bancorp from $49.00 to $50.00 and gave the company a "neutral" rating in a research report on Thursday, January 23rd. Finally, Truist Financial raised their price target on shares of Fifth Third Bancorp from $51.00 to $52.00 and gave the stock a "buy" rating in a report on Wednesday, January 22nd. One equities research analyst has rated the stock with a sell rating, nine have issued a hold rating and ten have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Hold" and an average price target of $46.75.

View Our Latest Research Report on Fifth Third Bancorp

About Fifth Third Bancorp

(

Free Report)

Fifth Third Bancorp operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States. It operates through three segments: Commercial Banking, Consumer and Small Business Banking, and Wealth and Asset Management.

Further Reading

Want to see what other hedge funds are holding FITB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fifth Third Bancorp (NASDAQ:FITB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fifth Third Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fifth Third Bancorp wasn't on the list.

While Fifth Third Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.