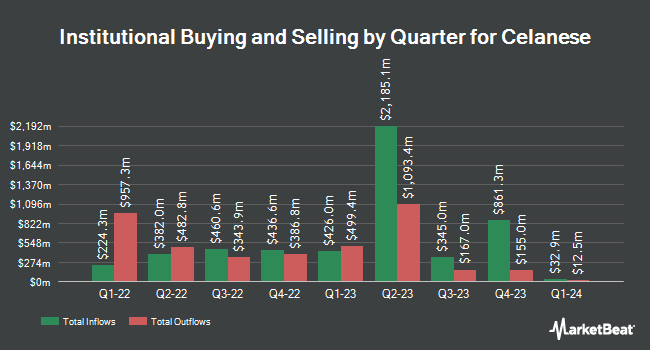

ING Groep NV purchased a new position in Celanese Co. (NYSE:CE - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 210,461 shares of the basic materials company's stock, valued at approximately $14,566,000. ING Groep NV owned 0.19% of Celanese as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors have also recently made changes to their positions in CE. Blue Trust Inc. increased its stake in Celanese by 137.8% in the 3rd quarter. Blue Trust Inc. now owns 1,284 shares of the basic materials company's stock worth $173,000 after acquiring an additional 744 shares during the last quarter. Raymond James & Associates increased its position in shares of Celanese by 6.5% in the third quarter. Raymond James & Associates now owns 78,790 shares of the basic materials company's stock worth $10,712,000 after purchasing an additional 4,794 shares during the last quarter. Allspring Global Investments Holdings LLC increased its position in shares of Celanese by 512.5% in the third quarter. Allspring Global Investments Holdings LLC now owns 118,149 shares of the basic materials company's stock worth $16,064,000 after purchasing an additional 98,860 shares during the last quarter. Commerzbank Aktiengesellschaft FI bought a new position in shares of Celanese in the 3rd quarter worth $269,000. Finally, Greenleaf Trust increased its holdings in shares of Celanese by 4.6% in the 3rd quarter. Greenleaf Trust now owns 7,329 shares of the basic materials company's stock worth $996,000 after buying an additional 325 shares during the last quarter. Institutional investors own 98.87% of the company's stock.

Analysts Set New Price Targets

CE has been the topic of a number of research analyst reports. Vertical Research lowered shares of Celanese from a "hold" rating to a "sell" rating and set a $130.00 price target on the stock. in a report on Tuesday, October 29th. Wells Fargo & Company reduced their target price on Celanese from $75.00 to $55.00 and set an "equal weight" rating on the stock in a research note on Thursday. JPMorgan Chase & Co. reduced their price objective on Celanese from $92.00 to $54.00 and set a "neutral" rating on the stock in a research report on Thursday. UBS Group reduced their price objective on Celanese from $72.00 to $60.00 and set a "neutral" rating on the stock in a research report on Thursday. Finally, Robert W. Baird reduced their price target on shares of Celanese from $110.00 to $67.00 and set an "outperform" rating on the stock in a research report on Thursday. Four research analysts have rated the stock with a sell rating, nine have assigned a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, Celanese presently has a consensus rating of "Hold" and a consensus price target of $80.00.

Check Out Our Latest Stock Analysis on CE

Celanese Trading Up 0.3 %

Shares of CE stock traded up $0.14 during mid-day trading on Friday, reaching $52.75. The stock had a trading volume of 5,328,541 shares, compared to its average volume of 2,937,180. The firm has a market capitalization of $5.77 billion, a PE ratio of -3.79, a price-to-earnings-growth ratio of 1.05 and a beta of 1.17. The stock's 50-day moving average price is $68.25 and its two-hundred day moving average price is $96.75. The company has a current ratio of 1.34, a quick ratio of 0.76 and a debt-to-equity ratio of 1.98. Celanese Co. has a 52-week low of $51.24 and a 52-week high of $172.16.

Celanese (NYSE:CE - Get Free Report) last posted its earnings results on Tuesday, February 18th. The basic materials company reported $1.45 earnings per share for the quarter, topping analysts' consensus estimates of $1.25 by $0.20. The company had revenue of $2.37 billion during the quarter, compared to analyst estimates of $2.36 billion. Celanese had a negative net margin of 14.81% and a positive return on equity of 12.86%. Equities analysts expect that Celanese Co. will post 8.79 earnings per share for the current fiscal year.

Celanese Cuts Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, March 11th. Investors of record on Tuesday, February 25th will be paid a $0.03 dividend. This represents a $0.12 dividend on an annualized basis and a yield of 0.23%. The ex-dividend date is Tuesday, February 25th. Celanese's payout ratio is -0.86%.

Celanese Profile

(

Free Report)

Celanese Corporation, a chemical and specialty materials company, manufactures and sells high performance engineered polymers in the United States and internationally. It operates through Engineered Materials and Acetyl Chain. The Engineered Materials segment develops, produces, and supplies specialty polymers for automotive and medical applications, as well as for use in industrial products and consumer electronics.

See Also

Before you consider Celanese, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celanese wasn't on the list.

While Celanese currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.