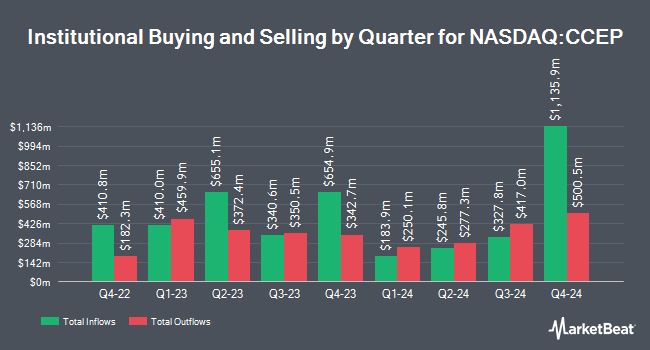

ING Groep NV lowered its holdings in shares of Coca-Cola Europacific Partners PLC (NASDAQ:CCEP - Free Report) by 54.5% during the 4th quarter, according to the company in its most recent filing with the SEC. The fund owned 15,757 shares of the company's stock after selling 18,877 shares during the period. ING Groep NV's holdings in Coca-Cola Europacific Partners were worth $1,210,000 as of its most recent filing with the SEC.

Other institutional investors and hedge funds also recently made changes to their positions in the company. MassMutual Private Wealth & Trust FSB boosted its position in Coca-Cola Europacific Partners by 85.3% during the fourth quarter. MassMutual Private Wealth & Trust FSB now owns 428 shares of the company's stock valued at $33,000 after buying an additional 197 shares during the period. Plato Investment Management Ltd purchased a new stake in Coca-Cola Europacific Partners during the 3rd quarter valued at about $50,000. Brown Brothers Harriman & Co. boosted its holdings in Coca-Cola Europacific Partners by 1,604.0% during the 3rd quarter. Brown Brothers Harriman & Co. now owns 852 shares of the company's stock valued at $67,000 after acquiring an additional 802 shares during the period. Blue Trust Inc. grew its position in Coca-Cola Europacific Partners by 21.5% during the 3rd quarter. Blue Trust Inc. now owns 1,023 shares of the company's stock worth $75,000 after acquiring an additional 181 shares during the last quarter. Finally, Icon Wealth Advisors LLC purchased a new position in Coca-Cola Europacific Partners in the 3rd quarter worth approximately $105,000. Institutional investors own 31.35% of the company's stock.

Coca-Cola Europacific Partners Stock Up 0.0 %

Shares of NASDAQ CCEP traded up $0.04 during mid-day trading on Thursday, hitting $86.12. 2,220,930 shares of the stock traded hands, compared to its average volume of 1,709,322. The company has a market cap of $39.70 billion, a price-to-earnings ratio of 17.72, a PEG ratio of 4.89 and a beta of 0.91. The stock has a fifty day moving average price of $78.90 and a 200-day moving average price of $78.42. Coca-Cola Europacific Partners PLC has a 52 week low of $65.94 and a 52 week high of $88.39. The company has a debt-to-equity ratio of 1.11, a quick ratio of 0.63 and a current ratio of 0.81.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the company. Morgan Stanley raised Coca-Cola Europacific Partners from an "equal weight" rating to an "overweight" rating in a research note on Monday, December 9th. Evercore ISI raised their price target on shares of Coca-Cola Europacific Partners from $82.00 to $90.00 and gave the stock an "outperform" rating in a report on Tuesday, February 18th. Barclays lowered their price objective on shares of Coca-Cola Europacific Partners from $86.00 to $83.00 and set an "overweight" rating for the company in a research note on Friday, January 17th. JPMorgan Chase & Co. downgraded Coca-Cola Europacific Partners from an "overweight" rating to a "neutral" rating and reduced their price target for the company from $85.00 to $82.00 in a report on Wednesday, November 27th. Finally, UBS Group increased their price objective on Coca-Cola Europacific Partners from $82.50 to $90.00 and gave the stock a "buy" rating in a report on Thursday, December 12th. One analyst has rated the stock with a sell rating, four have given a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $85.00.

View Our Latest Stock Analysis on CCEP

Coca-Cola Europacific Partners Company Profile

(

Free Report)

Coca-Cola Europacific Partners PLC, together with its subsidiaries, produces, distributes, and sells a range of non-alcoholic ready to drink beverages. It offers flavours, mixers, and energy drinks; soft drinks, waters, enhanced water, and isotonic drinks; and ready-to-drink tea and coffee, juices, and other drinks.

Featured Stories

Before you consider Coca-Cola Europacific Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coca-Cola Europacific Partners wasn't on the list.

While Coca-Cola Europacific Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.