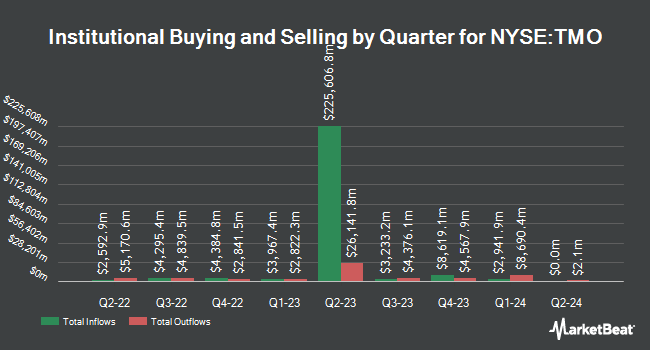

ING Groep NV lowered its holdings in Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 57.2% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 85,988 shares of the medical research company's stock after selling 114,777 shares during the period. ING Groep NV's holdings in Thermo Fisher Scientific were worth $53,190,000 at the end of the most recent quarter.

Other institutional investors have also recently bought and sold shares of the company. Signature Resources Capital Management LLC lifted its holdings in shares of Thermo Fisher Scientific by 318.2% during the 2nd quarter. Signature Resources Capital Management LLC now owns 46 shares of the medical research company's stock worth $25,000 after acquiring an additional 35 shares during the period. New Millennium Group LLC bought a new stake in shares of Thermo Fisher Scientific during the 2nd quarter worth approximately $29,000. Stephens Consulting LLC lifted its holdings in shares of Thermo Fisher Scientific by 116.0% during the 2nd quarter. Stephens Consulting LLC now owns 54 shares of the medical research company's stock worth $30,000 after acquiring an additional 29 shares during the period. Headlands Technologies LLC acquired a new position in Thermo Fisher Scientific during the 1st quarter worth approximately $32,000. Finally, Bank & Trust Co acquired a new position in Thermo Fisher Scientific during the 2nd quarter worth approximately $33,000. Institutional investors own 89.23% of the company's stock.

Wall Street Analyst Weigh In

TMO has been the subject of a number of research analyst reports. Robert W. Baird lowered their price objective on shares of Thermo Fisher Scientific from $632.00 to $622.00 and set an "outperform" rating for the company in a research report on Thursday, October 24th. Stephens initiated coverage on shares of Thermo Fisher Scientific in a research report on Tuesday, October 1st. They set an "overweight" rating and a $680.00 price objective for the company. Redburn Atlantic started coverage on shares of Thermo Fisher Scientific in a research report on Monday, October 14th. They set a "buy" rating and a $680.00 price objective for the company. Morgan Stanley upped their price target on shares of Thermo Fisher Scientific from $655.00 to $680.00 and gave the company an "overweight" rating in a research report on Friday, September 20th. Finally, Evercore ISI decreased their price target on shares of Thermo Fisher Scientific from $630.00 to $620.00 and set an "outperform" rating for the company in a research report on Thursday, October 24th. Four analysts have rated the stock with a hold rating, seventeen have given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $649.33.

Get Our Latest Report on Thermo Fisher Scientific

Thermo Fisher Scientific Stock Down 1.6 %

NYSE TMO traded down $8.88 on Thursday, hitting $533.02. 1,747,398 shares of the company were exchanged, compared to its average volume of 1,462,991. The company has a market cap of $203.88 billion, a PE ratio of 33.78, a PEG ratio of 3.57 and a beta of 0.79. Thermo Fisher Scientific Inc. has a 12 month low of $463.99 and a 12 month high of $627.88. The stock has a fifty day moving average of $589.87 and a 200-day moving average of $583.04. The company has a current ratio of 1.63, a quick ratio of 1.26 and a debt-to-equity ratio of 0.64.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The medical research company reported $5.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $5.25 by $0.03. The business had revenue of $10.60 billion for the quarter, compared to analyst estimates of $10.63 billion. Thermo Fisher Scientific had a net margin of 14.48% and a return on equity of 17.49%. Thermo Fisher Scientific's revenue was up .2% on a year-over-year basis. During the same period in the prior year, the firm earned $5.69 earnings per share. As a group, analysts forecast that Thermo Fisher Scientific Inc. will post 21.69 earnings per share for the current year.

Thermo Fisher Scientific Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Friday, December 13th will be issued a dividend of $0.39 per share. This represents a $1.56 dividend on an annualized basis and a dividend yield of 0.29%. The ex-dividend date is Friday, December 13th. Thermo Fisher Scientific's dividend payout ratio is currently 9.78%.

Insider Activity

In related news, SVP Michael A. Boxer sold 2,000 shares of the business's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $560.16, for a total transaction of $1,120,320.00. Following the transaction, the senior vice president now directly owns 12,736 shares in the company, valued at approximately $7,134,197.76. The trade was a 13.57 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Marc N. Casper sold 10,000 shares of the business's stock in a transaction dated Monday, October 28th. The stock was sold at an average price of $554.29, for a total transaction of $5,542,900.00. Following the transaction, the chief executive officer now owns 121,192 shares in the company, valued at approximately $67,175,513.68. This trade represents a 7.62 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 37,150 shares of company stock worth $20,651,865 over the last three months. 0.34% of the stock is currently owned by insiders.

About Thermo Fisher Scientific

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Featured Articles

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.