ING Groep NV trimmed its position in shares of Bunge Global SA (NYSE:BG - Free Report) by 45.5% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 18,944 shares of the basic materials company's stock after selling 15,809 shares during the period. ING Groep NV's holdings in Bunge Global were worth $1,831,000 at the end of the most recent reporting period.

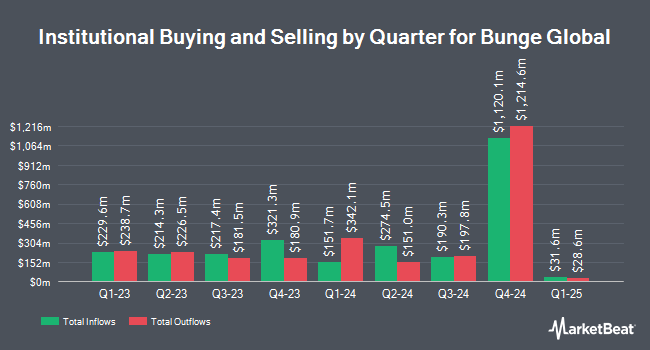

Other institutional investors have also added to or reduced their stakes in the company. Sei Investments Co. raised its stake in shares of Bunge Global by 10.6% during the first quarter. Sei Investments Co. now owns 57,269 shares of the basic materials company's stock valued at $5,873,000 after acquiring an additional 5,504 shares in the last quarter. Avantax Advisory Services Inc. purchased a new position in shares of Bunge Global in the first quarter worth about $899,000. Dorsey & Whitney Trust CO LLC purchased a new stake in shares of Bunge Global in the 1st quarter valued at $280,000. Edgestream Partners L.P. boosted its stake in shares of Bunge Global by 7.5% in the first quarter. Edgestream Partners L.P. now owns 25,111 shares of the basic materials company's stock worth $2,574,000 after buying an additional 1,759 shares during the last quarter. Finally, Jacobi Capital Management LLC purchased a new position in shares of Bunge Global during the 1st quarter valued at approximately $241,000. 86.23% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Separately, Citigroup lowered Bunge Global from a "buy" rating to a "neutral" rating and decreased their target price for the company from $125.00 to $114.00 in a research report on Thursday, August 1st. Four analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat, Bunge Global presently has an average rating of "Moderate Buy" and a consensus price target of $118.00.

Read Our Latest Stock Analysis on Bunge Global

Bunge Global Stock Up 2.9 %

Bunge Global stock opened at $90.60 on Friday. The stock has a market capitalization of $12.65 billion, a price-to-earnings ratio of 11.47 and a beta of 0.67. The company has a current ratio of 2.07, a quick ratio of 1.10 and a debt-to-equity ratio of 0.43. The stock has a 50 day moving average of $93.00 and a two-hundred day moving average of $100.33. Bunge Global SA has a twelve month low of $82.18 and a twelve month high of $114.92.

About Bunge Global

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

See Also

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.