ING Groep NV cut its position in Crown Castle Inc. (NYSE:CCI - Free Report) by 85.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 58,119 shares of the real estate investment trust's stock after selling 341,351 shares during the period. ING Groep NV's holdings in Crown Castle were worth $6,895,000 at the end of the most recent reporting period.

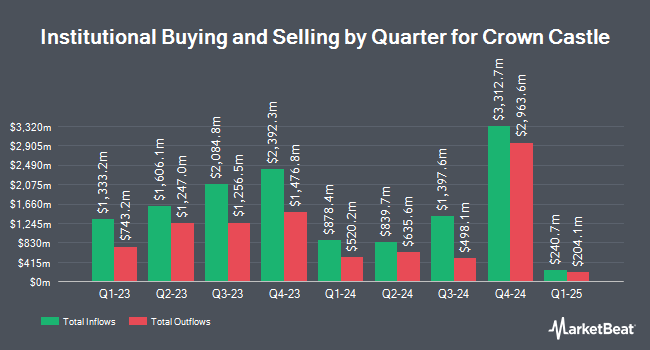

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Tokio Marine Asset Management Co. Ltd. grew its stake in shares of Crown Castle by 11.1% in the 3rd quarter. Tokio Marine Asset Management Co. Ltd. now owns 11,867 shares of the real estate investment trust's stock worth $1,408,000 after acquiring an additional 1,187 shares in the last quarter. Ferguson Wellman Capital Management Inc. increased its holdings in Crown Castle by 101.1% during the third quarter. Ferguson Wellman Capital Management Inc. now owns 421,652 shares of the real estate investment trust's stock worth $50,021,000 after buying an additional 211,933 shares during the last quarter. KBC Group NV raised its holdings in shares of Crown Castle by 333.4% in the 3rd quarter. KBC Group NV now owns 377,510 shares of the real estate investment trust's stock worth $44,784,000 after purchasing an additional 290,410 shares during the period. Plato Investment Management Ltd raised its stake in shares of Crown Castle by 46.1% in the third quarter. Plato Investment Management Ltd now owns 16,684 shares of the real estate investment trust's stock valued at $1,977,000 after buying an additional 5,262 shares during the period. Finally, Oppenheimer & Co. Inc. raised its stake in Crown Castle by 1.8% in the 3rd quarter. Oppenheimer & Co. Inc. now owns 28,657 shares of the real estate investment trust's stock valued at $3,400,000 after acquiring an additional 499 shares during the period. 90.77% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research firms have recently issued reports on CCI. UBS Group boosted their price target on shares of Crown Castle from $103.00 to $118.00 and gave the company a "neutral" rating in a research report on Thursday, October 17th. TD Cowen lowered their target price on shares of Crown Castle from $127.00 to $123.00 and set a "buy" rating on the stock in a research note on Thursday, October 17th. JPMorgan Chase & Co. lifted their price target on Crown Castle from $115.00 to $124.00 and gave the company a "neutral" rating in a research report on Monday, September 23rd. Bank of America upped their price objective on shares of Crown Castle from $110.00 to $115.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 13th. Finally, The Goldman Sachs Group lifted their target price on shares of Crown Castle from $105.00 to $120.00 and gave the company a "neutral" rating in a research report on Thursday, September 26th. Twelve analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $116.87.

Read Our Latest Stock Report on CCI

Crown Castle Trading Up 0.9 %

Shares of Crown Castle stock traded up $0.88 during trading on Friday, reaching $103.80. 2,293,374 shares of the stock were exchanged, compared to its average volume of 2,603,876. Crown Castle Inc. has a 1 year low of $92.48 and a 1 year high of $120.92. The firm has a market cap of $45.11 billion, a price-to-earnings ratio of 36.81 and a beta of 0.86. The company has a quick ratio of 0.54, a current ratio of 0.54 and a debt-to-equity ratio of 4.43. The stock's fifty day moving average is $112.05 and its 200 day moving average is $106.44.

Crown Castle (NYSE:CCI - Get Free Report) last issued its quarterly earnings data on Wednesday, October 16th. The real estate investment trust reported $0.70 EPS for the quarter, missing the consensus estimate of $1.73 by ($1.03). The company had revenue of $1.65 billion during the quarter, compared to the consensus estimate of $1.64 billion. Crown Castle had a return on equity of 20.98% and a net margin of 18.59%. The firm's revenue for the quarter was down .9% compared to the same quarter last year. During the same quarter last year, the company posted $1.77 earnings per share. As a group, equities research analysts expect that Crown Castle Inc. will post 6.66 earnings per share for the current fiscal year.

Crown Castle Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be issued a $1.565 dividend. The ex-dividend date is Friday, December 13th. This represents a $6.26 dividend on an annualized basis and a yield of 6.03%. Crown Castle's dividend payout ratio (DPR) is 221.99%.

Crown Castle Company Profile

(

Free Report)

Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service - bringing information, ideas and innovations to the people and businesses that need them.

Read More

Before you consider Crown Castle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crown Castle wasn't on the list.

While Crown Castle currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.