ING Groep NV trimmed its position in Jack Henry & Associates, Inc. (NASDAQ:JKHY - Free Report) by 59.2% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 3,675 shares of the technology company's stock after selling 5,342 shares during the period. ING Groep NV's holdings in Jack Henry & Associates were worth $649,000 at the end of the most recent quarter.

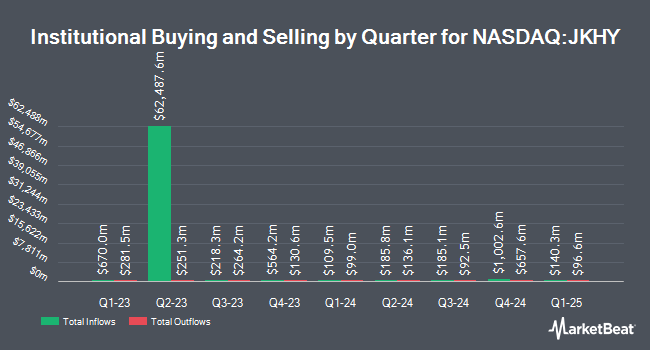

Other institutional investors also recently modified their holdings of the company. Vanguard Group Inc. increased its position in Jack Henry & Associates by 0.5% during the first quarter. Vanguard Group Inc. now owns 8,688,433 shares of the technology company's stock worth $1,509,441,000 after buying an additional 39,456 shares during the last quarter. Kayne Anderson Rudnick Investment Management LLC increased its stake in shares of Jack Henry & Associates by 1.7% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,958,305 shares of the technology company's stock valued at $657,158,000 after acquiring an additional 67,386 shares in the last quarter. Envestnet Asset Management Inc. increased its stake in Jack Henry & Associates by 2.3% during the 2nd quarter. Envestnet Asset Management Inc. now owns 1,056,151 shares of the technology company's stock valued at $175,342,000 after purchasing an additional 23,617 shares in the last quarter. Handelsbanken Fonder AB increased its holdings in Jack Henry & Associates by 8.4% during the 3rd quarter. Handelsbanken Fonder AB now owns 863,800 shares of the technology company's stock worth $152,495,000 after purchasing an additional 66,600 shares in the last quarter. Finally, Raymond James & Associates grew its position in Jack Henry & Associates by 3.2% in the 3rd quarter. Raymond James & Associates now owns 631,974 shares of the technology company's stock worth $111,569,000 after purchasing an additional 19,846 shares in the last quarter. 98.75% of the stock is currently owned by institutional investors.

Jack Henry & Associates Stock Performance

Shares of NASDAQ:JKHY traded down $1.15 during midday trading on Monday, hitting $172.06. The stock had a trading volume of 418,200 shares, compared to its average volume of 454,666. The company has a current ratio of 1.11, a quick ratio of 1.00 and a debt-to-equity ratio of 0.03. The stock has a 50 day moving average price of $179.46 and a two-hundred day moving average price of $171.05. Jack Henry & Associates, Inc. has a 1 year low of $151.59 and a 1 year high of $189.63. The company has a market capitalization of $12.55 billion, a PE ratio of 31.38, a P/E/G ratio of 3.26 and a beta of 0.63.

Jack Henry & Associates (NASDAQ:JKHY - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The technology company reported $1.63 earnings per share for the quarter, beating analysts' consensus estimates of $1.61 by $0.02. Jack Henry & Associates had a net margin of 17.79% and a return on equity of 21.81%. The business had revenue of $600.98 million during the quarter, compared to analyst estimates of $599.56 million. During the same quarter in the previous year, the business posted $1.39 earnings per share. The company's revenue was up 5.2% on a year-over-year basis. As a group, equities analysts predict that Jack Henry & Associates, Inc. will post 5.8 earnings per share for the current fiscal year.

Jack Henry & Associates Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 23rd. Shareholders of record on Monday, December 2nd will be issued a $0.55 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $2.20 dividend on an annualized basis and a yield of 1.28%. Jack Henry & Associates's dividend payout ratio is currently 40.29%.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on JKHY. UBS Group raised their price target on Jack Henry & Associates from $180.00 to $190.00 and gave the stock a "neutral" rating in a report on Thursday, November 7th. Keefe, Bruyette & Woods increased their price objective on shares of Jack Henry & Associates from $180.00 to $190.00 and gave the company a "market perform" rating in a research report on Thursday, November 7th. William Blair downgraded shares of Jack Henry & Associates from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, November 6th. Royal Bank of Canada boosted their price target on Jack Henry & Associates from $181.00 to $203.00 and gave the stock a "sector perform" rating in a report on Thursday, November 7th. Finally, Oppenheimer initiated coverage on Jack Henry & Associates in a report on Tuesday, October 1st. They issued an "outperform" rating and a $206.00 price objective for the company. Ten analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $188.73.

Read Our Latest Research Report on JKHY

About Jack Henry & Associates

(

Free Report)

Jack Henry & Associates, Inc, a financial technology company that connects people and financial institutions through technology solutions and payment processing services that reduce the barriers to financial health. It operates through four segments: Core, Payments, Complementary, and Corporate and Other.

Featured Stories

Before you consider Jack Henry & Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jack Henry & Associates wasn't on the list.

While Jack Henry & Associates currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.