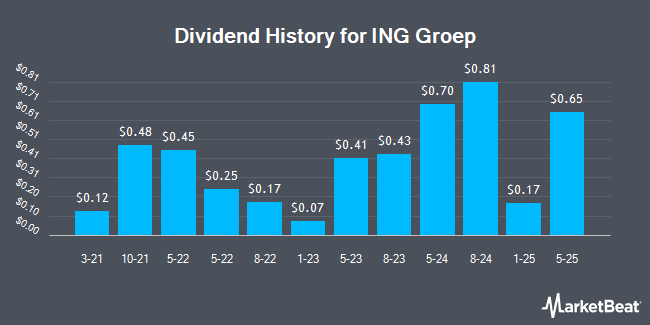

ING Groep (NYSE:ING - Get Free Report) declared a semi-annual dividend on Tuesday, March 25th, Wall Street Journal reports. Investors of record on Friday, April 25th will be paid a dividend of 0.6526 per share by the financial services provider on Friday, May 9th. This represents a yield of 5.1%. The ex-dividend date is Friday, April 25th. This is a 291.5% increase from ING Groep's previous semi-annual dividend of $0.17.

ING Groep has increased its dividend by an average of 19.7% per year over the last three years. ING Groep has a dividend payout ratio of 13.8% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect ING Groep to earn $2.56 per share next year, which means the company should continue to be able to cover its $0.33 annual dividend with an expected future payout ratio of 12.9%.

ING Groep Stock Performance

Shares of ING Groep stock traded down $0.23 during trading on Friday, hitting $19.83. 1,771,267 shares of the stock were exchanged, compared to its average volume of 2,281,610. The stock has a market cap of $69.35 billion, a PE ratio of 9.26, a P/E/G ratio of 6.42 and a beta of 1.44. The stock's fifty day moving average is $18.09 and its 200 day moving average is $17.05. ING Groep has a 12 month low of $15.09 and a 12 month high of $20.79. The company has a debt-to-equity ratio of 2.89, a quick ratio of 1.13 and a current ratio of 1.13.

ING Groep (NYSE:ING - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The financial services provider reported $0.39 earnings per share for the quarter, missing analysts' consensus estimates of $0.41 by ($0.02). ING Groep had a net margin of 28.30% and a return on equity of 11.81%. As a group, sell-side analysts anticipate that ING Groep will post 2.14 EPS for the current year.

Wall Street Analysts Forecast Growth

Separately, The Goldman Sachs Group raised ING Groep from a "neutral" rating to a "buy" rating in a research note on Thursday. Three equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy".

View Our Latest Analysis on ING

About ING Groep

(

Get Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

Featured Articles

Before you consider ING Groep, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Groep wasn't on the list.

While ING Groep currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.