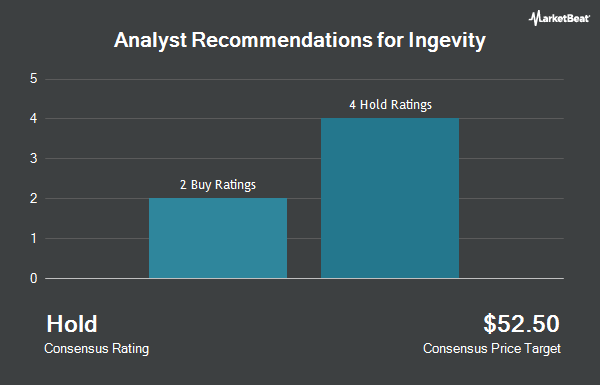

Ingevity (NYSE:NGVT - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "buy" rating to a "hold" rating in a report released on Monday.

Separately, BMO Capital Markets raised Ingevity from a "market perform" rating to an "outperform" rating and increased their price target for the stock from $62.00 to $65.00 in a research note on Wednesday, February 26th. Three investment analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $55.17.

Get Our Latest Analysis on NGVT

Ingevity Price Performance

NGVT stock traded up $0.12 during trading on Monday, reaching $39.84. 69,217 shares of the company were exchanged, compared to its average volume of 240,108. Ingevity has a 52-week low of $30.90 and a 52-week high of $56.29. The company has a debt-to-equity ratio of 6.86, a quick ratio of 1.04 and a current ratio of 1.87. The company has a market cap of $1.45 billion, a P/E ratio of -3.36 and a beta of 1.53. The stock's 50 day moving average price is $45.31 and its 200 day moving average price is $42.43.

Ingevity (NYSE:NGVT - Get Free Report) last released its earnings results on Tuesday, February 18th. The company reported $0.95 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.29 by $0.66. The company had revenue of $298.80 million for the quarter, compared to analyst estimates of $297.40 million. Ingevity had a negative net margin of 30.60% and a positive return on equity of 41.44%. As a group, analysts predict that Ingevity will post 4.45 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the company. First Horizon Advisors Inc. raised its stake in Ingevity by 45.9% during the 3rd quarter. First Horizon Advisors Inc. now owns 862 shares of the company's stock valued at $34,000 after acquiring an additional 271 shares in the last quarter. KBC Group NV increased its stake in Ingevity by 27.5% in the 4th quarter. KBC Group NV now owns 2,007 shares of the company's stock worth $82,000 after purchasing an additional 433 shares in the last quarter. Empowered Funds LLC purchased a new stake in Ingevity during the fourth quarter valued at about $187,000. O Shaughnessy Asset Management LLC acquired a new position in shares of Ingevity in the fourth quarter worth about $214,000. Finally, Teacher Retirement System of Texas purchased a new stake in shares of Ingevity in the 4th quarter valued at approximately $237,000. Institutional investors own 91.59% of the company's stock.

About Ingevity

(

Get Free Report)

Ingevity Corporation manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America. It operates through three segments: Performance Materials, Performance Chemicals, and Advanced Polymer Technologies.

See Also

Before you consider Ingevity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingevity wasn't on the list.

While Ingevity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.