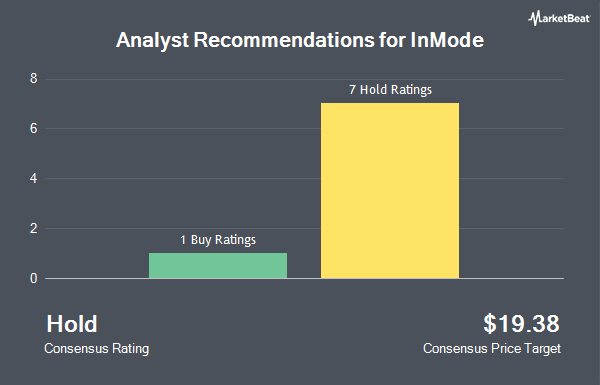

Shares of InMode Ltd. (NASDAQ:INMD - Get Free Report) have been assigned a consensus recommendation of "Hold" from the six brokerages that are covering the stock, MarketBeat reports. Four analysts have rated the stock with a hold rating and two have issued a buy rating on the company. The average 12 month target price among brokerages that have issued a report on the stock in the last year is $22.60.

A number of analysts recently commented on the company. Needham & Company LLC reaffirmed a "hold" rating on shares of InMode in a research note on Thursday, October 31st. Barclays lowered their price target on InMode from $29.00 to $27.00 and set an "overweight" rating for the company in a report on Monday, October 14th. BTIG Research began coverage on InMode in a report on Thursday, October 17th. They set a "buy" rating and a $25.00 target price for the company. Finally, Jefferies Financial Group lowered InMode from a "buy" rating to a "hold" rating and reduced their price target for the stock from $21.00 to $19.00 in a research report on Tuesday, July 23rd.

Get Our Latest Stock Report on INMD

InMode Stock Down 1.7 %

Shares of INMD traded down $0.32 on Thursday, reaching $19.00. The stock had a trading volume of 908,541 shares, compared to its average volume of 1,337,926. InMode has a twelve month low of $14.87 and a twelve month high of $26.80. The firm has a market capitalization of $1.60 billion, a PE ratio of 10.44 and a beta of 2.15. The firm has a 50-day moving average of $17.12 and a 200 day moving average of $17.43.

Institutional Investors Weigh In On InMode

Several hedge funds have recently modified their holdings of INMD. Asset Dedication LLC bought a new stake in shares of InMode in the second quarter valued at about $33,000. Headlands Technologies LLC raised its stake in shares of InMode by 118.2% in the first quarter. Headlands Technologies LLC now owns 1,916 shares of the healthcare company's stock valued at $41,000 after purchasing an additional 1,038 shares in the last quarter. nVerses Capital LLC bought a new position in InMode in the second quarter worth $42,000. Nisa Investment Advisors LLC increased its holdings in InMode by 314.7% in the 3rd quarter. Nisa Investment Advisors LLC now owns 3,550 shares of the healthcare company's stock valued at $60,000 after buying an additional 2,694 shares during the period. Finally, EMC Capital Management acquired a new position in shares of InMode in the 1st quarter valued at $90,000. 68.04% of the stock is owned by institutional investors.

InMode Company Profile

(

Get Free ReportInMode Ltd. designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radiofrequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States and internationally. The company offers minimally invasive aesthetic medical products for various procedures, such as liposuction with simultaneous skin tightening, body and face contouring, and ablative skin rejuvenation treatments, as well as for use in women's health conditions and procedures.

Further Reading

Before you consider InMode, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InMode wasn't on the list.

While InMode currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.