Renaissance Technologies LLC decreased its position in Innoviva, Inc. (NASDAQ:INVA - Free Report) by 1.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 4,261,732 shares of the biotechnology company's stock after selling 68,175 shares during the period. Renaissance Technologies LLC owned about 6.81% of Innoviva worth $73,941,000 as of its most recent SEC filing.

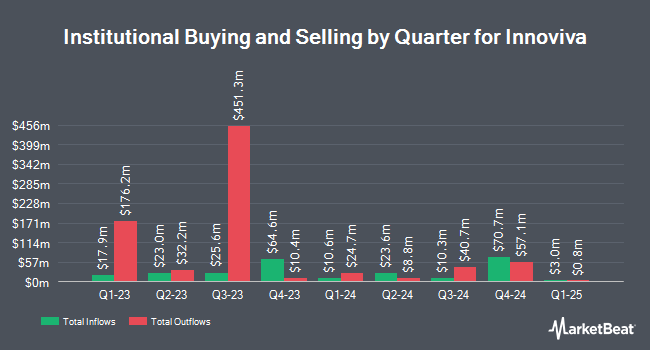

Several other institutional investors and hedge funds have also bought and sold shares of the company. FMR LLC increased its holdings in Innoviva by 8.2% in the 3rd quarter. FMR LLC now owns 10,119 shares of the biotechnology company's stock worth $195,000 after acquiring an additional 771 shares during the last quarter. Walleye Capital LLC bought a new position in Innoviva during the third quarter worth about $214,000. Jane Street Group LLC boosted its position in Innoviva by 46.4% during the third quarter. Jane Street Group LLC now owns 136,361 shares of the biotechnology company's stock worth $2,633,000 after purchasing an additional 43,218 shares during the period. MML Investors Services LLC increased its stake in shares of Innoviva by 19.4% in the third quarter. MML Investors Services LLC now owns 18,375 shares of the biotechnology company's stock worth $355,000 after purchasing an additional 2,985 shares in the last quarter. Finally, Barclays PLC raised its position in shares of Innoviva by 254.2% in the third quarter. Barclays PLC now owns 100,594 shares of the biotechnology company's stock valued at $1,942,000 after purchasing an additional 72,192 shares during the period. 99.12% of the stock is owned by institutional investors.

Innoviva Price Performance

Innoviva stock traded up $0.17 during midday trading on Tuesday, reaching $18.15. 125,308 shares of the stock were exchanged, compared to its average volume of 801,953. The company's fifty day moving average is $17.73 and its 200-day moving average is $18.48. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.64 and a current ratio of 1.79. Innoviva, Inc. has a 52 week low of $14.32 and a 52 week high of $21.28. The firm has a market cap of $1.14 billion, a PE ratio of 26.30 and a beta of 0.48.

Innoviva (NASDAQ:INVA - Get Free Report) last issued its quarterly earnings data on Wednesday, February 26th. The biotechnology company reported $0.57 earnings per share (EPS) for the quarter. The company had revenue of $91.81 million for the quarter. Innoviva had a return on equity of 20.84% and a net margin of 18.31%. On average, sell-side analysts forecast that Innoviva, Inc. will post 0.33 EPS for the current year.

Insider Transactions at Innoviva

In other news, major shareholder Alexander J. Denner sold 1,196,746 shares of the stock in a transaction on Thursday, March 6th. The shares were sold at an average price of $17.52, for a total value of $20,966,989.92. Following the transaction, the insider now owns 5,658,705 shares of the company's stock, valued at $99,140,511.60. This represents a 17.46 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 1.70% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on INVA. Scotiabank began coverage on shares of Innoviva in a research note on Friday, March 7th. They issued a "sector outperform" rating and a $55.00 price objective for the company. StockNews.com raised Innoviva from a "hold" rating to a "buy" rating in a report on Monday.

Read Our Latest Research Report on Innoviva

Innoviva Profile

(

Free Report)

Innoviva, Inc engages in the development and commercialization of pharmaceutical products in the United States and internationally. The company's products include RELVAR/BREO ELLIPTA, a once-daily combination medicine consisting of a LABA, vilanterol (VI), an inhaled corticosteroid (ICS), and fluticasone furoate; ANORO ELLIPTA, a once-daily medicine combining a long-acting muscarinic antagonist (LAMA) and umeclidinium bromide (UMEC) with a LABA, VI; GIAPREZA (angiotensin II), a vasoconstrictor to increase blood pressure in adults with septic or other distributive shock; XERAVA (eravacycline) for the treatment of complicated intra-abdominal infections in adults; and XACDURO, a beta lactamase inhibitor for the treatment of hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia.

See Also

Before you consider Innoviva, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innoviva wasn't on the list.

While Innoviva currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.