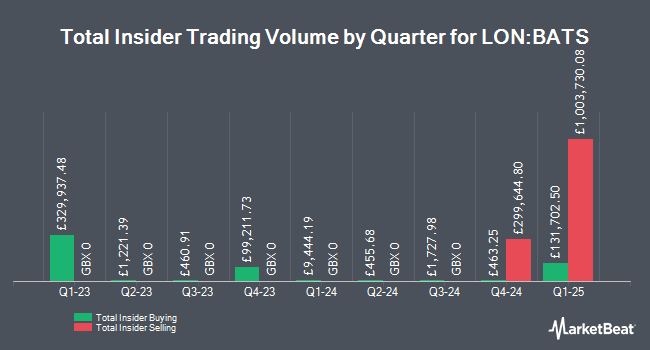

British American Tobacco p.l.c. (LON:BATS - Get Free Report) insider Tadeu Marroco sold 9,555 shares of the firm's stock in a transaction on Wednesday, March 26th. The shares were sold at an average price of GBX 3,136 ($40.55), for a total value of £299,644.80 ($387,438.32).

Tadeu Marroco also recently made the following trade(s):

- On Wednesday, March 5th, Tadeu Marroco bought 5 shares of British American Tobacco stock. The shares were bought at an average cost of GBX 3,074 ($39.75) per share, for a total transaction of £153.70 ($198.73).

British American Tobacco Price Performance

LON BATS traded up GBX 24 ($0.31) on Friday, reaching GBX 3,129 ($40.46). The company's stock had a trading volume of 14,652,567 shares, compared to its average volume of 17,436,309. The firm's 50 day moving average is GBX 3,132.27 and its two-hundred day moving average is GBX 2,944.82. The stock has a market cap of £68.84 billion, a PE ratio of -5.05, a PEG ratio of 3.12 and a beta of 0.27. The company has a debt-to-equity ratio of 74.63, a quick ratio of 0.47 and a current ratio of 0.88. British American Tobacco p.l.c. has a twelve month low of GBX 2,228.78 ($28.82) and a twelve month high of GBX 3,416 ($44.17).

British American Tobacco (LON:BATS - Get Free Report) last released its earnings results on Thursday, February 13th. The company reported GBX 364.30 ($4.71) EPS for the quarter. British American Tobacco had a negative net margin of 52.84% and a negative return on equity of 25.94%. As a group, sell-side analysts predict that British American Tobacco p.l.c. will post 361.5079365 EPS for the current year.

British American Tobacco Increases Dividend

The business also recently announced a dividend, which will be paid on Friday, November 7th. Stockholders of record on Thursday, October 2nd will be given a dividend of GBX 60.06 ($0.78) per share. The ex-dividend date of this dividend is Thursday, October 2nd. This is a positive change from British American Tobacco's previous dividend of $58.88. This represents a dividend yield of 1.9%. British American Tobacco's payout ratio is -38.08%.

Analyst Ratings Changes

Separately, JPMorgan Chase & Co. reiterated a "neutral" rating and set a GBX 2,800 ($36.20) price objective on shares of British American Tobacco in a research note on Thursday, December 12th.

View Our Latest Report on British American Tobacco

British American Tobacco Company Profile

(

Get Free Report)

BAT was founded in 1902 and was first listed on the London Stock Exchange in 1912. A constituent of the FTSE 100 since its creation in 1984, we have evolved, becoming the only truly global company in our sector.

BAT is transforming and is well positioned with a global footprint and multi-category portfolio.

See Also

Before you consider British American Tobacco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and British American Tobacco wasn't on the list.

While British American Tobacco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.