CNA Financial Co. (NYSE:CNA - Get Free Report) Chairman Dino Robusto sold 6,250 shares of the company's stock in a transaction on Monday, March 17th. The shares were sold at an average price of $48.86, for a total value of $305,375.00. Following the completion of the transaction, the chairman now directly owns 720,442 shares in the company, valued at approximately $35,200,796.12. This represents a 0.86 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website.

Dino Robusto also recently made the following trade(s):

- On Thursday, March 13th, Dino Robusto acquired 3,896 shares of CNA Financial stock. The stock was purchased at an average cost of $47.63 per share, for a total transaction of $185,566.48.

CNA Financial Price Performance

Shares of CNA traded down $0.40 during trading hours on Friday, hitting $48.80. 1,739,155 shares of the company were exchanged, compared to its average volume of 289,034. The company has a market cap of $13.22 billion, a price-to-earnings ratio of 13.86, a P/E/G ratio of 9.23 and a beta of 0.68. CNA Financial Co. has a fifty-two week low of $42.33 and a fifty-two week high of $52.36. The company has a quick ratio of 0.28, a current ratio of 0.28 and a debt-to-equity ratio of 0.28. The firm's fifty day moving average is $48.76 and its 200 day moving average is $48.92.

CNA Financial (NYSE:CNA - Get Free Report) last released its earnings results on Monday, February 10th. The insurance provider reported $1.25 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.11 by $0.14. CNA Financial had a return on equity of 12.90% and a net margin of 6.72%. On average, equities analysts anticipate that CNA Financial Co. will post 4.64 earnings per share for the current fiscal year.

CNA Financial Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, March 13th. Investors of record on Monday, February 24th were paid a $0.46 dividend. The ex-dividend date of this dividend was Monday, February 24th. This is a positive change from CNA Financial's previous quarterly dividend of $0.44. This represents a $1.84 annualized dividend and a yield of 3.77%. CNA Financial's dividend payout ratio (DPR) is 52.27%.

Wall Street Analyst Weigh In

A number of research analysts have commented on the company. Keefe, Bruyette & Woods decreased their price objective on CNA Financial from $54.00 to $53.00 and set a "market perform" rating on the stock in a report on Wednesday, February 12th. StockNews.com lowered CNA Financial from a "buy" rating to a "hold" rating in a report on Tuesday, February 11th.

Read Our Latest Analysis on CNA

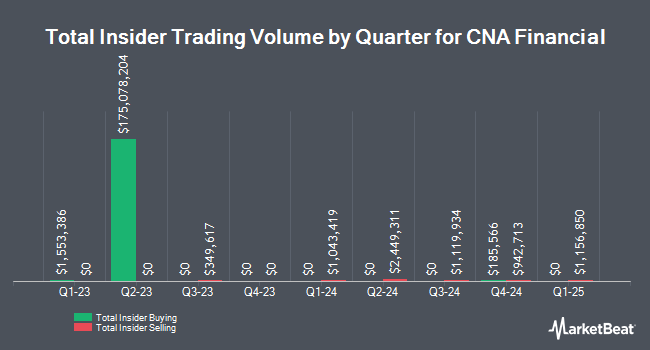

Institutional Trading of CNA Financial

Several large investors have recently bought and sold shares of CNA. AQR Capital Management LLC boosted its stake in CNA Financial by 41.4% in the fourth quarter. AQR Capital Management LLC now owns 1,939,336 shares of the insurance provider's stock valued at $93,806,000 after buying an additional 567,926 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in CNA Financial by 66.0% in the fourth quarter. Bank of New York Mellon Corp now owns 1,177,110 shares of the insurance provider's stock valued at $56,937,000 after buying an additional 468,058 shares in the last quarter. Norges Bank acquired a new stake in CNA Financial in the fourth quarter valued at about $14,859,000. Raymond James Financial Inc. acquired a new stake in CNA Financial in the fourth quarter valued at about $13,129,000. Finally, First Trust Advisors LP boosted its stake in CNA Financial by 20.1% in the fourth quarter. First Trust Advisors LP now owns 1,486,853 shares of the insurance provider's stock valued at $71,919,000 after buying an additional 249,346 shares in the last quarter. 98.45% of the stock is owned by institutional investors and hedge funds.

CNA Financial Company Profile

(

Get Free Report)

CNA Financial Corporation provides commercial property and casualty insurance products in the United States and internationally. It operates through Specialty, Commercial, International, Life & Group, and Corporate & Other segments. The company offers professional liability coverages and risk management services to various professional firms, including architects, real estate agents, and accounting and law firms; directors and officers, employment practices, fiduciary, and fidelity and cyber coverages to small and mid-size firms, public and privately held firms, and not-for-profit organizations; professional and general liability, as well as associated casualty coverages for healthcare industry; surety and fidelity bonds; and warranty and alternative risks products.

See Also

Before you consider CNA Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CNA Financial wasn't on the list.

While CNA Financial currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.