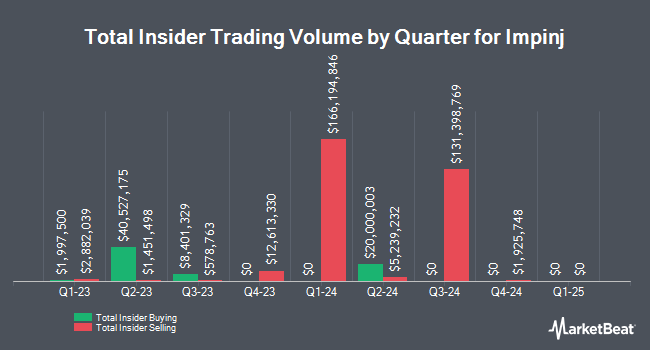

Impinj, Inc. (NASDAQ:PI - Get Free Report) major shareholder Sylebra Capital Llc sold 250,000 shares of the company's stock in a transaction on Friday, November 8th. The shares were sold at an average price of $203.00, for a total transaction of $50,750,000.00. Following the completion of the sale, the insider now directly owns 2,222,352 shares in the company, valued at approximately $451,137,456. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Major shareholders that own more than 10% of a company's stock are required to disclose their sales and purchases with the SEC.

Sylebra Capital Llc also recently made the following trade(s):

- On Monday, November 11th, Sylebra Capital Llc sold 78,616 shares of Impinj stock. The stock was sold at an average price of $201.79, for a total transaction of $15,863,922.64.

- On Wednesday, November 6th, Sylebra Capital Llc sold 89,809 shares of Impinj stock. The shares were sold at an average price of $201.78, for a total transaction of $18,121,660.02.

- On Monday, November 4th, Sylebra Capital Llc sold 95,670 shares of Impinj stock. The stock was sold at an average price of $195.21, for a total transaction of $18,675,740.70.

- On Friday, November 1st, Sylebra Capital Llc sold 22,373 shares of Impinj stock. The stock was sold at an average price of $195.00, for a total transaction of $4,362,735.00.

- On Wednesday, October 30th, Sylebra Capital Llc sold 32,031 shares of Impinj stock. The stock was sold at an average price of $195.35, for a total transaction of $6,257,255.85.

- On Friday, September 13th, Sylebra Capital Llc bought 4,264,393 shares of Impinj stock. The stock was bought at an average price of $4.69 per share, for a total transaction of $20,000,003.17.

Impinj Trading Down 2.3 %

Shares of NASDAQ:PI traded down $4.66 on Tuesday, reaching $194.64. 312,090 shares of the company were exchanged, compared to its average volume of 474,106. Impinj, Inc. has a 1-year low of $69.50 and a 1-year high of $239.88. The firm has a market cap of $5.51 billion, a price-to-earnings ratio of 223.93 and a beta of 1.81. The company has a 50-day moving average of $203.93 and a 200-day moving average of $175.32.

Impinj (NASDAQ:PI - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The company reported $0.56 earnings per share for the quarter, topping analysts' consensus estimates of $0.48 by $0.08. Impinj had a net margin of 8.21% and a negative return on equity of 1.64%. The company had revenue of $95.20 million during the quarter, compared to the consensus estimate of $92.86 million. During the same period in the previous year, the firm posted ($0.36) earnings per share. The company's revenue was up 46.5% on a year-over-year basis. As a group, analysts forecast that Impinj, Inc. will post 0.4 earnings per share for the current year.

Hedge Funds Weigh In On Impinj

Several hedge funds and other institutional investors have recently modified their holdings of the stock. SG Americas Securities LLC acquired a new position in Impinj in the first quarter worth $513,000. Harbor Capital Advisors Inc. boosted its holdings in shares of Impinj by 112.0% in the 2nd quarter. Harbor Capital Advisors Inc. now owns 13,533 shares of the company's stock valued at $2,122,000 after buying an additional 7,151 shares during the last quarter. Raymond James & Associates grew its position in shares of Impinj by 21.7% during the 3rd quarter. Raymond James & Associates now owns 22,951 shares of the company's stock worth $4,969,000 after purchasing an additional 4,090 shares in the last quarter. New York State Teachers Retirement System bought a new stake in Impinj during the 3rd quarter worth approximately $1,126,000. Finally, Vanguard Group Inc. increased its stake in Impinj by 1.5% during the 1st quarter. Vanguard Group Inc. now owns 2,510,583 shares of the company's stock valued at $322,384,000 after purchasing an additional 35,893 shares in the last quarter.

Analyst Upgrades and Downgrades

PI has been the subject of several recent research reports. StockNews.com lowered shares of Impinj from a "hold" rating to a "sell" rating in a research note on Friday, October 25th. Needham & Company LLC boosted their target price on Impinj from $195.00 to $245.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. The Goldman Sachs Group lifted their price target on Impinj from $165.00 to $200.00 and gave the company a "neutral" rating in a research note on Friday, October 25th. Susquehanna boosted their price target on Impinj from $215.00 to $260.00 and gave the stock a "positive" rating in a report on Monday, October 21st. Finally, Evercore ISI restated an "outperform" rating and set a $270.00 price target (up from $205.00) on shares of Impinj in a research note on Thursday, October 24th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and nine have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $224.60.

Check Out Our Latest Report on PI

About Impinj

(

Get Free Report)

Impinj, Inc operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. Its platform wirelessly connects items and delivers data about the connected items to business and consumer applications. The company's platform comprises endpoint ICs, a miniature radios-on-a-chip that attaches to a host item and includes a number to identify the item.

Recommended Stories

Before you consider Impinj, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Impinj wasn't on the list.

While Impinj currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.