Teachers Retirement System of The State of Kentucky raised its holdings in shares of Installed Building Products, Inc. (NYSE:IBP - Free Report) by 121.1% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 16,094 shares of the construction company's stock after buying an additional 8,815 shares during the period. Teachers Retirement System of The State of Kentucky owned about 0.06% of Installed Building Products worth $3,963,000 at the end of the most recent reporting period.

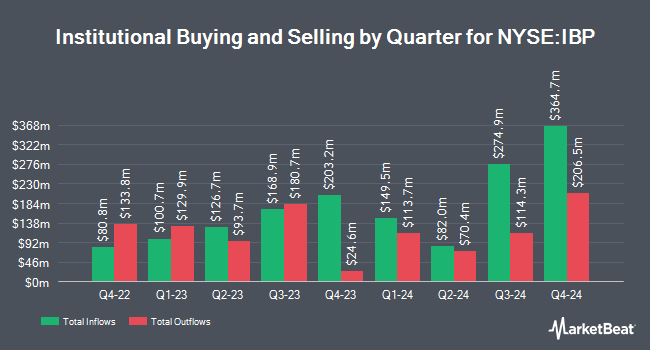

A number of other hedge funds have also recently modified their holdings of IBP. Coldstream Capital Management Inc. purchased a new stake in shares of Installed Building Products in the third quarter valued at approximately $203,000. Geode Capital Management LLC lifted its holdings in shares of Installed Building Products by 3.9% in the 3rd quarter. Geode Capital Management LLC now owns 623,003 shares of the construction company's stock worth $153,452,000 after buying an additional 23,179 shares during the period. Barclays PLC grew its position in shares of Installed Building Products by 61.9% during the 3rd quarter. Barclays PLC now owns 97,711 shares of the construction company's stock worth $24,063,000 after buying an additional 37,347 shares in the last quarter. Public Employees Retirement System of Ohio increased its stake in shares of Installed Building Products by 366.7% during the third quarter. Public Employees Retirement System of Ohio now owns 854 shares of the construction company's stock valued at $210,000 after buying an additional 671 shares during the period. Finally, MML Investors Services LLC lifted its stake in Installed Building Products by 6.4% in the third quarter. MML Investors Services LLC now owns 9,053 shares of the construction company's stock worth $2,229,000 after acquiring an additional 544 shares during the period. Institutional investors own 99.61% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have commented on IBP shares. Evercore ISI raised their target price on shares of Installed Building Products from $271.00 to $272.00 and gave the company an "outperform" rating in a research report on Wednesday, October 16th. Jefferies Financial Group boosted their price objective on shares of Installed Building Products from $240.00 to $252.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. JPMorgan Chase & Co. upped their target price on Installed Building Products from $236.00 to $241.00 and gave the stock a "neutral" rating in a report on Friday, November 22nd. DA Davidson cut their price target on Installed Building Products from $275.00 to $260.00 and set a "buy" rating on the stock in a report on Friday, November 8th. Finally, StockNews.com upgraded Installed Building Products from a "hold" rating to a "buy" rating in a research note on Wednesday, December 4th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $253.70.

Get Our Latest Analysis on Installed Building Products

Installed Building Products Stock Performance

NYSE:IBP traded down $6.91 during trading hours on Friday, reaching $198.50. The company had a trading volume of 387,535 shares, compared to its average volume of 291,423. The company has a debt-to-equity ratio of 1.18, a current ratio of 2.99 and a quick ratio of 2.50. Installed Building Products, Inc. has a 1-year low of $168.08 and a 1-year high of $281.04. The business's 50 day moving average price is $223.81 and its 200-day moving average price is $222.75. The firm has a market cap of $5.59 billion, a PE ratio of 22.04 and a beta of 1.93.

Installed Building Products Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Sunday, December 15th will be paid a $0.35 dividend. This represents a $1.40 annualized dividend and a dividend yield of 0.71%. The ex-dividend date of this dividend is Friday, December 13th. Installed Building Products's dividend payout ratio is currently 15.56%.

About Installed Building Products

(

Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

Featured Articles

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.