Installed Building Products (NYSE:IBP - Get Free Report) was downgraded by equities research analysts at StockNews.com from a "buy" rating to a "hold" rating in a research note issued to investors on Thursday.

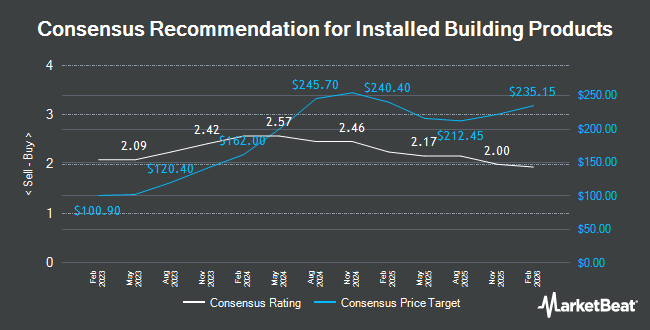

Several other research firms also recently weighed in on IBP. Evercore ISI upped their price target on Installed Building Products from $271.00 to $272.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 16th. The Goldman Sachs Group raised their price target on Installed Building Products from $260.00 to $295.00 and gave the company a "buy" rating in a report on Friday, August 2nd. Jefferies Financial Group upped their target price on shares of Installed Building Products from $240.00 to $252.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. Stephens reiterated an "equal weight" rating and set a $240.00 price target on shares of Installed Building Products in a report on Monday, August 5th. Finally, Truist Financial increased their price objective on Installed Building Products from $235.00 to $240.00 and gave the company a "hold" rating in a research report on Friday, August 2nd. Six research analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $254.40.

View Our Latest Research Report on IBP

Installed Building Products Stock Down 4.7 %

Shares of Installed Building Products stock traded down $10.65 during trading on Thursday, hitting $217.04. The company's stock had a trading volume of 554,735 shares, compared to its average volume of 292,496. Installed Building Products has a 52 week low of $115.25 and a 52 week high of $281.04. The company has a debt-to-equity ratio of 1.24, a quick ratio of 2.59 and a current ratio of 3.08. The company has a fifty day simple moving average of $231.34 and a two-hundred day simple moving average of $225.41. The company has a market capitalization of $6.13 billion, a PE ratio of 24.22 and a beta of 1.95.

Institutional Inflows and Outflows

Institutional investors have recently made changes to their positions in the stock. Pathstone Holdings LLC boosted its holdings in Installed Building Products by 91.6% in the 3rd quarter. Pathstone Holdings LLC now owns 7,102 shares of the construction company's stock worth $1,749,000 after buying an additional 3,396 shares during the period. Joseph Group Capital Management bought a new position in shares of Installed Building Products in the third quarter worth about $2,995,000. Prudent Man Advisors LLC purchased a new stake in shares of Installed Building Products during the third quarter worth about $203,000. Thrivent Financial for Lutherans raised its stake in Installed Building Products by 379.5% during the 3rd quarter. Thrivent Financial for Lutherans now owns 93,439 shares of the construction company's stock valued at $23,012,000 after purchasing an additional 73,952 shares during the period. Finally, Vaughan Nelson Investment Management L.P. lifted its holdings in Installed Building Products by 6.5% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 329,166 shares of the construction company's stock worth $81,063,000 after purchasing an additional 20,155 shares in the last quarter. Institutional investors own 99.61% of the company's stock.

Installed Building Products Company Profile

(

Get Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

Featured Articles

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.