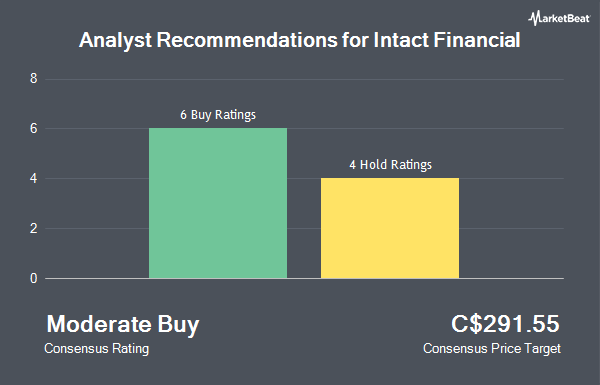

Shares of Intact Financial Co. (TSE:IFC - Get Free Report) have been assigned an average rating of "Moderate Buy" from the ten brokerages that are covering the company, Marketbeat.com reports. Two investment analysts have rated the stock with a hold recommendation and eight have issued a buy recommendation on the company. The average 12 month price objective among brokers that have issued a report on the stock in the last year is C$274.90.

Several brokerages have commented on IFC. TD Securities boosted their target price on shares of Intact Financial from C$293.00 to C$300.00 in a research report on Wednesday, November 6th. CIBC upped their price target on Intact Financial from C$250.00 to C$270.00 and gave the stock an "outperform" rating in a report on Thursday, August 1st. National Bankshares boosted their target price on Intact Financial from C$294.00 to C$296.00 in a research report on Wednesday, November 6th. Cormark boosted their price objective on shares of Intact Financial from C$250.00 to C$260.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st. Finally, Scotiabank increased their price objective on shares of Intact Financial from C$281.00 to C$283.00 in a research note on Thursday, November 7th.

Check Out Our Latest Stock Report on Intact Financial

Intact Financial Stock Performance

TSE IFC traded down C$2.18 on Wednesday, hitting C$266.49. 252,392 shares of the company's stock were exchanged, compared to its average volume of 286,188. The company has a debt-to-equity ratio of 31.26, a current ratio of 0.36 and a quick ratio of 0.28. The firm's 50-day moving average price is C$264.64 and its two-hundred day moving average price is C$247.74. The firm has a market cap of C$47.53 billion, a price-to-earnings ratio of 23.46, a P/E/G ratio of 2.01 and a beta of 0.57. Intact Financial has a fifty-two week low of C$197.82 and a fifty-two week high of C$275.00.

Intact Financial Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Monday, December 16th will be issued a $1.21 dividend. The ex-dividend date of this dividend is Monday, December 16th. This represents a $4.84 dividend on an annualized basis and a yield of 1.82%. Intact Financial's payout ratio is 42.61%.

Insider Transactions at Intact Financial

In other news, Senior Officer Kenneth Anderson sold 2,000 shares of the stock in a transaction dated Friday, September 20th. The stock was sold at an average price of C$253.88, for a total value of C$507,759.00. Also, Senior Officer Marie-Lucie Paradis sold 565 shares of the business's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of C$266.23, for a total value of C$150,419.95. Insiders sold a total of 4,565 shares of company stock worth $1,168,179 in the last ninety days. Insiders own 0.24% of the company's stock.

About Intact Financial

(

Get Free ReportIntact Financial Corporation, through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally. The company offers insurance, such as personal auto which provides coverage from accidents, third party liability, and physical damage; personal property which provides protection for homes and contents from risks, including fire, theft, vandalism, water damages, other damages, and personal liability; and commercial line and specialty line insurance which provides commercial auto, property, and liability coverages.

Featured Stories

Before you consider Intact Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intact Financial wasn't on the list.

While Intact Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.