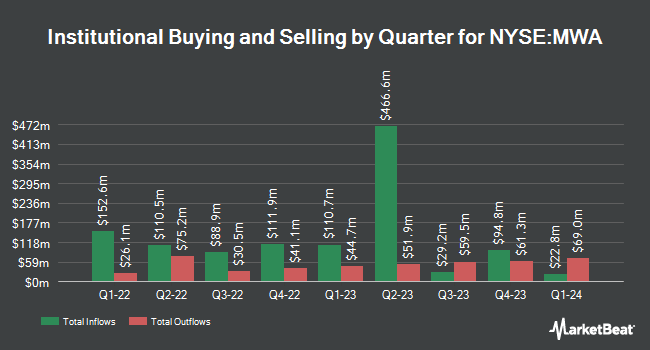

Intech Investment Management LLC purchased a new stake in Mueller Water Products, Inc. (NYSE:MWA - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 30,940 shares of the industrial products company's stock, valued at approximately $671,000.

A number of other large investors have also made changes to their positions in the stock. Price T Rowe Associates Inc. MD lifted its holdings in Mueller Water Products by 13.7% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 694,469 shares of the industrial products company's stock valued at $11,175,000 after purchasing an additional 83,567 shares in the last quarter. QRG Capital Management Inc. boosted its position in Mueller Water Products by 24.1% during the 2nd quarter. QRG Capital Management Inc. now owns 75,016 shares of the industrial products company's stock worth $1,344,000 after purchasing an additional 14,566 shares during the period. SG Americas Securities LLC purchased a new stake in shares of Mueller Water Products in the second quarter worth about $3,077,000. Diversified Trust Co purchased a new stake in Mueller Water Products during the 2nd quarter worth $346,000. Finally, AlphaMark Advisors LLC purchased a new stake in shares of Mueller Water Products during the second quarter worth about $346,000. Hedge funds and other institutional investors own 91.68% of the company's stock.

Mueller Water Products Stock Performance

Shares of NYSE:MWA traded up $0.08 during midday trading on Friday, hitting $25.04. The company's stock had a trading volume of 465,437 shares, compared to its average volume of 1,279,778. The company has a debt-to-equity ratio of 0.55, a quick ratio of 2.16 and a current ratio of 3.33. The stock's 50 day simple moving average is $23.04 and its 200 day simple moving average is $20.62. The stock has a market capitalization of $3.91 billion, a price-to-earnings ratio of 34.30, a PEG ratio of 1.42 and a beta of 1.34. Mueller Water Products, Inc. has a fifty-two week low of $13.08 and a fifty-two week high of $26.28.

Mueller Water Products (NYSE:MWA - Get Free Report) last issued its earnings results on Wednesday, November 6th. The industrial products company reported $0.22 EPS for the quarter, meeting analysts' consensus estimates of $0.22. Mueller Water Products had a return on equity of 19.38% and a net margin of 8.82%. The business had revenue of $348.20 million during the quarter, compared to analyst estimates of $324.80 million. During the same period in the prior year, the company posted $0.19 earnings per share. Mueller Water Products's revenue was up 15.5% on a year-over-year basis. As a group, research analysts anticipate that Mueller Water Products, Inc. will post 1.17 earnings per share for the current year.

Mueller Water Products Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 20th. Stockholders of record on Friday, November 8th were paid a $0.067 dividend. The ex-dividend date was Friday, November 8th. This represents a $0.27 dividend on an annualized basis and a dividend yield of 1.07%. This is an increase from Mueller Water Products's previous quarterly dividend of $0.06. Mueller Water Products's dividend payout ratio is 36.99%.

Analyst Ratings Changes

Several brokerages recently weighed in on MWA. Royal Bank of Canada boosted their price objective on Mueller Water Products from $20.00 to $23.00 and gave the company a "sector perform" rating in a report on Wednesday, August 7th. StockNews.com lowered shares of Mueller Water Products from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, October 30th. TD Cowen lowered shares of Mueller Water Products from a "buy" rating to a "hold" rating and raised their price target for the company from $19.00 to $20.00 in a research note on Friday, August 9th. Finally, Oppenheimer reissued an "outperform" rating and set a $27.00 price target (up from $26.00) on shares of Mueller Water Products in a report on Friday, November 8th. Five research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to MarketBeat, Mueller Water Products currently has a consensus rating of "Hold" and a consensus target price of $22.20.

View Our Latest Research Report on MWA

Insiders Place Their Bets

In related news, SVP Todd P. Helms sold 3,556 shares of Mueller Water Products stock in a transaction dated Friday, November 22nd. The shares were sold at an average price of $25.02, for a total transaction of $88,971.12. Following the completion of the sale, the senior vice president now owns 38,683 shares of the company's stock, valued at approximately $967,848.66. The trade was a 8.42 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Lydia W. Thomas sold 10,791 shares of the company's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $24.40, for a total value of $263,300.40. Following the completion of the transaction, the director now directly owns 136,405 shares in the company, valued at approximately $3,328,282. This represents a 7.33 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 1.40% of the company's stock.

Mueller Water Products Company Profile

(

Free Report)

Mueller Water Products, Inc manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally. It operates in two segments, Water Flow Solutions and Water Management Solutions.

Further Reading

Before you consider Mueller Water Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Water Products wasn't on the list.

While Mueller Water Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.