Intech Investment Management LLC lessened its stake in Brixmor Property Group Inc. (NYSE:BRX - Free Report) by 41.4% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 49,421 shares of the real estate investment trust's stock after selling 34,971 shares during the quarter. Intech Investment Management LLC's holdings in Brixmor Property Group were worth $1,377,000 at the end of the most recent reporting period.

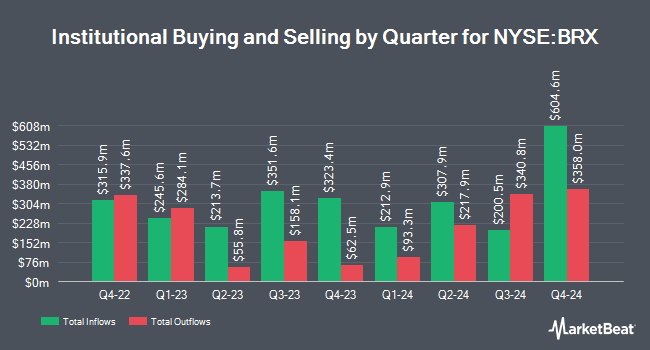

Other large investors also recently bought and sold shares of the company. PGGM Investments lifted its stake in shares of Brixmor Property Group by 167.2% in the second quarter. PGGM Investments now owns 3,761,248 shares of the real estate investment trust's stock worth $86,847,000 after acquiring an additional 2,353,582 shares in the last quarter. Boston Partners boosted its stake in shares of Brixmor Property Group by 1,140.5% during the 1st quarter. Boston Partners now owns 545,367 shares of the real estate investment trust's stock valued at $12,774,000 after buying an additional 501,403 shares during the last quarter. Wolverine Asset Management LLC acquired a new stake in shares of Brixmor Property Group during the second quarter worth approximately $494,000. Envestnet Portfolio Solutions Inc. acquired a new stake in shares of Brixmor Property Group during the second quarter worth approximately $228,000. Finally, Raymond James & Associates increased its stake in shares of Brixmor Property Group by 633.0% in the third quarter. Raymond James & Associates now owns 97,728 shares of the real estate investment trust's stock worth $2,723,000 after buying an additional 84,395 shares during the last quarter. Institutional investors and hedge funds own 98.43% of the company's stock.

Brixmor Property Group Stock Performance

BRX stock opened at $30.28 on Wednesday. Brixmor Property Group Inc. has a 1 year low of $20.80 and a 1 year high of $30.31. The stock has a market capitalization of $9.15 billion, a price-to-earnings ratio of 28.04, a PEG ratio of 4.09 and a beta of 1.57. The company has a debt-to-equity ratio of 1.85, a quick ratio of 1.38 and a current ratio of 1.38. The stock's fifty day moving average is $28.05 and its two-hundred day moving average is $25.56.

Brixmor Property Group (NYSE:BRX - Get Free Report) last issued its quarterly earnings data on Monday, October 28th. The real estate investment trust reported $0.32 earnings per share for the quarter, missing the consensus estimate of $0.53 by ($0.21). Brixmor Property Group had a net margin of 25.81% and a return on equity of 11.48%. The firm had revenue of $320.68 million during the quarter, compared to the consensus estimate of $320.22 million. During the same quarter in the prior year, the business earned $0.50 earnings per share. The company's revenue for the quarter was up 4.3% compared to the same quarter last year. On average, research analysts predict that Brixmor Property Group Inc. will post 2.14 EPS for the current year.

Brixmor Property Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Friday, January 3rd will be paid a dividend of $0.287 per share. This is a boost from Brixmor Property Group's previous quarterly dividend of $0.27. This represents a $1.15 dividend on an annualized basis and a dividend yield of 3.79%. The ex-dividend date is Friday, January 3rd. Brixmor Property Group's payout ratio is currently 100.93%.

Analyst Ratings Changes

A number of research analysts have commented on BRX shares. Stifel Nicolaus increased their price objective on shares of Brixmor Property Group from $25.50 to $27.50 and gave the company a "hold" rating in a research note on Tuesday, October 29th. Compass Point lifted their price target on Brixmor Property Group from $28.00 to $30.00 and gave the stock a "buy" rating in a research note on Tuesday, September 10th. Truist Financial increased their target price on Brixmor Property Group from $28.00 to $31.00 and gave the stock a "buy" rating in a report on Friday, November 15th. Wells Fargo & Company boosted their price target on Brixmor Property Group from $24.00 to $28.00 and gave the company an "equal weight" rating in a report on Wednesday, August 28th. Finally, Piper Sandler restated an "overweight" rating and set a $33.00 price objective (up from $30.00) on shares of Brixmor Property Group in a research note on Wednesday, July 31st. Five analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $29.38.

View Our Latest Analysis on Brixmor Property Group

Insider Activity at Brixmor Property Group

In other Brixmor Property Group news, insider Steven F. Siegel sold 25,000 shares of the company's stock in a transaction that occurred on Wednesday, November 20th. The stock was sold at an average price of $29.54, for a total value of $738,500.00. Following the completion of the sale, the insider now directly owns 315,004 shares in the company, valued at $9,305,218.16. This represents a 7.35 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 0.76% of the company's stock.

About Brixmor Property Group

(

Free Report)

Brixmor NYSE: BRX is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers. Its 362 retail centers comprise approximately 64 million square feet of prime retail space in established trade areas. The Company strives to own and operate shopping centers that reflect Brixmor's vision to be the center of the communities we serve and are home to a diverse mix of thriving national, regional and local retailers.

Featured Articles

Before you consider Brixmor Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brixmor Property Group wasn't on the list.

While Brixmor Property Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.