Intech Investment Management LLC lifted its stake in shares of Enviri Co. (NYSE:NVRI - Free Report) by 413.2% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 164,836 shares of the company's stock after purchasing an additional 132,718 shares during the quarter. Intech Investment Management LLC owned about 0.21% of Enviri worth $1,704,000 as of its most recent filing with the Securities and Exchange Commission.

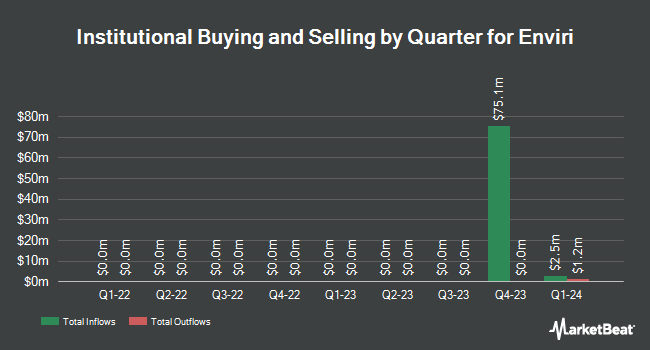

Other institutional investors and hedge funds have also made changes to their positions in the company. Innealta Capital LLC acquired a new stake in shares of Enviri during the 2nd quarter worth approximately $26,000. CWM LLC increased its position in Enviri by 137.6% in the 2nd quarter. CWM LLC now owns 4,130 shares of the company's stock valued at $36,000 after acquiring an additional 2,392 shares during the period. DekaBank Deutsche Girozentrale acquired a new stake in Enviri in the 1st quarter valued at approximately $70,000. SG Americas Securities LLC acquired a new stake in Enviri in the 1st quarter valued at approximately $100,000. Finally, Wealth Enhancement Advisory Services LLC acquired a new stake in Enviri in the 3rd quarter valued at approximately $127,000. 93.43% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, BMO Capital Markets lowered their target price on Enviri from $13.00 to $10.00 and set a "market perform" rating on the stock in a research report on Friday, November 1st.

Check Out Our Latest Stock Analysis on NVRI

Enviri Price Performance

Shares of NVRI stock traded up $0.06 during mid-day trading on Tuesday, hitting $7.52. 401,646 shares of the stock traded hands, compared to its average volume of 469,124. Enviri Co. has a twelve month low of $5.65 and a twelve month high of $12.79. The firm has a market cap of $602.25 million, a price-to-earnings ratio of -6.06 and a beta of 2.22. The company's 50-day simple moving average is $9.15 and its 200-day simple moving average is $9.52. The company has a debt-to-equity ratio of 2.72, a quick ratio of 0.99 and a current ratio of 1.30.

Enviri (NYSE:NVRI - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The company reported ($0.01) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.07 by ($0.08). Enviri had a negative net margin of 4.28% and a negative return on equity of 1.25%. The firm had revenue of $573.60 million for the quarter, compared to analyst estimates of $613.63 million. During the same quarter last year, the business posted $0.05 earnings per share. The firm's revenue for the quarter was down 3.9% compared to the same quarter last year. As a group, equities research analysts expect that Enviri Co. will post -0.11 earnings per share for the current year.

Enviri Profile

(

Free Report)

Enviri Corporation provides environmental solutions for industrial and specialty waste streams in the United States and internationally. The company operates through two segments: Harsco Environmental and Clean Earth. The Harsco Environmental segment offers on-site services under long-term contracts for material logistics, product quality improvement, and resource recovery for iron, steel, and metals manufacturing; manufactures and sells industrial abrasives, roofing granules, aluminum dross, and scrap processing systems; and meltshop and furnace services, such as under-vessel cleaning, removal of ladle slag, and general melt shop debris.

Featured Stories

Before you consider Enviri, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enviri wasn't on the list.

While Enviri currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.