Intech Investment Management LLC increased its stake in shares of The Simply Good Foods Company (NASDAQ:SMPL - Free Report) by 356.7% in the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 30,464 shares of the financial services provider's stock after buying an additional 23,794 shares during the period. Intech Investment Management LLC's holdings in Simply Good Foods were worth $1,059,000 as of its most recent SEC filing.

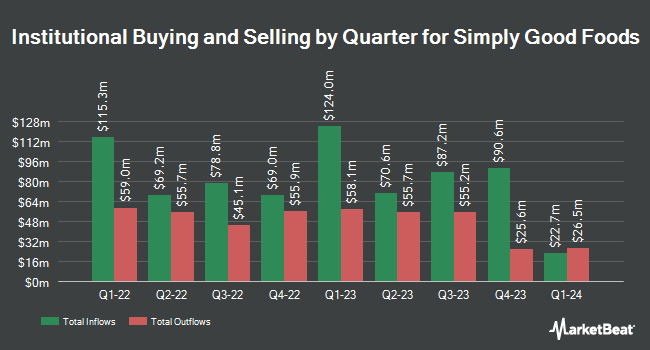

Several other hedge funds have also added to or reduced their stakes in the stock. Quarry LP purchased a new stake in shares of Simply Good Foods during the 2nd quarter worth approximately $30,000. GAMMA Investing LLC raised its stake in shares of Simply Good Foods by 182.4% in the second quarter. GAMMA Investing LLC now owns 850 shares of the financial services provider's stock valued at $31,000 after buying an additional 549 shares during the period. EverSource Wealth Advisors LLC lifted its position in shares of Simply Good Foods by 236.4% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 1,766 shares of the financial services provider's stock valued at $60,000 after buying an additional 1,241 shares during the last quarter. Innealta Capital LLC bought a new position in shares of Simply Good Foods during the 2nd quarter worth $71,000. Finally, KBC Group NV increased its holdings in Simply Good Foods by 31.9% in the 3rd quarter. KBC Group NV now owns 3,084 shares of the financial services provider's stock worth $107,000 after acquiring an additional 746 shares during the last quarter. Institutional investors own 88.45% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have commented on the stock. Stephens dropped their price objective on shares of Simply Good Foods from $44.00 to $42.00 and set an "overweight" rating on the stock in a report on Wednesday, October 23rd. Citigroup cut their price objective on shares of Simply Good Foods from $46.00 to $43.00 and set a "buy" rating for the company in a report on Thursday, November 14th. Three research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $40.78.

Get Our Latest Analysis on Simply Good Foods

Insider Transactions at Simply Good Foods

In related news, CAO Timothy Allen Matthews sold 5,325 shares of the company's stock in a transaction on Thursday, November 14th. The shares were sold at an average price of $37.31, for a total value of $198,675.75. Following the completion of the transaction, the chief accounting officer now directly owns 17,063 shares in the company, valued at approximately $636,620.53. The trade was a 23.79 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Joseph Scalzo sold 25,000 shares of the firm's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $35.99, for a total value of $899,750.00. Following the sale, the director now owns 139,204 shares in the company, valued at $5,009,951.96. The trade was a 15.22 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 327,869 shares of company stock valued at $12,139,570. 10.98% of the stock is owned by corporate insiders.

Simply Good Foods Price Performance

NASDAQ:SMPL traded down $0.09 during trading hours on Thursday, hitting $39.92. The stock had a trading volume of 583,786 shares, compared to its average volume of 894,930. The company has a 50 day simple moving average of $35.11 and a two-hundred day simple moving average of $35.07. The firm has a market capitalization of $4.00 billion, a price-to-earnings ratio of 28.93, a P/E/G ratio of 3.52 and a beta of 0.64. The company has a debt-to-equity ratio of 0.23, a current ratio of 4.05 and a quick ratio of 2.75. The Simply Good Foods Company has a one year low of $30.00 and a one year high of $43.00.

Simply Good Foods (NASDAQ:SMPL - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The financial services provider reported $0.50 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.50. The company had revenue of $375.70 million during the quarter, compared to analyst estimates of $373.07 million. Simply Good Foods had a return on equity of 10.23% and a net margin of 10.46%. The firm's quarterly revenue was up 17.3% on a year-over-year basis. During the same quarter last year, the company earned $0.41 earnings per share. Research analysts forecast that The Simply Good Foods Company will post 1.76 earnings per share for the current fiscal year.

Simply Good Foods Company Profile

(

Free Report)

The Simply Good Foods Company operates as a consumer-packaged food and beverage company in North America and internationally. The company develops, markets, and sells snacks and meal replacements. It offers protein bars, ready-to-drink shakes, sweet and salty snacks, cookies, protein chips, and recipes under the Atkins and Quest brand names.

Featured Articles

Before you consider Simply Good Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simply Good Foods wasn't on the list.

While Simply Good Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.