Intech Investment Management LLC grew its position in shares of Century Aluminum (NASDAQ:CENX - Free Report) by 206.4% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 196,048 shares of the industrial products company's stock after buying an additional 132,074 shares during the period. Intech Investment Management LLC owned about 0.21% of Century Aluminum worth $3,572,000 as of its most recent SEC filing.

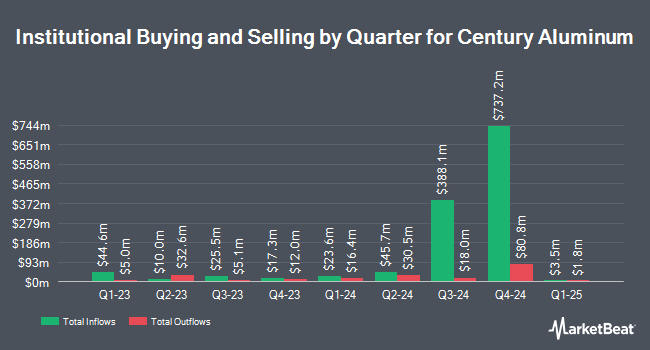

Other hedge funds also recently made changes to their positions in the company. AlphaQuest LLC lifted its stake in Century Aluminum by 2,889.3% during the fourth quarter. AlphaQuest LLC now owns 2,511 shares of the industrial products company's stock worth $46,000 after purchasing an additional 2,427 shares during the last quarter. FNY Investment Advisers LLC bought a new position in shares of Century Aluminum in the 4th quarter worth about $54,000. Nisa Investment Advisors LLC boosted its holdings in shares of Century Aluminum by 159.2% in the 4th quarter. Nisa Investment Advisors LLC now owns 3,256 shares of the industrial products company's stock valued at $59,000 after buying an additional 2,000 shares during the period. Dynamic Technology Lab Private Ltd bought a new stake in shares of Century Aluminum during the 3rd quarter valued at about $189,000. Finally, Inceptionr LLC acquired a new stake in Century Aluminum during the fourth quarter worth about $207,000. Institutional investors and hedge funds own 61.59% of the company's stock.

Century Aluminum Stock Performance

Shares of NASDAQ CENX traded down $0.41 during midday trading on Monday, hitting $18.91. 1,436,937 shares of the company's stock were exchanged, compared to its average volume of 1,342,890. Century Aluminum has a twelve month low of $11.40 and a twelve month high of $25.39. The firm has a market cap of $1.75 billion, a P/E ratio of 5.98 and a beta of 2.67. The stock's 50 day moving average price is $19.41 and its 200-day moving average price is $18.82. The company has a debt-to-equity ratio of 0.71, a current ratio of 1.71 and a quick ratio of 0.56.

Century Aluminum (NASDAQ:CENX - Get Free Report) last announced its quarterly earnings results on Thursday, February 20th. The industrial products company reported $0.47 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.42 by $0.05. Century Aluminum had a return on equity of 13.38% and a net margin of 14.69%. The company had revenue of $631.00 million during the quarter, compared to analyst estimates of $515.27 million. During the same quarter in the previous year, the firm posted $0.39 EPS. Equities research analysts anticipate that Century Aluminum will post 2.76 EPS for the current year.

Insider Transactions at Century Aluminum

In other Century Aluminum news, CEO Jesse E. Gary sold 29,243 shares of the company's stock in a transaction that occurred on Thursday, December 26th. The stock was sold at an average price of $18.97, for a total value of $554,739.71. Following the completion of the sale, the chief executive officer now directly owns 50,753 shares in the company, valued at $962,784.41. This represents a 36.56 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CAO Robert F. Hoffman sold 2,500 shares of the stock in a transaction on Friday, March 14th. The shares were sold at an average price of $19.99, for a total value of $49,975.00. Following the transaction, the chief accounting officer now directly owns 64,083 shares of the company's stock, valued at approximately $1,281,019.17. The trade was a 3.75 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 0.68% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have commented on CENX shares. StockNews.com upgraded Century Aluminum from a "sell" rating to a "hold" rating in a research note on Friday, March 7th. BMO Capital Markets upgraded Century Aluminum from a "market perform" rating to an "outperform" rating and set a $22.00 price objective for the company in a research note on Monday, February 24th. Finally, Wolfe Research raised Century Aluminum from a "peer perform" rating to an "outperform" rating and set a $27.00 target price on the stock in a research report on Tuesday, December 3rd.

Check Out Our Latest Research Report on CENX

Century Aluminum Company Profile

(

Free Report)

Century Aluminum Company, together with its subsidiaries, engages in the production of standard-grade and value-added primary aluminum products in the United States and Iceland. It also owns and operates an alumina production facility in Iceland, and a carbon anode production facility in the Netherlands.

See Also

Before you consider Century Aluminum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Century Aluminum wasn't on the list.

While Century Aluminum currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.