Intech Investment Management LLC increased its position in Adeia Inc. (NASDAQ:ADEA - Free Report) by 320.5% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 128,333 shares of the company's stock after acquiring an additional 97,815 shares during the period. Intech Investment Management LLC owned about 0.12% of Adeia worth $1,528,000 at the end of the most recent reporting period.

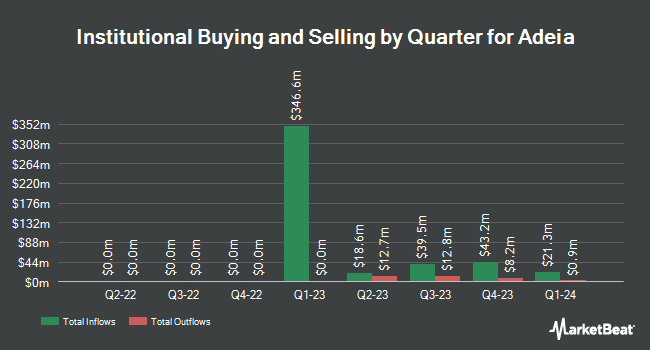

A number of other hedge funds also recently added to or reduced their stakes in ADEA. Innealta Capital LLC purchased a new stake in Adeia during the 2nd quarter valued at $47,000. EMC Capital Management raised its stake in Adeia by 27.8% during the 1st quarter. EMC Capital Management now owns 10,856 shares of the company's stock valued at $119,000 after buying an additional 2,360 shares during the last quarter. Algert Global LLC purchased a new stake in Adeia during the 2nd quarter valued at $122,000. Seizert Capital Partners LLC purchased a new stake in Adeia during the 3rd quarter valued at $197,000. Finally, O Shaughnessy Asset Management LLC increased its stake in shares of Adeia by 35.1% in the 1st quarter. O Shaughnessy Asset Management LLC now owns 20,480 shares of the company's stock worth $224,000 after purchasing an additional 5,316 shares in the last quarter. 97.36% of the stock is currently owned by hedge funds and other institutional investors.

Adeia Price Performance

Adeia stock traded down $0.04 during mid-day trading on Tuesday, hitting $12.21. The stock had a trading volume of 363,707 shares, compared to its average volume of 481,480. The firm has a market capitalization of $1.33 billion, a P/E ratio of 34.03 and a beta of 1.44. The company has a current ratio of 3.42, a quick ratio of 3.42 and a debt-to-equity ratio of 1.32. The firm's 50 day moving average is $12.13 and its 200 day moving average is $11.70. Adeia Inc. has a one year low of $9.05 and a one year high of $14.24.

Adeia Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, November 27th will be issued a $0.05 dividend. This represents a $0.20 annualized dividend and a yield of 1.64%. The ex-dividend date is Wednesday, November 27th. Adeia's dividend payout ratio is currently 55.56%.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on ADEA shares. BWS Financial restated a "buy" rating and issued a $16.00 price objective on shares of Adeia in a research note on Monday, November 11th. Rosenblatt Securities restated a "buy" rating and issued a $15.00 price objective on shares of Adeia in a research note on Friday, November 8th.

Get Our Latest Stock Analysis on Adeia

About Adeia

(

Free Report)

Adeia Inc, together with its subsidiaries, operates as a media and semiconductor intellectual property licensing company in the United States, Canada, Asia, Europe, the Middle East, and internationally. The company licenses its patent portfolios across various markets, including multichannel video programming distributors comprising cable, satellite, and telecommunications television providers that aggregate and distribute linear content over networks, as well as television providers that aggregate and stream linear content over broadband networks; over-the-top video service providers and social media companies, such as subscription video-on-demand and advertising-supported streaming service providers, as well as content providers, networks, and media companies.

Further Reading

Before you consider Adeia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adeia wasn't on the list.

While Adeia currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.