Intech Investment Management LLC bought a new stake in Brookfield Infrastructure Co. (NASDAQ:BIPC - Free Report) during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 15,392 shares of the company's stock, valued at approximately $668,000.

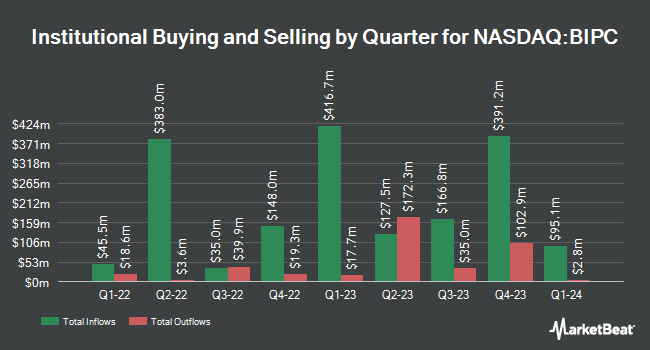

A number of other hedge funds have also recently bought and sold shares of BIPC. Bank of Montreal Can grew its holdings in shares of Brookfield Infrastructure by 3.9% during the 2nd quarter. Bank of Montreal Can now owns 4,527,120 shares of the company's stock worth $153,880,000 after purchasing an additional 169,892 shares during the period. Principal Financial Group Inc. grew its holdings in Brookfield Infrastructure by 9.0% during the 2nd quarter. Principal Financial Group Inc. now owns 2,872,954 shares of the company's stock worth $96,704,000 after acquiring an additional 236,355 shares in the last quarter. Copeland Capital Management LLC increased its holdings in Brookfield Infrastructure by 1.2% in the third quarter. Copeland Capital Management LLC now owns 2,081,877 shares of the company's stock valued at $90,416,000 after buying an additional 23,882 shares during the last quarter. National Bank of Canada FI raised its position in shares of Brookfield Infrastructure by 2.7% during the 2nd quarter. National Bank of Canada FI now owns 1,272,758 shares of the company's stock valued at $41,935,000 after acquiring an additional 33,541 shares in the last quarter. Finally, Bank of New York Mellon Corp lifted its position in shares of Brookfield Infrastructure by 12.0% in the 2nd quarter. Bank of New York Mellon Corp now owns 441,589 shares of the company's stock worth $14,864,000 after buying an additional 47,319 shares during the last quarter. Institutional investors and hedge funds own 70.38% of the company's stock.

Brookfield Infrastructure Trading Down 0.1 %

BIPC traded down $0.03 during trading on Friday, reaching $44.89. 270,996 shares of the company were exchanged, compared to its average volume of 503,847. The stock has a market cap of $5.93 billion, a P/E ratio of 31.17 and a beta of 1.45. The firm has a 50 day moving average of $42.89 and a 200 day moving average of $39.03. Brookfield Infrastructure Co. has a 52 week low of $28.47 and a 52 week high of $45.29.

Brookfield Infrastructure Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, November 29th will be issued a $0.405 dividend. This represents a $1.62 dividend on an annualized basis and a dividend yield of 3.61%. The ex-dividend date is Friday, November 29th. Brookfield Infrastructure's payout ratio is 112.50%.

About Brookfield Infrastructure

(

Free Report)

Brookfield Infrastructure Corporation, together with its subsidiaries, owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia.

Further Reading

Before you consider Brookfield Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure wasn't on the list.

While Brookfield Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.