Intech Investment Management LLC acquired a new position in shares of Tri Pointe Homes, Inc. (NYSE:TPH - Free Report) in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 24,066 shares of the construction company's stock, valued at approximately $1,090,000.

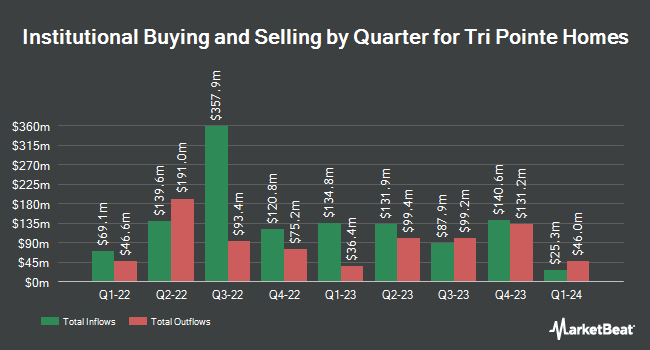

Several other large investors have also modified their holdings of the company. Connor Clark & Lunn Investment Management Ltd. boosted its holdings in shares of Tri Pointe Homes by 703.3% during the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 158,853 shares of the construction company's stock worth $7,198,000 after buying an additional 139,079 shares during the period. Jennison Associates LLC boosted its holdings in shares of Tri Pointe Homes by 27.1% during the 3rd quarter. Jennison Associates LLC now owns 52,197 shares of the construction company's stock worth $2,365,000 after buying an additional 11,131 shares during the period. Natixis Advisors LLC boosted its holdings in shares of Tri Pointe Homes by 33.5% during the 3rd quarter. Natixis Advisors LLC now owns 57,077 shares of the construction company's stock worth $2,586,000 after buying an additional 14,337 shares during the period. Empowered Funds LLC boosted its holdings in Tri Pointe Homes by 0.3% in the 3rd quarter. Empowered Funds LLC now owns 99,346 shares of the construction company's stock valued at $4,501,000 after purchasing an additional 265 shares during the period. Finally, CIBC Asset Management Inc bought a new stake in Tri Pointe Homes in the 3rd quarter valued at $250,000. 97.01% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, General Counsel David Ch Lee sold 5,000 shares of the company's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $44.28, for a total transaction of $221,400.00. Following the transaction, the general counsel now owns 85,792 shares in the company, valued at $3,798,869.76. This represents a 5.51 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. 2.50% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of analysts have weighed in on the stock. Wedbush reissued a "neutral" rating and issued a $42.00 price target on shares of Tri Pointe Homes in a report on Thursday, October 24th. Royal Bank of Canada reduced their price objective on Tri Pointe Homes from $48.00 to $45.00 and set an "outperform" rating for the company in a research report on Friday, October 25th. Oppenheimer lowered their price objective on Tri Pointe Homes from $56.00 to $53.00 and set an "outperform" rating on the stock in a research report on Friday, October 25th. Finally, Zelman & Associates raised Tri Pointe Homes from an "underperform" rating to a "neutral" rating and set a $43.00 target price for the company in a research report on Tuesday, September 17th. Two research analysts have rated the stock with a hold rating, three have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $45.75.

View Our Latest Report on TPH

Tri Pointe Homes Price Performance

Shares of NYSE:TPH traded down $0.02 on Thursday, hitting $43.62. The stock had a trading volume of 535,658 shares, compared to its average volume of 887,266. The firm's 50 day moving average price is $43.16 and its 200-day moving average price is $41.65. The company has a debt-to-equity ratio of 0.28, a quick ratio of 1.64 and a current ratio of 1.64. Tri Pointe Homes, Inc. has a twelve month low of $28.74 and a twelve month high of $47.78. The company has a market capitalization of $4.08 billion, a price-to-earnings ratio of 9.05, a price-to-earnings-growth ratio of 0.73 and a beta of 1.60.

Tri Pointe Homes (NYSE:TPH - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The construction company reported $1.18 earnings per share for the quarter, topping the consensus estimate of $1.07 by $0.11. Tri Pointe Homes had a net margin of 10.41% and a return on equity of 14.83%. The firm had revenue of $1.11 billion for the quarter, compared to analysts' expectations of $1.05 billion. During the same period in the prior year, the firm earned $0.76 earnings per share. The company's quarterly revenue was up 34.9% compared to the same quarter last year. On average, equities research analysts predict that Tri Pointe Homes, Inc. will post 4.72 earnings per share for the current year.

Tri Pointe Homes Profile

(

Free Report)

Tri Pointe Homes, Inc engages in the design, construction, and sale of single-family attached and detached homes in the United States. The company operates through a portfolio of six regional home building brands comprising Maracay in Arizona; Pardee Homes in California and Nevada; Quadrant Homes in Washington; Trendmaker Homes in Texas; TRI Pointe Homes in California, Colorado, and the Carolinas; and Winchester Homes in Maryland and Northern Virginia.

Featured Articles

Before you consider Tri Pointe Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tri Pointe Homes wasn't on the list.

While Tri Pointe Homes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.