Intech Investment Management LLC acquired a new position in ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD - Free Report) in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 37,683 shares of the biopharmaceutical company's stock, valued at approximately $580,000.

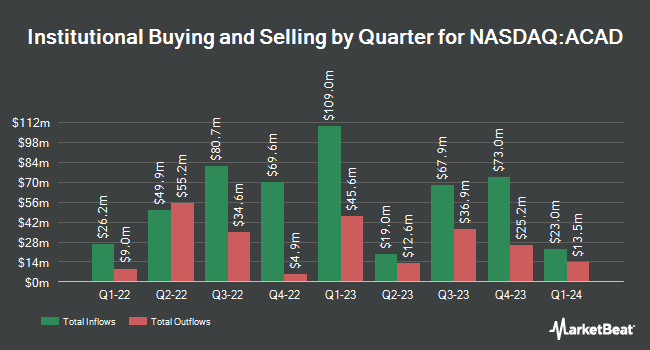

Several other large investors have also recently added to or reduced their stakes in the business. Advisors Asset Management Inc. raised its position in shares of ACADIA Pharmaceuticals by 13.4% during the 3rd quarter. Advisors Asset Management Inc. now owns 21,087 shares of the biopharmaceutical company's stock worth $324,000 after buying an additional 2,499 shares in the last quarter. B. Metzler seel. Sohn & Co. Holding AG bought a new stake in ACADIA Pharmaceuticals during the third quarter worth approximately $483,000. Quest Partners LLC lifted its position in ACADIA Pharmaceuticals by 42.3% in the third quarter. Quest Partners LLC now owns 3,520 shares of the biopharmaceutical company's stock worth $54,000 after purchasing an additional 1,047 shares during the period. Natixis Advisors LLC boosted its stake in ACADIA Pharmaceuticals by 58.6% during the 3rd quarter. Natixis Advisors LLC now owns 40,488 shares of the biopharmaceutical company's stock valued at $623,000 after purchasing an additional 14,961 shares in the last quarter. Finally, Oppenheimer Asset Management Inc. increased its position in shares of ACADIA Pharmaceuticals by 26.6% during the 3rd quarter. Oppenheimer Asset Management Inc. now owns 37,429 shares of the biopharmaceutical company's stock valued at $576,000 after purchasing an additional 7,872 shares during the period. 96.71% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research analysts recently weighed in on the company. Raymond James reaffirmed a "market perform" rating on shares of ACADIA Pharmaceuticals in a research note on Thursday, October 10th. UBS Group cut their target price on shares of ACADIA Pharmaceuticals from $25.00 to $23.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Morgan Stanley lowered shares of ACADIA Pharmaceuticals from an "overweight" rating to an "equal weight" rating and decreased their price target for the stock from $28.00 to $20.00 in a research report on Wednesday, August 7th. Royal Bank of Canada cut their price objective on ACADIA Pharmaceuticals from $29.00 to $26.00 and set an "outperform" rating for the company in a research report on Wednesday, August 7th. Finally, HC Wainwright restated a "buy" rating and issued a $27.00 target price on shares of ACADIA Pharmaceuticals in a report on Thursday, November 7th. Six research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. According to MarketBeat, ACADIA Pharmaceuticals currently has an average rating of "Moderate Buy" and a consensus target price of $25.56.

Check Out Our Latest Stock Analysis on ACAD

Insider Buying and Selling at ACADIA Pharmaceuticals

In other ACADIA Pharmaceuticals news, insider James Kihara sold 4,073 shares of ACADIA Pharmaceuticals stock in a transaction that occurred on Tuesday, November 19th. The stock was sold at an average price of $16.81, for a total value of $68,467.13. Following the transaction, the insider now directly owns 19,863 shares of the company's stock, valued at $333,897.03. The trade was a 17.02 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CFO Mark C. Schneyer sold 10,259 shares of the stock in a transaction that occurred on Tuesday, November 19th. The shares were sold at an average price of $16.81, for a total value of $172,453.79. Following the completion of the sale, the chief financial officer now directly owns 53,302 shares of the company's stock, valued at $896,006.62. This represents a 16.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 24,661 shares of company stock worth $414,551 over the last ninety days. 28.30% of the stock is currently owned by insiders.

ACADIA Pharmaceuticals Stock Performance

Shares of NASDAQ ACAD traded up $0.29 during mid-day trading on Monday, reaching $16.61. The company had a trading volume of 1,418,012 shares, compared to its average volume of 1,664,788. The stock has a market capitalization of $2.76 billion, a PE ratio of 20.69 and a beta of 0.38. ACADIA Pharmaceuticals Inc. has a twelve month low of $14.15 and a twelve month high of $32.59. The stock's 50 day moving average is $15.61 and its 200-day moving average is $16.01.

ACADIA Pharmaceuticals (NASDAQ:ACAD - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The biopharmaceutical company reported $0.20 earnings per share for the quarter, topping analysts' consensus estimates of $0.14 by $0.06. The company had revenue of $250.40 million during the quarter, compared to the consensus estimate of $248.83 million. ACADIA Pharmaceuticals had a return on equity of 25.83% and a net margin of 13.83%. The business's quarterly revenue was up 18.3% on a year-over-year basis. During the same period last year, the business earned ($0.40) EPS. On average, sell-side analysts anticipate that ACADIA Pharmaceuticals Inc. will post 0.73 EPS for the current year.

ACADIA Pharmaceuticals Profile

(

Free Report)

ACADIA Pharmaceuticals Inc, a biopharmaceutical company, focuses on the development and commercialization innovative medicines that address unmet medical needs in central nervous system (CNS) disorders and rare diseases in the United States. The company offers NUPLAZID (pimavanserin) for the treatment of hallucinations and delusions associated with Parkinson's disease psychosis; and DAYBUE, a novel synthetic analog of the amino-terminal tripeptide of insulin-like growth factor 1 for treatment of Rett Syndrome.

Read More

Before you consider ACADIA Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ACADIA Pharmaceuticals wasn't on the list.

While ACADIA Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.