Intech Investment Management LLC purchased a new position in shares of Amicus Therapeutics, Inc. (NASDAQ:FOLD - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor purchased 78,071 shares of the biopharmaceutical company's stock, valued at approximately $834,000.

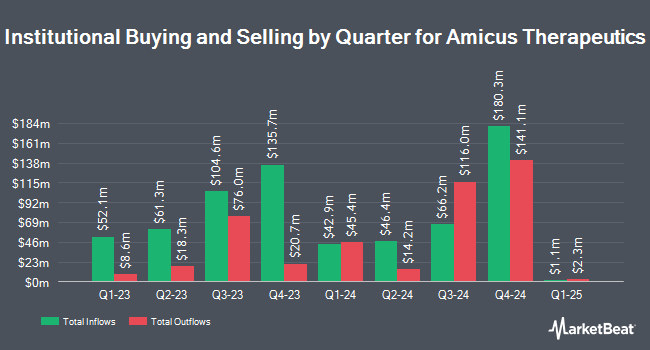

A number of other hedge funds and other institutional investors also recently modified their holdings of FOLD. Xponance Inc. increased its holdings in shares of Amicus Therapeutics by 5.3% in the second quarter. Xponance Inc. now owns 18,555 shares of the biopharmaceutical company's stock valued at $184,000 after purchasing an additional 936 shares during the last quarter. Hazlett Burt & Watson Inc. lifted its position in Amicus Therapeutics by 156.9% during the third quarter. Hazlett Burt & Watson Inc. now owns 2,569 shares of the biopharmaceutical company's stock worth $28,000 after acquiring an additional 1,569 shares during the last quarter. Arizona State Retirement System boosted its holdings in shares of Amicus Therapeutics by 2.6% during the second quarter. Arizona State Retirement System now owns 62,020 shares of the biopharmaceutical company's stock worth $615,000 after acquiring an additional 1,577 shares during the period. Mirae Asset Global Investments Co. Ltd. grew its position in shares of Amicus Therapeutics by 21.3% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 10,727 shares of the biopharmaceutical company's stock valued at $115,000 after purchasing an additional 1,884 shares during the last quarter. Finally, OLD Second National Bank of Aurora bought a new position in shares of Amicus Therapeutics during the third quarter worth approximately $26,000.

Insiders Place Their Bets

In other news, CEO Bradley L. Campbell sold 7,500 shares of the firm's stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $10.60, for a total value of $79,500.00. Following the completion of the sale, the chief executive officer now directly owns 886,654 shares of the company's stock, valued at approximately $9,398,532.40. This trade represents a 0.84 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Insiders have sold 30,401 shares of company stock worth $352,038 in the last ninety days. 2.20% of the stock is currently owned by insiders.

Amicus Therapeutics Stock Performance

Shares of FOLD traded up $0.02 during trading hours on Friday, hitting $9.98. The company's stock had a trading volume of 818,677 shares, compared to its average volume of 2,694,340. The company has a debt-to-equity ratio of 2.18, a current ratio of 3.15 and a quick ratio of 2.42. Amicus Therapeutics, Inc. has a 52-week low of $9.02 and a 52-week high of $14.57. The company has a market cap of $2.98 billion, a price-to-earnings ratio of -29.29 and a beta of 0.68. The business has a 50 day simple moving average of $10.73 and a two-hundred day simple moving average of $10.58.

Analysts Set New Price Targets

Several research analysts have weighed in on FOLD shares. Jefferies Financial Group started coverage on Amicus Therapeutics in a research report on Friday, September 6th. They set a "buy" rating and a $18.00 price objective on the stock. Cantor Fitzgerald boosted their price objective on shares of Amicus Therapeutics from $20.00 to $21.00 and gave the company an "overweight" rating in a report on Thursday, November 7th. Guggenheim raised their target price on shares of Amicus Therapeutics from $13.00 to $15.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Morgan Stanley cut their price target on Amicus Therapeutics from $19.00 to $18.00 and set an "overweight" rating for the company in a research note on Friday, October 11th. Finally, Bank of America upped their price objective on shares of Amicus Therapeutics from $13.00 to $15.00 and gave the stock a "buy" rating in a research report on Thursday, October 17th. One equities research analyst has rated the stock with a hold rating and nine have given a buy rating to the stock. According to data from MarketBeat.com, Amicus Therapeutics currently has an average rating of "Moderate Buy" and a consensus price target of $17.63.

Check Out Our Latest Analysis on FOLD

Amicus Therapeutics Profile

(

Free Report)

Amicus Therapeutics, Inc, a biotechnology company, focuses on discovering, developing, and delivering medicines for rare diseases. Its commercial product and product candidates include Galafold, an oral precision medicine for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene variant; and Pombiliti + Opfolda, for the treatment of late onset.

See Also

Before you consider Amicus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amicus Therapeutics wasn't on the list.

While Amicus Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.